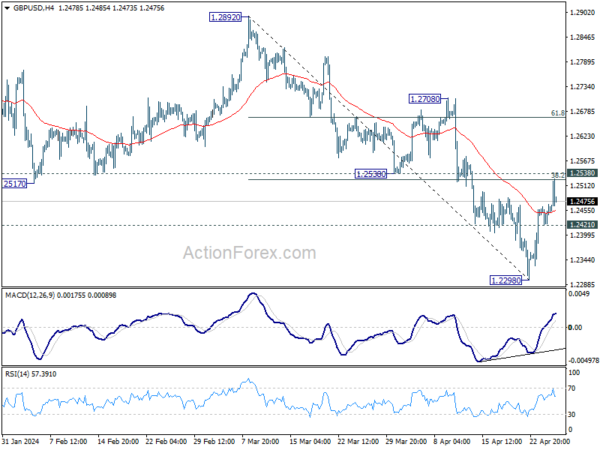

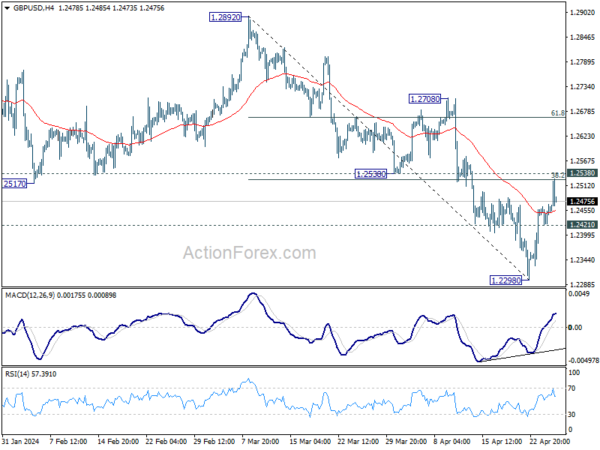

Daily Pivots: (S1) 1.2368; (P) 1.2414; (R1) 1.2495; More…

Intraday bias in GBP/USD remains neutral for the moment. Near term outlook stays bearish as long as 1.2538 support turned resistance holds. Break of 1.2421 minor support will argue that rebound from 1.2298 has completed and bring retest of this low. However, decisive break of 1.2538 will bring stronger rally to 55 D EMA (now at 1.2585) instead.

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Fall from 1.2892 is seen as the third leg. Deeper decline would be seen to 1.2036 support and possibly below. But strong support should emerge from 61.8% retracement of 1.0351 to 1.2452 at 1.1417 to complete the correction.