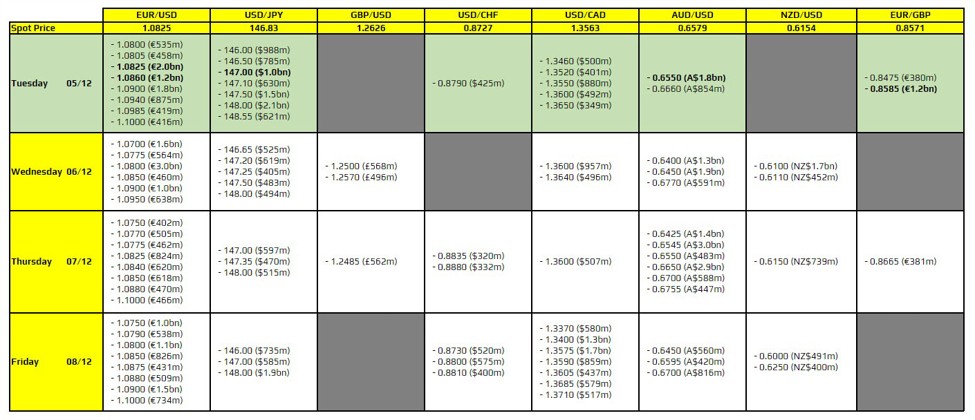

There are a couple to take note of for the day, as highlighted in bold.

The first ones are for EUR/USD at 1.0825 and 1.0860, which could keep price action more contained during the session in and around the expiries. That being said, a more risk-off push in broader markets could yet underpin the dollar further so there is a slight bias that the pair could trace lower still.

Then, there is the one for USD/JPY at 147.00 but it is a level that does not offer any technical significance whatsoever. As such, trading sentiment will be much more heavily influenced by the bond market and overall dollar sentiment instead.

There is also a large one for AUD/USD at 0.6550, which might offer some pull for the pair. However, the 200-day moving average at 0.6578 remains the more critical level to watch on the daily chart at the moment as highlighted here.

And lastly, there is one for EUR/GBP at 0.8585 but again, it isn’t one that really offers much of any technical significance. So, given the breakdown in the pair at the end of last week, sellers are still in control and may perhaps look towards a push to 0.8500 next in the bigger picture.

For more information on how to use this data, you may refer to this post here.