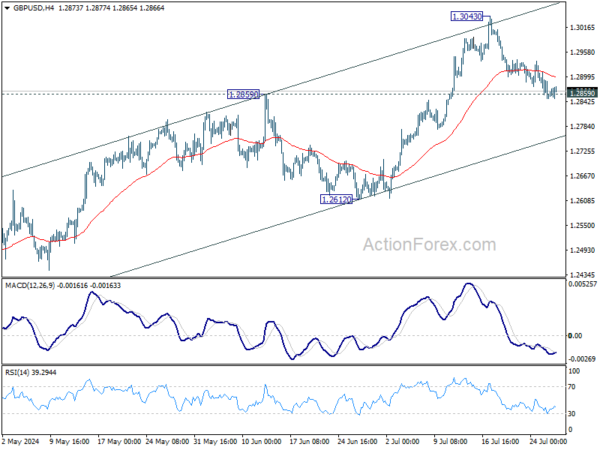

GBP/USD gyrated lower last week but failed to break through 1.2859 resistance turned support decisively. Initial bias remains neutral first. Further rally is in favor. Break of 1.3043 will resume the rise from 1.2298. However, firm break of 1.2859 will turn bias to the downside for deeper decline to 55 D EMA (now at 1.2771).

In the bigger picture, corrective pattern from 1.3141 medium term top (2023 high) could have completed with three waves to 1.2298 already. This will now remain the favored case as long as 1.2612 support holds. Firm break of 1.3141 will target 61.8% projection of 1.0351 (2022 low) to 1.3141 from 1.2298 at 1.4022.

In the long term picture, as long as 1.2298 support holds, rise from 1.0351 long term bottom is expected to continue. But still, firm break of 1.4248 structural resistance is needed to indicate bullish trend reversal. Otherwise, price actions from 1.0351 are tentatively seen as a consolidation pattern only.