MUMBAI: India’s GDP growth rate for Oct-Dec, which at 8.4% beat estimates by every economist and analyst by wide margins, enthused Dalal Street investors and the subsequent buying pushed sensex and Nifty to new all-time peaks on Friday. The day’s rally also lifted India’s market capitalisation to almost at Rs 400 lakh crore or $4.8 trillion, also a new all-time high.

A slightly easing inflation number in US also added to the positive sentiment, market players said. Robust economic data also added to optimism, with manufacturing PMI scaling a five-month high and GST collections rising 12.5% year-on-year to reach Rs 1.68 lakh crore in Feb.

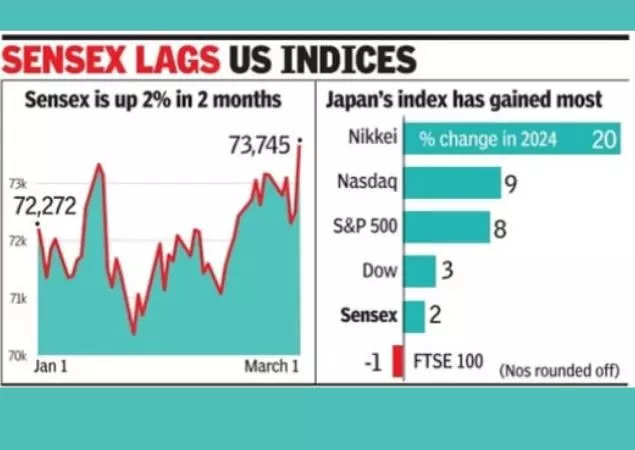

At close, sensex was at 73,745 points, up 1,245 points or 1.7%, while Nifty was at 22,339 points, up 356 points or 1.6%. The day’s points gain in sensex was the biggest in nearly three months, BSE data showed.

According to Vinod Nair, head of research, Geojit Financial Services, better-than-expected GDP numbers and easing US inflation added buoyancy in both domestic and global markets. “As the general election draws closer, stellar economic growth data raised confidence among investors.”

Lok Sabha polls are expected in April and a new govt should be in place by the third week of May. Ahead of the election results, market players are expecting a rally as they believe that governing NDA will come back ensuring continuity of policy and economic reforms.

On Friday, stocks of companies from metals, capital goods and banking sectors led the rally. Almost all sectoral indices, except software and healthcare, closed with gains, BSE data showed.

Among the 30 sensex stocks, 26 closed with gains, with ICICI Bank, HDFC Bank and Reliance Industries contributing the most to the day’s gains. The four stocks that closed lower were Infosys, HCL Tech, Sun Pharma and Tech Mahindra. In the broader market, there were 2,366 gainers to 1,489 laggards, BSE data showed.

The day’s gains were largely helped by domestic funds, which recorded a net buying of Rs 3,814 crore while foreign funds were net buyers at Rs 129 crore.

The day’s rally made investors richer by Rs 4.6 lakh crore.

Going ahead, brokers and analysts believe that the current rally will continue. According to Siddhartha Khemka, head (retail research), Motilal Oswal Financial Services, the ongoing momentum should continue while taking cues from a fresh set of economic data next week. Khemka expects sectors like auto will be in focus, on the back of better-than-expected monthly sales numbers. “Cement and metals are also expected to be in focus on the back of stronger economic growth, while defence and solar sectors on account of improved order visibility.”