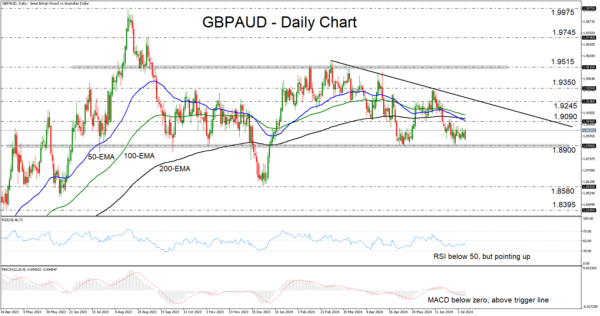

- GBPAUD consolidates above key support zone

- RSI and MACD detect negative momentum

- But a break below 1.8900 is needed to darken the outlook

- A rebound above 1.9350 may invite more bulls

GBPAUD has been trading in a consolidative manner lately staying above the key support area of 1.8900, which prevented the bears from drifting south on several occasions during the last 12 months. However, the pair is also trading below a downward sloping trendline, suggesting that it may be a matter of time before we see a dip below 1.8900.

The RSI is lying below 50, but it is pointing up, while the MACD, although negative, has bottomed and crossed above its trigger line. Both indicators detect negative momentum, but they corroborate the notion that it is too early to start examining the case of further declines.

A break below 1.8900 could be the move that will give the green light to the bears, perhaps allowing extensions towards the low of December 27, at around 1.8580. A break lower could aim for the 1.8395 zone, marked by the low of April 18.

For the picture to start looking positive, a move above 1.9350 may be needed. GBPAUD would already be above the aforementioned downtrend line, and the bulls may feel confident to climb towards the key resistance zone of 1.9515.

Summarizing, GBPAUD is hovering above the key support zone of 1.8900, the break of which may invite more bears into the action.