By RoboForex Analytical Department

The British pound sterling continues to decline steadily against the US dollar. The GBP/USD pair is trending towards 1.2848.

On the one hand, the pressure from the USD rate is evident. On the other hand, investors are awaiting the outcome of today’s Bank of England meeting and its decision on interest rates.

There is speculation that the BoE will lower the interest rate from 5.25% to 5.00% today. The inflationary environment, coupled with the state of the employment market in the UK, supports this adjustment. The probability of a rate cut is currently estimated at 65%.

An early move towards monetary policy easing is considered possible for the Bank of England. However, the regulator’s tone in its statements may be relatively cautious, indicating that the BoE is unlikely to lower the rate rapidly. A certain degree of conservatism can be expected from the Bank of England, which will only act if it is fully confident about the economic conditions.

This potential decision is already factored into GBP quotes. The future movements in GBPUSD will be directly influenced by the details provided in the Bank of England’s accompanying statement.

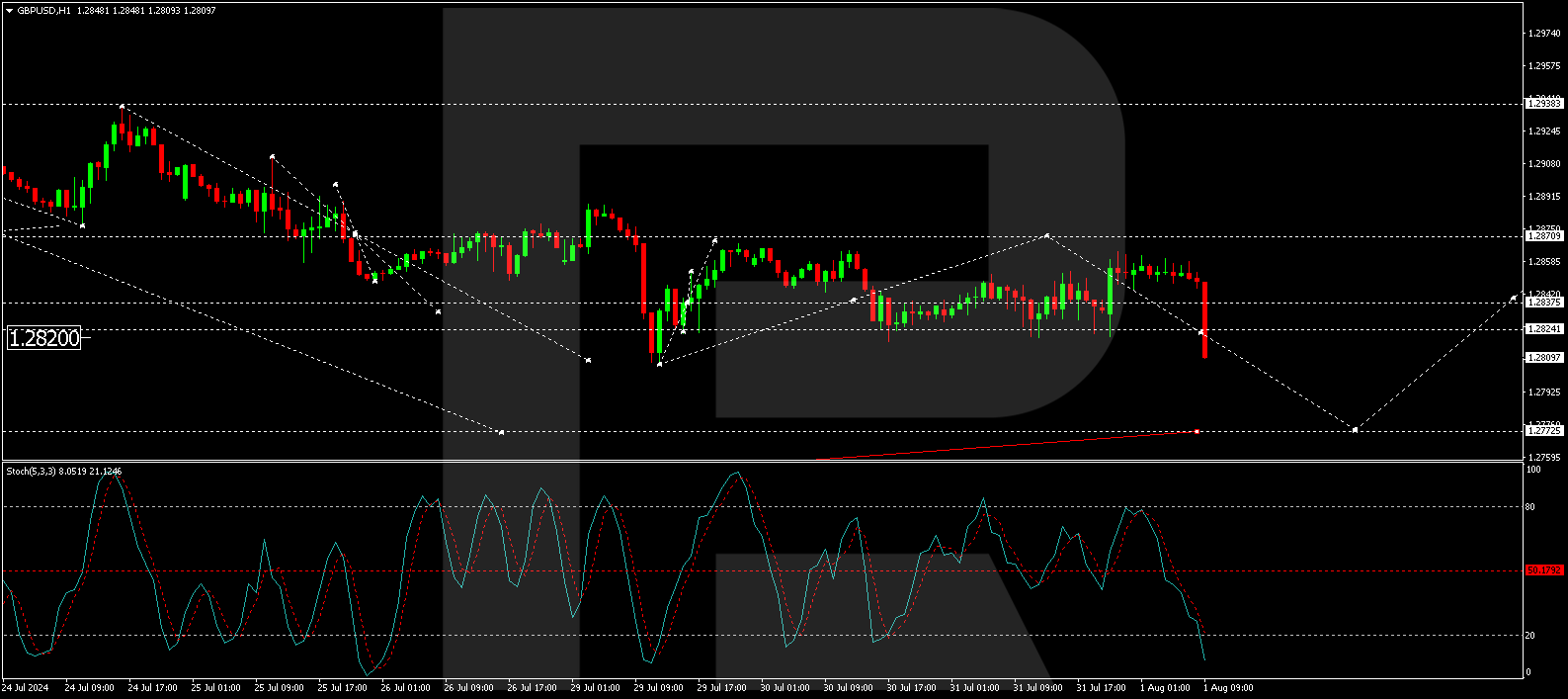

Technical Analysis: GBP/USD

On the H4 chart of GBP/USD, the market has executed a decline wave to 1.2820 and a subsequent correction to 1.2867. Today, the market continues its downward movement towards 1.2772. After reaching this level, we will assess the probability of a correction to 1.2870 (testing from below). After the correction is complete, we expect the beginning of a new decline wave to the local target of 1.2611. This scenario is technically supported by the MACD indicator, which shows the signal line below the zero mark and pointing downwards.

On the H1 chart of GBP/USD, a correction wave is currently underway towards 1.2867. Today, the formation of the next downward wave to the initial target of 1.2772 is in progress. After reaching this level, we will evaluate the likelihood of a new correction wave towards 1.2870. Following the completion of the correction, we expect a new decline wave to 1.2770. This scenario is technically confirmed by the Stochastic oscillator, with its signal line positioned below 50 and continuing to decline towards 20.

Investors and traders should closely monitor the BoE’s statement for any indications of future policy direction, as it will be crucial in determining the short to medium-term trajectory of the GBP/USD pair.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- GBP/USD Under Pressure as Market Anticipates Bank of England Rate Decision Aug 1, 2024

- The US Federal Reserve is set to cut rates in September. Today, investors are focused on the Bank of England meeting Aug 1, 2024

- Oil rises amid escalation of conflict in the Middle East. Inflationary pressures in Australia are easing Jul 31, 2024

- USD/JPY Plummets as Bank of Japan Tightens Policy Jul 31, 2024

- Oil prices fell to June lows. Traders are waiting for Australian inflation data Jul 30, 2024

- USDJPY: Braced for BoJ & Fed combo Jul 30, 2024

- NZD/USD Sinks to Three-Month Minimum, Driven by Rate Speculation and Strengthening USD Jul 30, 2024

- AUD/USD Gains Amid Anticipation for Key Economic Data Jul 29, 2024

- Oil rises in price amid rising geopolitical tensions in the Middle East. Bitcoin has reached the $70,000 mark Jul 29, 2024

- MAS has maintained a monetary policy. Japan’s inflation is on the rise Jul 26, 2024