COT | Data | Leaders | What is COT? | Excel | COT Dashboard

Here are the latest links to our coverage of the Commitment of Traders data changes. Data updated through January 9th.

The COT currency market speculator bets were higher this week as seven out of the eleven currency markets we cover had higher positioning. See full article…

Weekly Market Price Changes

| Name | PctChg_5_Days |

|---|---|

| Natural Gas | 14.85 |

| Lean Hogs | 5.14 |

| Nikkei 225 | 4.39 |

| Heating Oil | 3.30 |

| Nasdaq | 3.27 |

| S&P500 Mini | 2.03 |

| Cotton | 1.55 |

| Sugar | 1.36 |

| MSCI EAFE MINI | 1.21 |

| Soybean Oil | 1.02 |

| Name | PctChg_5_Days |

|---|---|

| VIX | -11.96 |

| Palladium | -5.90 |

| Soybean Meal | -5.19 |

| Platinum | -5.15 |

| Corn | -2.97 |

| Steel | -2.18 |

| Soybeans | -1.87 |

| Ultra U.S. Treasury Bonds | -1.62 |

| Wheat | -1.59 |

| Copper | -1.42 |

See Weekly Price Changes for major markets and their performance.

COT Speculator Extremes

This weekly Extreme Positions report highlights the Most Bullish and Most Bearish Positions for the speculator category. See full article…

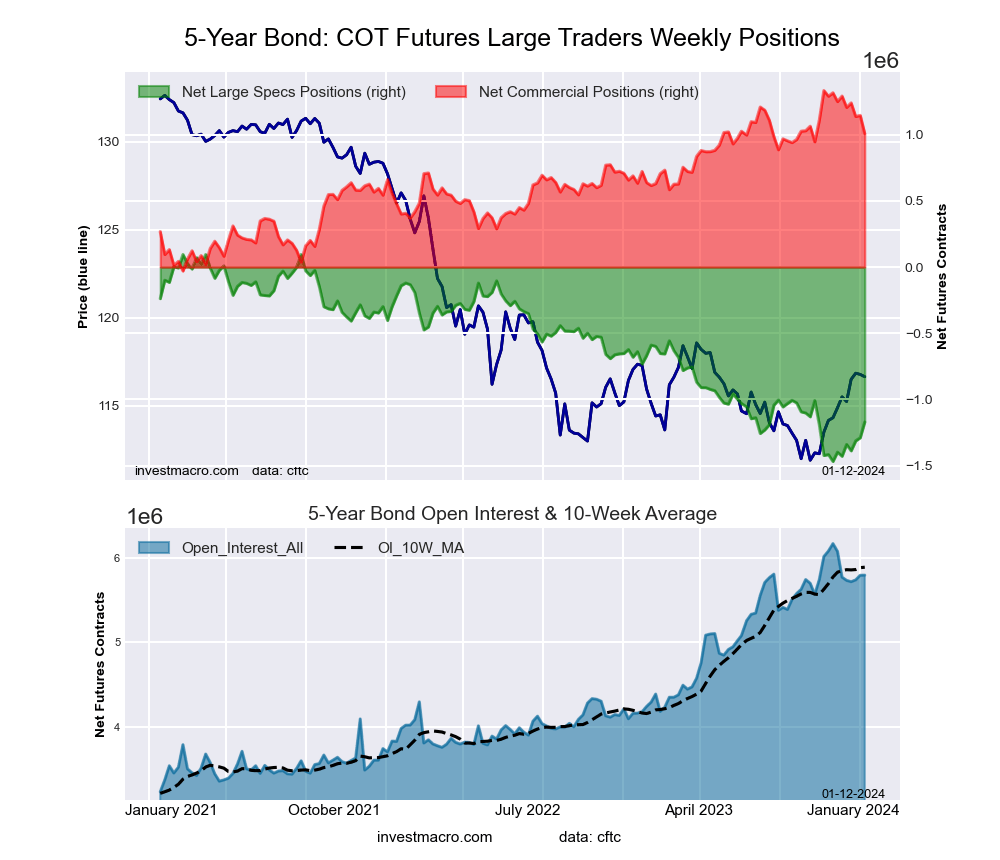

COT Bonds

The COT bond market speculator bets were higher this week as five out of the eight bond markets we cover had higher positioning. See full article…

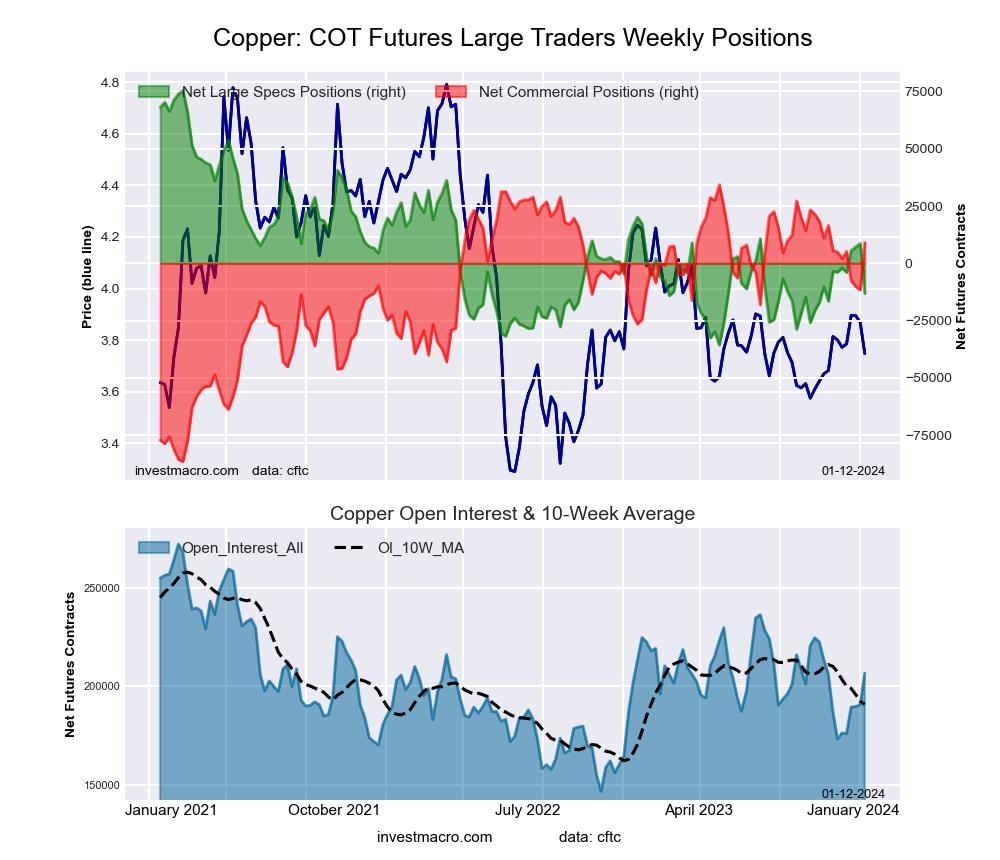

COT Metals

The COT metals markets speculator bets were lower this week as all of the six metals markets we cover had lower speculator contracts. See full article…

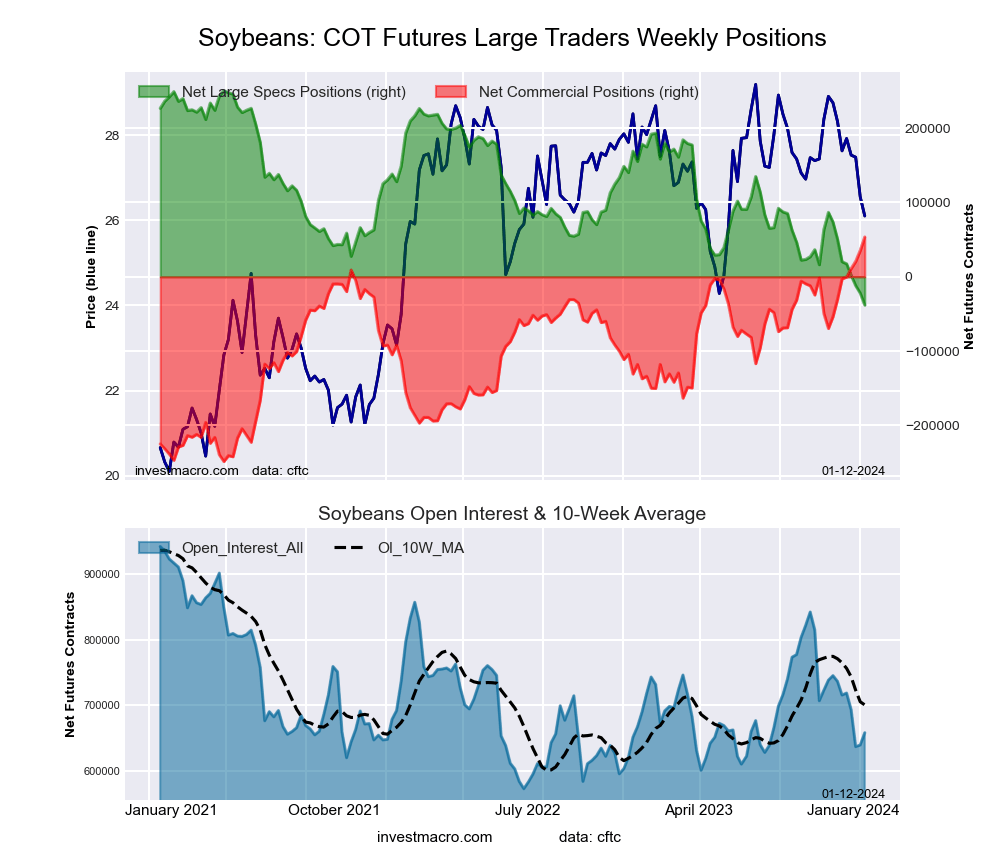

COT Soft Commodities

The COT soft commodities speculator bets were lower this week as five out of the eleven softs markets we cover had higher positioning. See full article…

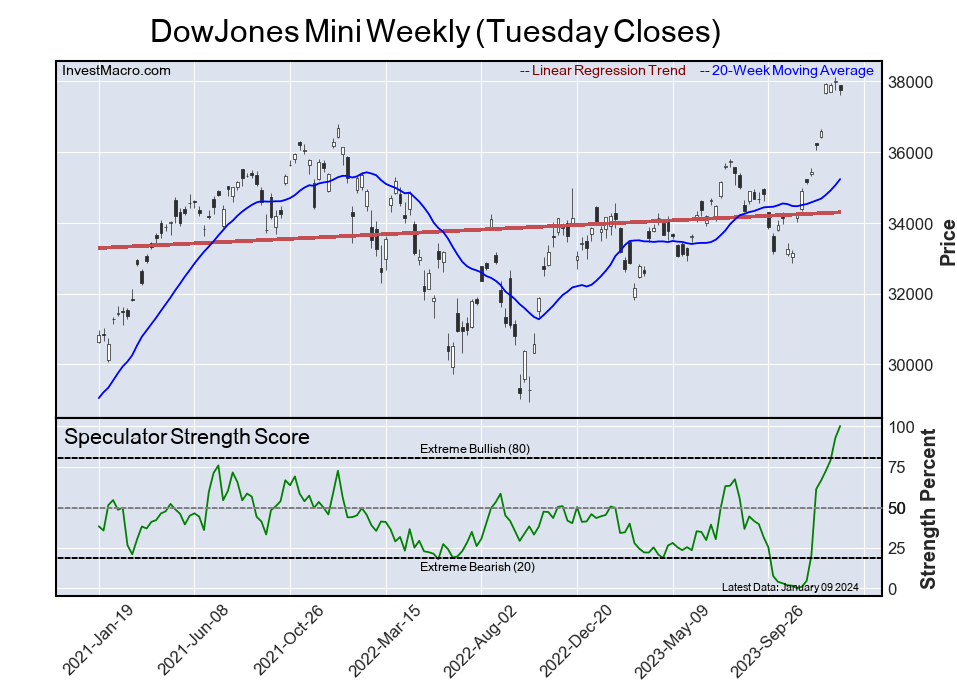

COT Stock Markets

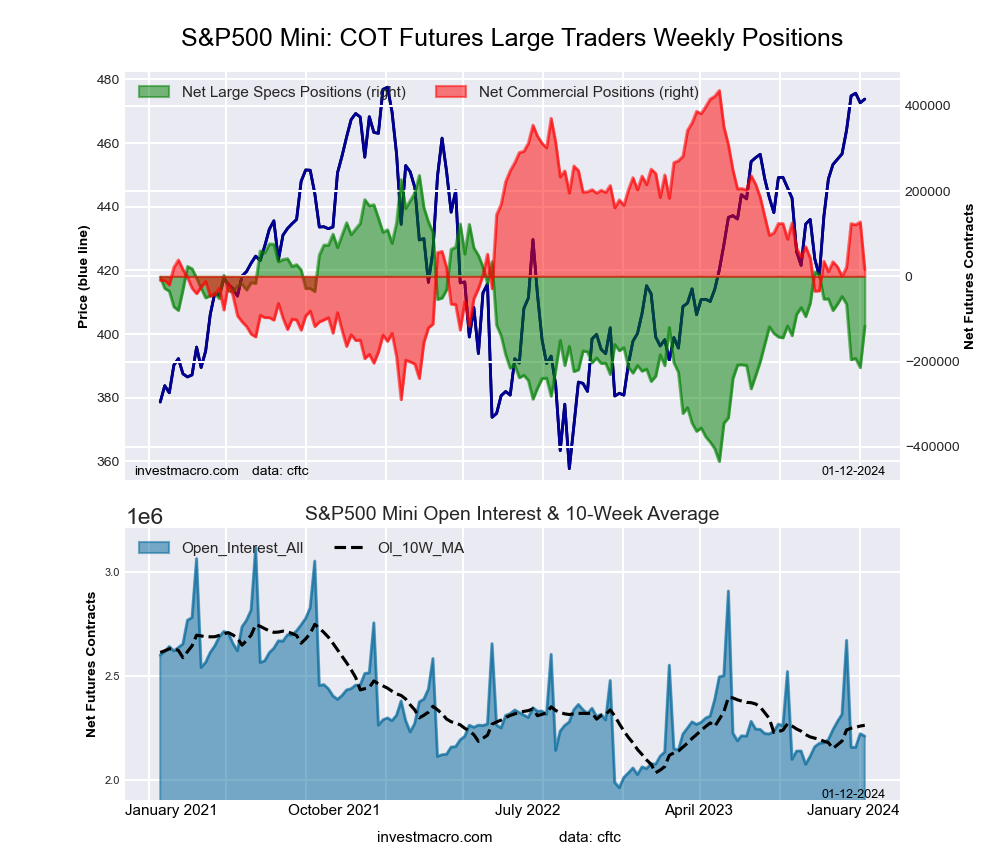

The COT stock markets speculator bets were higher this week as six out of the seven stock markets we cover had higher positioning. See full article…

Have a Wonderful Trading Week

By InvestMacro.com

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators, non-commercials (for-profit traders), commercial traders and small traders were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

- Protected: Week 2: FX Speculators push British Pound bets to highest since September Jan 14, 2024

- COT Metals Charts: Speculator Bets go lower led by Copper & Gold Jan 13, 2024

- COT Bonds Charts: Speculator Bets led higher by SOFR 3-Months & 5-Year Bonds Jan 13, 2024

- COT Stock Market Charts: Speculator Bets led higher by S&P500 & Russell Jan 13, 2024

- COT Soft Commodities Charts: Speculator Bets led lower by Soybean Meal & Corn Jan 13, 2024

- When can we stop worrying about rising prices? The latest inflation report offers no easy answers Jan 12, 2024

- The United States and Britain are striking back at the Houthis. Oil rises amid escalating conflict in the Middle East Jan 12, 2024

- The Nikkei 225 has hit a 34-year high. Rising inflation in the US may push back the US Fed’s plans to cut rates in the spring Jan 11, 2024

- Gold on standby mode as US CPI looms Jan 11, 2024

- Inflation in Australia continues to decline. The World Bank forecasts a contraction in growth Jan 10, 2024