From Washington to Frankfurt to London and beyond, central bankers are approaching their final decisions of the year against a backdrop of unease at how the global inflation cycle is turning.

Policymakers from fully half of the Group of 10 jurisdictions of most-traded currencies are scheduled to meet in the coming days, and interest rates for 60% of the world economy will be set in a whirlwind 60-hour window.

Most notable will be the US Federal Reserve on Wednesday, followed on Thursday by central banks including those of the euro zone and the UK.

With the exception of Norway, which may conceivably raise borrowing costs, most monetary officials are confronting financial-market pressure to explain why they seem unhurried about pivoting to monetary easing.

Synchronized weakening in inflation data and some evidence of softening economies have prompted investors to ramp up bets on rate cuts in the first half of 2024. That’s a view that could clash with the mantra the Fed and its peers expounded little more than three months ago, of “higher for longer.”

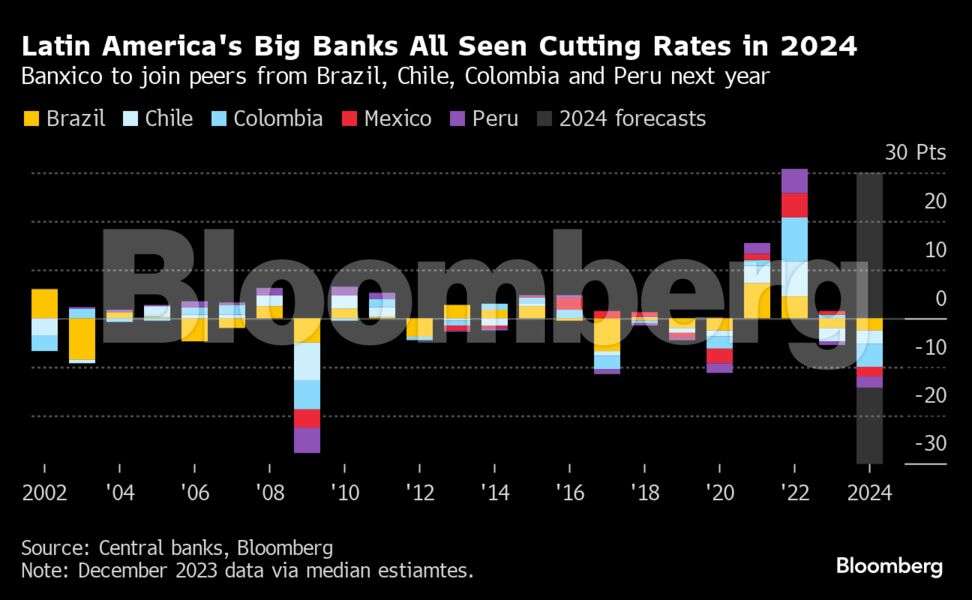

In Latin America, which led the push upwards with rate hikes, most central banks are already on the way down, and Brazil and Peru may both cut in the coming week.

Their peers in the US and Europe aren’t so sure. After starting the year with renewed vigor to aggressively ramp up borrowing costs, they’re ending 2023 with more hesitation — setting the scene for what could become a prolonged standoff with investors.

“Central bankers are saying, ‘look, we’re waiting to see if what we’re seeing on this disinflation is sustainable,’” Joyce Chang, chair of global research at JPMorgan, told Bloomberg Television. “We think you’re not looking to see cuts until the second half of the year.”

Click here for what happened in the past week, and below is our look ahead to the series of major rate decisions in the coming week.

Federal Reserve

The Fed is widely expected to keep its benchmark rate at the highest level in two decades as policymakers assess the lagged impact of their aggressive series of hikes since early 2022.

As central bankers gather Tuesday to begin two days of deliberations, they’ll have fresh inflation data in hand. The core consumer price index is seen reinforcing expectations that Chair Jerome Powell, at his press conference the following day, will acknowledge both the progress made on inflation as well as the risks of stubborn price pressures.

The core CPI for November, which excludes food and fuel for a better snapshot of underlying inflation, is projected to climb 0.3% from a month earlier, when it rose 0.2%. Compared with a year ago, forecasters see a 4% advance that indicates that inflation is abating only gradually.

The inflation figures follow Friday’s solid labor-market report that showed healthy growth in employment and wages, along with a decline in the jobless rate.

Nonetheless, there are indications demand across the economy is cooling as the year draws to a close. November retail sales data on Thursday are expected to reveal consumers are becoming more guarded.

At the end of the week, industrial production figures are seen showing a partial rebound in factory output as striking auto workers returned to assembly lines.

What Bloomberg Economics says:

“There’s no incentive for the Fed to sound too eager to cut rates, lest financial conditions loosen further. While the December FOMC meeting may not move all the way to endorse the bond market’s pricing of sharp rate cuts next year, we think it will meet them about halfway.” —Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists.

European Central Bank

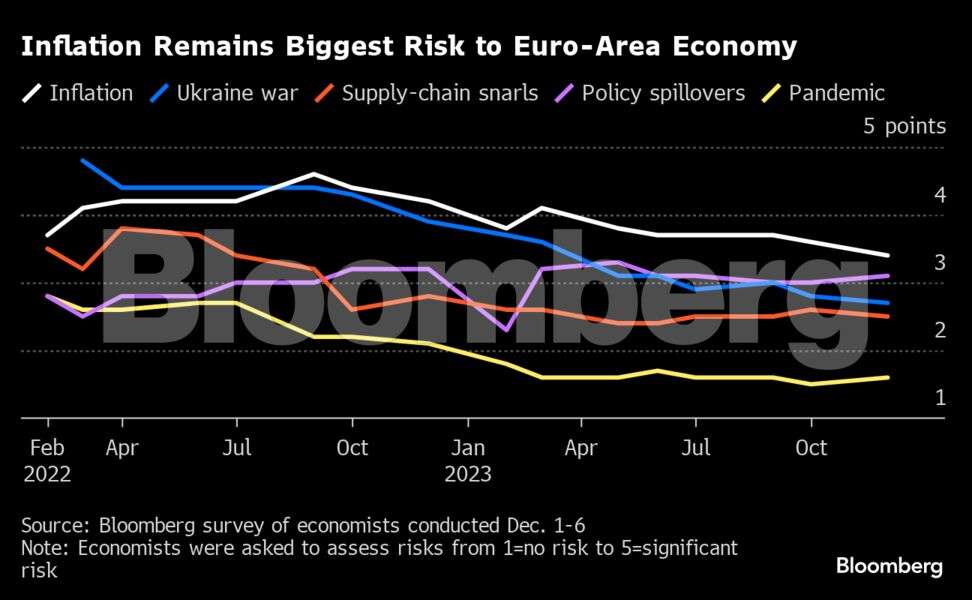

President Christine Lagarde will probably try to temper market expectations that price in a quarter-point European Central Bank rate cut in April.

While the euro zone could well be in a recession, and policymakers acknowledge that the labor market is showing signs of turning, they aren’t fully convinced that the danger to consumer prices has passed, and want to see more wage data.

Executive Board member Isabel Schnabel has called the inflation slowdown so far “remarkable,” and said that further rate hikes are now unlikely. But she hasn’t pivoted much further. One colleague, Peter Kazimir of Slovakia, termed expectations for a rate cut in the first quarter of 2024 “science fiction.”

Lagarde will present new forecasts, accompanied by a collective view on the risks to growth and inflation, that will likely be a central component of the ECB’s messaging to counter market speculation.

What Bloomberg Economics Says:

“Given the risks around the inflation outlook, the ECB is probably unhappy with interest-rate swaps pricing in a rate cut in March. Lagarde may make that clear in the press conference. Our view remains that the first cut will come in June and the risks are skewed toward earlier action.” — David Powell.

Bank of England

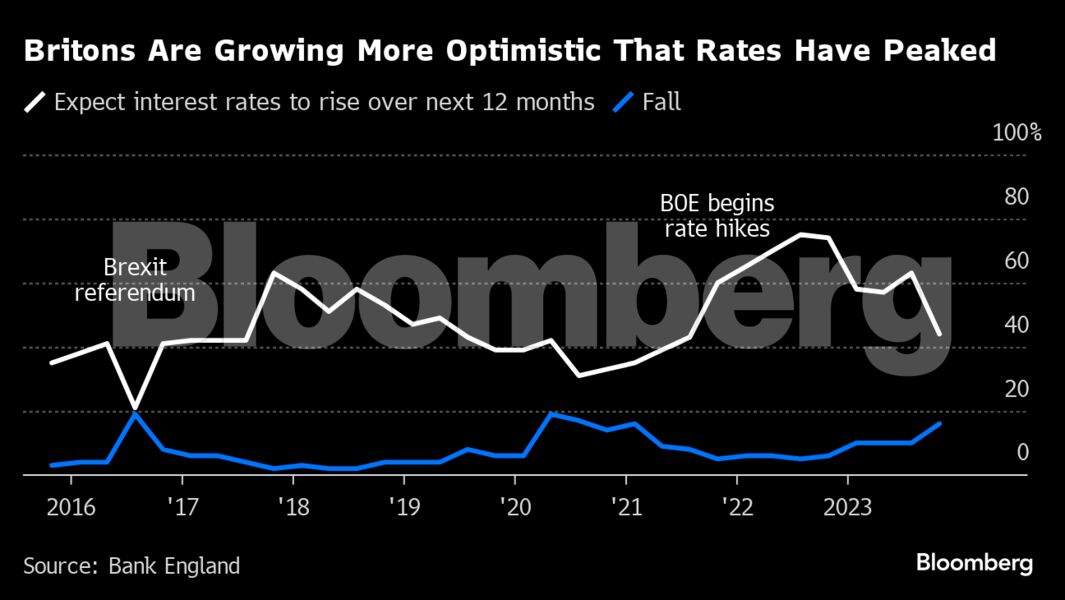

The Bank of England is expected to keep rates on hold for a third straight meeting and deliver a warning that the fight against inflation is far from over.

With the UK economy facing stagnation at best next year, investors are betting that the Monetary Policy Committee will start cutting borrowing costs – now at a 15-year high of 5.25% — in June.

However, officials are likely to repeat their guidance that policy needs to remain restrictive for an “extended” period to stop inflation from sticking above their 2% target amid a still-tight labor market and price pressures in the services sector. The BOE announces its decision at noon on Thursday.

What Bloomberg Economics Says:

“We expect the BOE to double down on its message that policy is likely to remain restrictive for an extended period of time — services inflation is too high and there are tentative signs the economy may have regathered some momentum in the fourth quarter. There is still a long way to go on the road to 2% inflation.” —Dan Hanson and Ana Andrade.

Switzerland

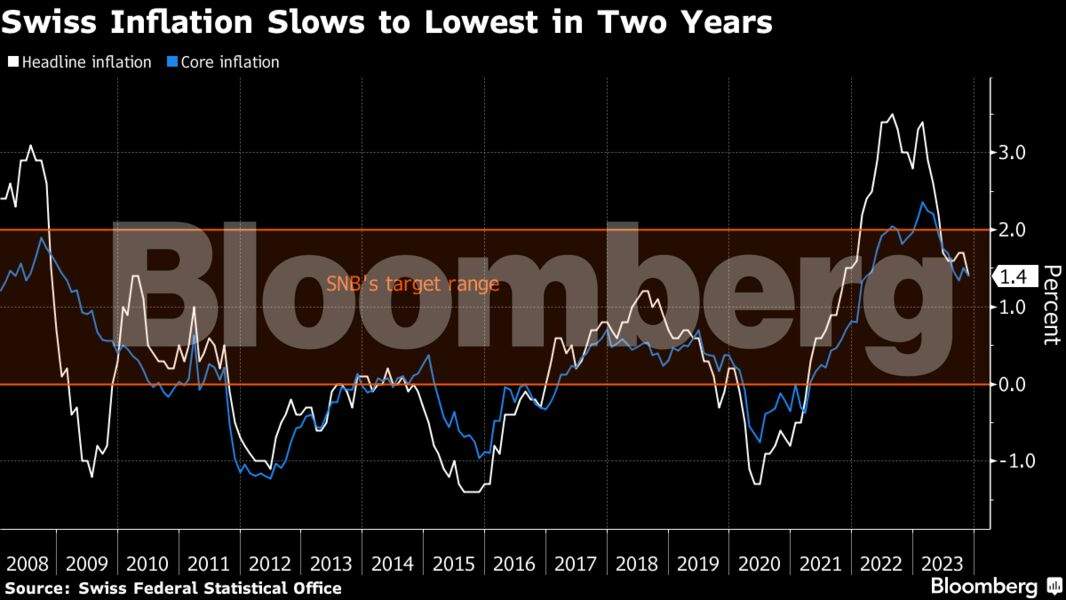

Swiss inflation is even weaker than in the neighboring euro zone — in fact, it has now declined to well below the 2% ceiling targeted by policymakers.

Speculation that they won’t cut rates as quickly as the ECB has pushed the franc to its highest level since the Swiss National Bank abandoned its cap on the currency nine years ago.

Even so, with Switzerland’s economy growing only feebly, officials will still face questions on the prospect of a reduction in borrowing costs in due course when they reveal their latest decision on Thursday.

Norway

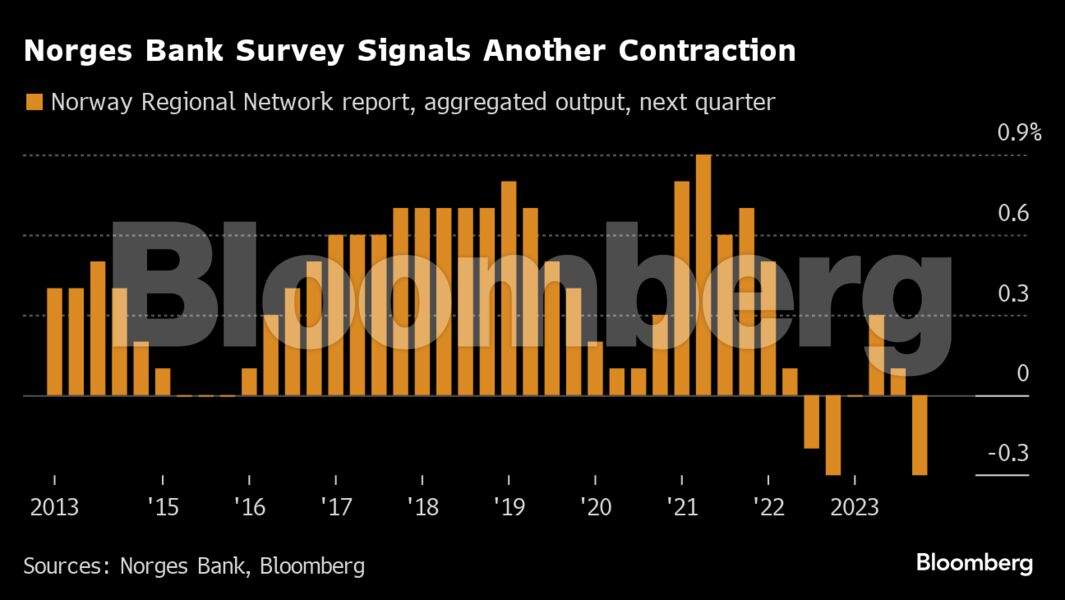

Norges Bank faces a tough choice on whether or not to go ahead with a final quarter-point rate hike. Recent data could encourage officials to brush off potentially inflationary krone weakness and stay on hold as the economy cools.

Stagnation is anticipated for the current quarter before a contraction at the start of 2024, as businesses encounter more spare capacity and fewer hiring problems, a key sentiment survey by the central bank showed this week.

Meanwhile, building activity is falling sharply and retail activity is slowing, even as Norway’s fossil-fuel sector cushions some of the fallout from stubbornly high inflation and rising credit costs. The Norges Bank decision comes Thursday.

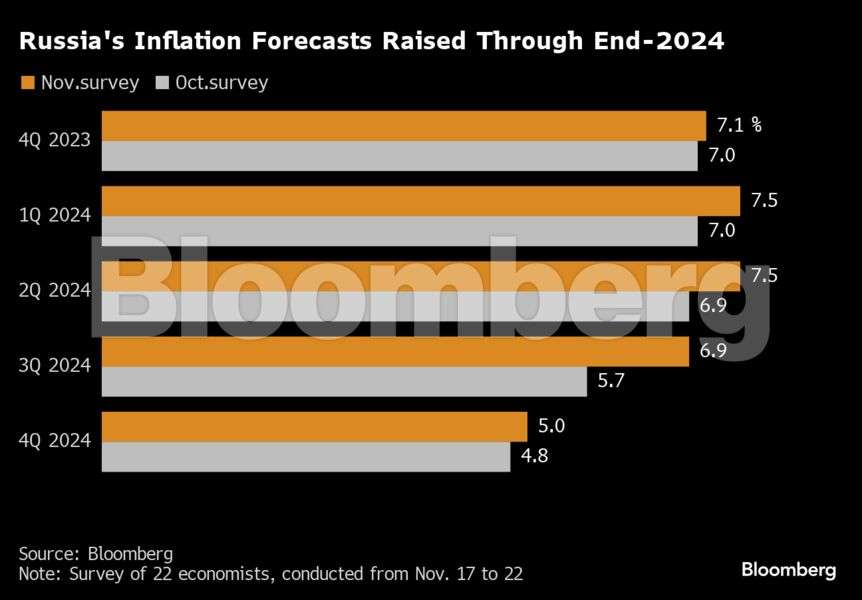

Russia

After raising its key rate by 200 basis points in October, the Bank of Russia will likely need to hike by another percentage point to 16% on Friday as policymakers strive to bring inflation back to their 4% target, according to Bloomberg Economics Russia economist Alexander Isakov.

Brazil

True to repeated signaling, Brazil’s central bank, led by Roberto Campos Neto, can be expected to deliver a fourth-straight half-point rate cut on Wednesday, to 11.75%.

A cooling economy and inflation that’s slowed back to within the central bank’s target range is widely expected to keep Banco Central do Brasil on that pace through the first quarter of 2024.

At that point, the board may slow the pace of rate reductions — depending on the global backdrop and state of local long-term inflation expectations, which remain above target across the entire forecast horizon.

Mexico

In Mexico, where Banxico typically doesn’t go in for dovish surprises, expect a unanimous decision on Thursday to keep the key rate at a record 11.25% for a sixth straight meeting.

Looking ahead, slowing core inflation and a cooling services component now have Governor Victoria Rodriguez saying that the rate-cut discussion could begin in early 2024. The consensus among analysts is for an easing cycle to begin in the first quarter.

Peru

Also on Thursday, Banco Central de Reserva del Perú’s December meeting finds the economy in recession and riding consecutive months of deflation, possibly making a case for a 50 basis-point reduction after three straight quarter-point cuts.

Still, upside risks to inflation from El Niño-related disruptions and ongoing political turmoil will likely see veteran bank chief Julio Velarde stay the course and lower the key rate to 6.75% from 7%.