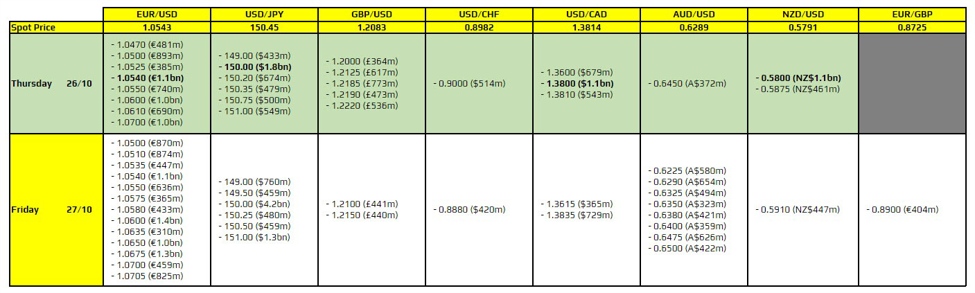

There are a couple to take note of on the day, as highlighted in bold.

The first being for EUR/USD at 1.0540, although I would say the expiries may not factor into play all too much. They aren’t associated with any technical significance, so it is just pretty much that – an expiry level on its own. Considering the market mood and if USD/JPY does continue to run higher, there is scope for more dollar strength and for the pair to fall back towards 1.0500. That will be a stronger factor than the expiry above.

Then, there is the one for USD/JPY at 150.00 but that is more of a factor considering the large amount we’re seeing rolling off tomorrow instead at the figure level. For now, it seems like Tokyo has given the go-ahead to push past 150.00 but traders are still cautious so as to not overstep. Despite the extravagant size of the expiries today and tomorrow, the psychological play in USD/JPY outweighs that handily at the moment.

Besides that, there is one for USD/CAD at the 1.3800 mark although similar to the one for EUR/USD, it does not have any technical significance. As such, it might not factor into play in the session ahead. Adding to that is the one for NZD/USD at 0.5800, which also doesn’t contain any technical significance. It could slow down the falling momentum a bit but with risk trades on the cusp of a further decline, it’s hard to imagine the expiry alone holding sellers off on the day.

For more information on how to use this data, you may refer to this post here.