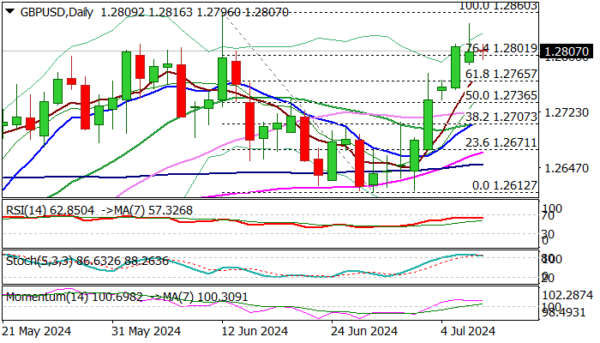

Cable is holding within a narrow range under new multi-week high during European trading on Tuesday, as markets await today’s key event – the testimony of Fed Chair Powell.

Long upper shadow of Monday’s daily candle and overbought conditions on daily chart suggest that bulls may take a breather at 1.2800 zone (also Fibo 76.4% of 1.2860/1.2612 bear-leg).

Bullish studies favor further upside, with consolidation likely to be narrow, before final push towards targets at 1.2860/93 (Jun 12 high / 2024 top).

Comments from Powell are likely to be dovish and to add to expectations for rate cut plans however, Thursday’s release of US June inflation report would play significant role after policymakers reiterated their stance that rate cut decision will highly depend on economic data.

Initial supports at 1.2788/65 (Monday’s low / broken Fibo 61.8%) should ideally contain, with extended dips not to exceed daily Kijun-sen (1.2736) to keep larger bulls in play.

Res: 1.2822; 1.2845; 1.2860; 1.2893.

Sup: 1.2788; 1.2769; 1.2736; 1.2713.