By RoboForex Analytical Department

Gold prices are on an upward trajectory, moving towards 2351.00 USD per troy ounce on Tuesday. This marks a significant rise after days of sideways movement, highlighting the metal’s renewed appeal among investors.

This surge in gold prices can be attributed to a localised weakness in the US dollar, which has investors keenly anticipating the release of critical US inflation data later this week. The focus is particularly on the Core PCE indicator set for release on Friday, which is expected to provide further insights into the Federal Reserve’s potential interest rate adjustments.

The market’s reaction to the upcoming data could be pivotal, as strong movements in gold prices are likely once the Fed’s intentions on rates become clearer. To date, discussions on rate adjustments have been vague, leaving investors craving more definitive guidance.

Despite the Fed’s recent minutes suggesting a possibility of rate hikes due to persistent inflation, the market sentiment is tilted towards an eventual easing of the Fed’s stance, as indicated by the positive direction of short-term futures contracts on gold.

Technical analysis of XAU/USD

On the H4 chart of XAU/USD, a second downward impulse to the 2340.00 level has been formed. Today, a correction to 2358.50 has been executed. A downside movement to 2341.44 is expected, where a consolidation range may form. If the price breaks upwards from this range, a further correction towards 2384.80 could be considered. Conversely, a downward breakout could open the potential for a decline to 2318.80, the first target of the decline wave. This scenario is technically supported by the MACD indicator, with its signal line below zero and pointing strictly downwards towards new lows.

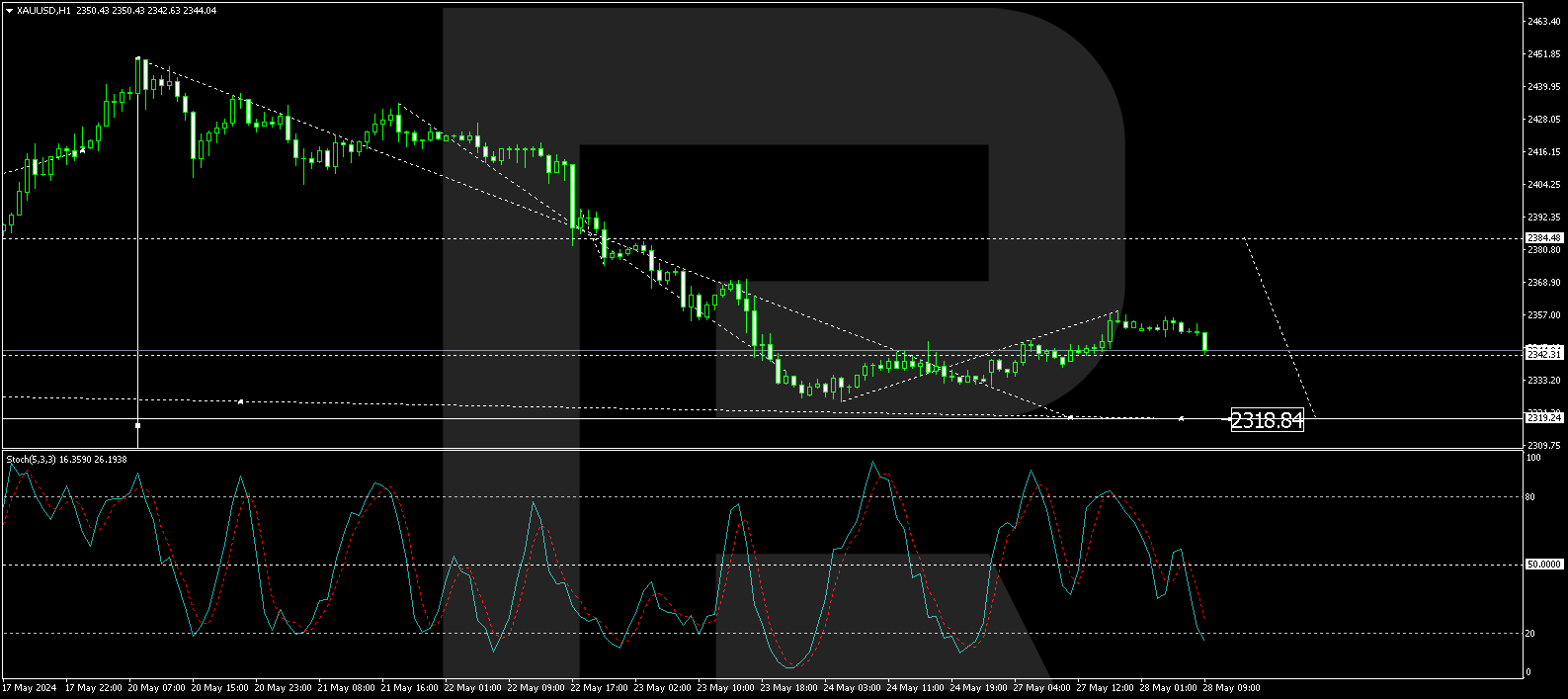

On the H1 chart, a decline to 2325.40 has been executed, followed by the formation of a growth structure to 2342.31. A consolidation range has formed around this level, with a correction wave to 2358.50, starting with an upward exit. Today, a decrease to 2342.31 (testing from above) has been executed. The new consolidation range is practically outlined. A downward breakout from this range could lead to another downward impulse to 2318.85. Further development towards 2384.50 is possible if the price breaks upwards, continuing the correction to 2384.85. Afterwards, a decline along the trend to 2318.85 is likely. This scenario is technically confirmed by the Stochastic oscillator, with its signal line having broken through 50 and continuing its decline to 20.

Summary

Gold prices are rising due to a weaker US dollar and anticipation of key US inflation data. Technical indicators suggest potential corrections and further declines, with significant support and resistance levels to monitor. Investors should closely follow the upcoming data and Fed communications for additional market direction.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Gold prices edge towards $2351 amid weakening US Dollar May 28, 2024

- Oil rises moderately ahead of OPEC+ meeting. ECB plans to cut interest rates next week May 28, 2024

- Strong economic reports fuel the dollar and harm indices May 24, 2024

- The Australian Dollar rapidly depreciates May 24, 2024

- Strong NVDA report helped indices stay afloat after hawkish FOMC minutes May 23, 2024

- Gold falls from highs May 23, 2024

- Is Oil Back in Buying Territory? May 22, 2024

- The RBNZ maintained its hawkish bias, leaving the interest rate at 5.5%. Inflationary pressures are easing in Canada May 22, 2024

- The New Zealand Dollar shows a steady rise May 22, 2024

- Today, traders are focused on Canadian inflation data and waiting for the RBNZ interest rate decision May 21, 2024