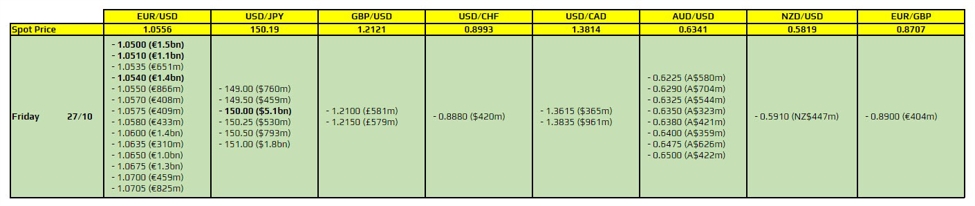

There are a couple to take note of on the day, as highlighted in bold.

The one that stands out the most is that of USD/JPY at 150.00 with the size of over $5 billion. That’s one of the largest expiries in recent memory and it comes at a rather crucial level for the pair. For now, the expiries should serve to help keep price action close by the figure level. But after they run off later today, it will be interesting to see if buyers can run price higher or if the quick dip lower yesterday will feature for a second round before the weekend.

Then, there are ones for EUR/USD at 1.0500-10 and 1.0540. The former are ones to likely help keep price action from falling too sharply on the day alongside bids layered at the figure level for now. Meanwhile, the latter while significant in size does not hold much technical significance so it shouldn’t be one to influence price action too much.

For more information on how to use this data, you may refer to this post here.