The Initial Public Offering (IPO) of Go Digit General Insurance Limited, a prominent player in the insurtech sector, is set to hit the market from May 15 to May 17. The IPO price band is fixed in the range of ₹258 to ₹272 per equity share, with a face value of ₹10 each.

This move is part of the company’s strategy to raise capital for its growth initiatives and strengthen its market presence.

The IPO comprises a fresh issue of ₹1,125 crore, along with an offer-for-sale (OFS) of 54,766,392 equity shares by the promoters and other selling shareholders. Notably, the IPO lot size is 55 equity shares, with multiples of 55 thereafter.

The allocation of shares in the public issue is structured to reserve 75% for qualified institutional buyers (QIBs), 15% for non-institutional institutional investors (NIIs), and 10% for retail investors.

The basis for share allocation is expected to be finalized on May 21, with refunds commencing on May 22. Shares will be credited to the demat accounts of allottees on the same day, following the refund process.

Go Digit General Insurance’s IPO is led by a consortium of book running lead managers, including ICICI Securities Limited, Morgan Stanley India Company Pvt Ltd, Axis Capital Limited, Edelweiss Financial Services Ltd, HDFC Bank Limited, and Iifl Securities Ltd. The issue’s registrar is Link Intime India Private Ltd.

The company, known for its customizable insurance products spanning health, liability, property, marine, travel, and auto insurance, currently offers 74 active goods to its clientele. Its listed peers include New India Assurance Company Ltd, Star Health and Allied Insurance Company Ltd, and ICICI Lombard General Insurance Company Ltd.

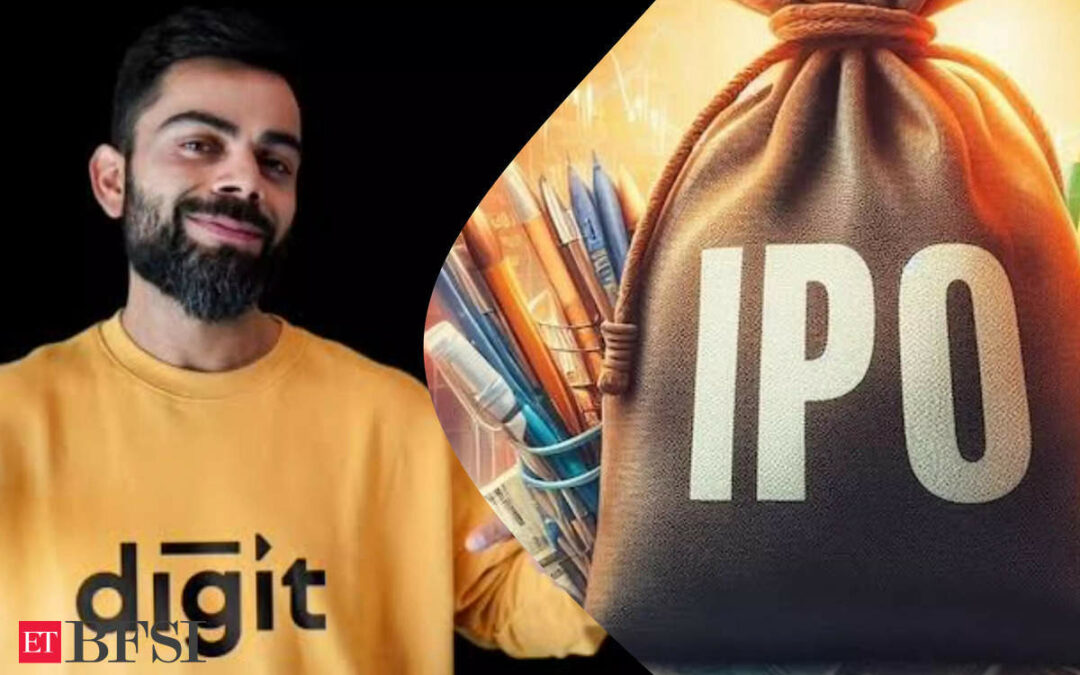

Noteworthy shareholders in Go Digit General Insurance include Indian cricket icon Virat Kohli and his spouse, renowned actress Anushka Sharma. Both celebrities invested in the company in February 2020, with Kohli purchasing 2,66,667 equity shares for Rs 2 crore and Sharma acquiring 66,667 equity shares for Rs 50 lakh.

The company plans to utilize the net proceeds from the IPO to fund its existing business operations and support proposed projects. Additionally, it anticipates the IPO to enhance brand visibility and image among current and potential consumers.

The listing of Go Digit General Insurance shares on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) is scheduled for May 23, marking a significant milestone in the company’s journey towards expansion and market capitalization.

Investors and industry analysts are closely watching the developments surrounding the IPO, anticipating its impact on the insurtech landscape.