For India, even though there are no formal fiscal rules in place, policymakers have been following the path of fiscal consolidation. The consolidated fiscal deficit was lowered from 6.9 per cent in FY16 to 5.8 per cent in FY19 and public debt to GDP stabilised at around 70 per cent then. But the Covid shock meant that policymakers had to move to support the economy at a time of need.

This altered the fiscal dynamics but policymakers then returned to the path of fiscal consolidation. From a peak of 13.1 per cent of GDP in FY21, the consolidated fiscal deficit is expected to reach 7.7 per cent of GDP in FY25. The headline fiscal deficit masks the true adjustment that has already been underway, revealed a latest report by Morgan Stanley.

Importantly, as policymakers focus on boosting the ratio of investment to GDP, the underlying mix of the deficit has also shifted from revenue to capex. While the overall deficit narrowed by 4.7 ppt of GDP between FY21 and FY24, this was driven by a larger 6.1 ppt narrowing in the revenue deficit (from 9.2 per cent of GDP to a 17-year low of 2.2 per cent).

In fact, the FY25 revenue deficit is now at its lowest since FY08. Hence, what is delaying the consolidation at a headline level is the rise in capital spending as policymakers have lifted capital expenditure to GDP ratios to a 20-year high. Even then, this was necessary for the post-Covid recovery as policymakers needed to crowd in private demand, the report said.

ALSO READ: Budget 2024: Fiscal Consolidation to pace up, focus on Viksit Bharat, says Morgan Stanley

India’s fiscal & public debt better than Emerging Markets

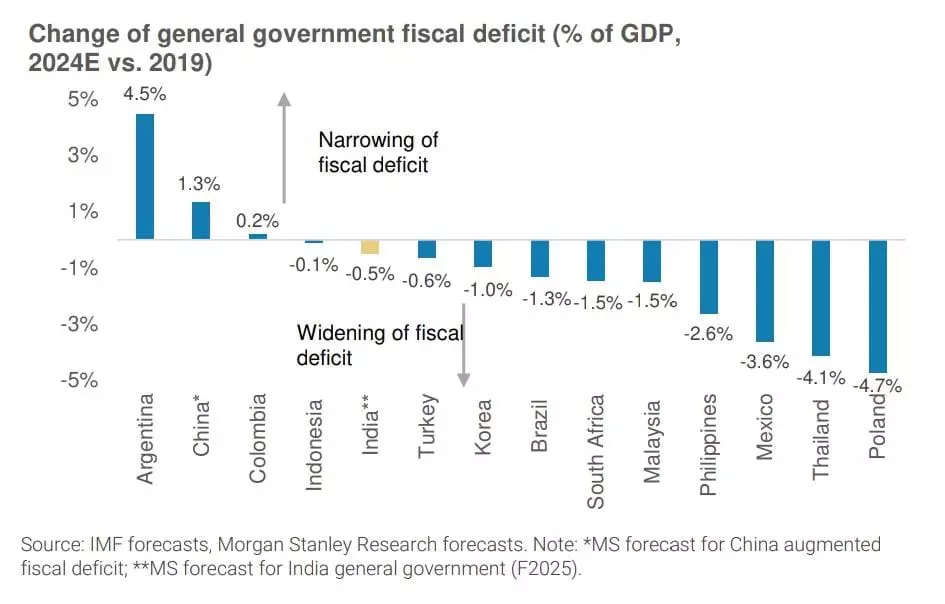

The widening of fiscal deficits and higher public debt ratios is an EM-wide issue. What stands out for India is that the policymakers’ commitment to the fiscal consolidation path post-Covid has meant that its consolidated fiscal deficit would be just 0.5 ppt of GDP above FY20 levels by FY25.

This would mark a quicker return to near pre-pandemic levels than most major EMs. The consolidated deficit will have narrowed 540 bps from a high of 13.1 per cent of GDP in FY21 by FY25, also among the largest declines from post-covid peaks across EMs, said the report.

India’s ratio of government debt to GDP has steadily declined 6 ppt from a FY21 high of 89 per cent and the increase of 9 ppt compared to pre-Covid levels has been milder as compared to most other EM Asian economies.

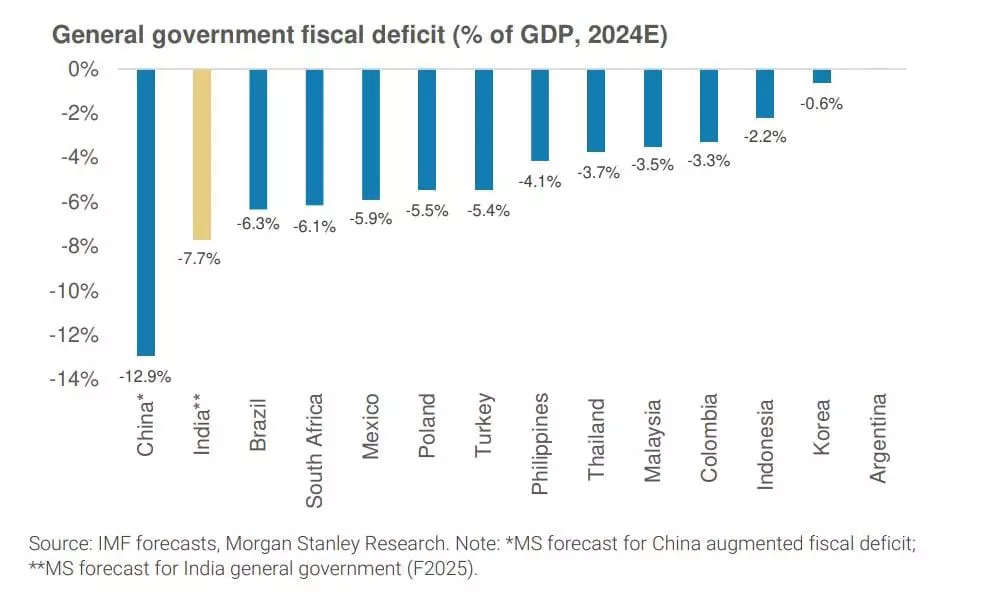

Despite these improving trends, India’s consolidated fiscal deficit of 7.7 per cent of GDP in FY25 would still likely be the highest amongst major EMs. Only China’s augmented fiscal deficit is expected to reach 12.9 per cent of GDP in 2024 – would be wider. At 83 per cent of GDP, India’s government debt to GDP ratio also remains elevated relative to other EMs, the report added.

Further efforts to consolidate the fiscal deficit will be needed. Given that India’s ratio of revenues to GDP is not that low on a comparative basis across major EMs, and that the continued formalization of the economy will likely lead to an increase in this ratio, the active consolidation efforts will have to come from the reduction of expenditures, the report further stated.

ALSO READ: Fiscal deficit may be budgeted below 5% GDP, borrowing to reduce: SBI Report

Public Debt should be lower

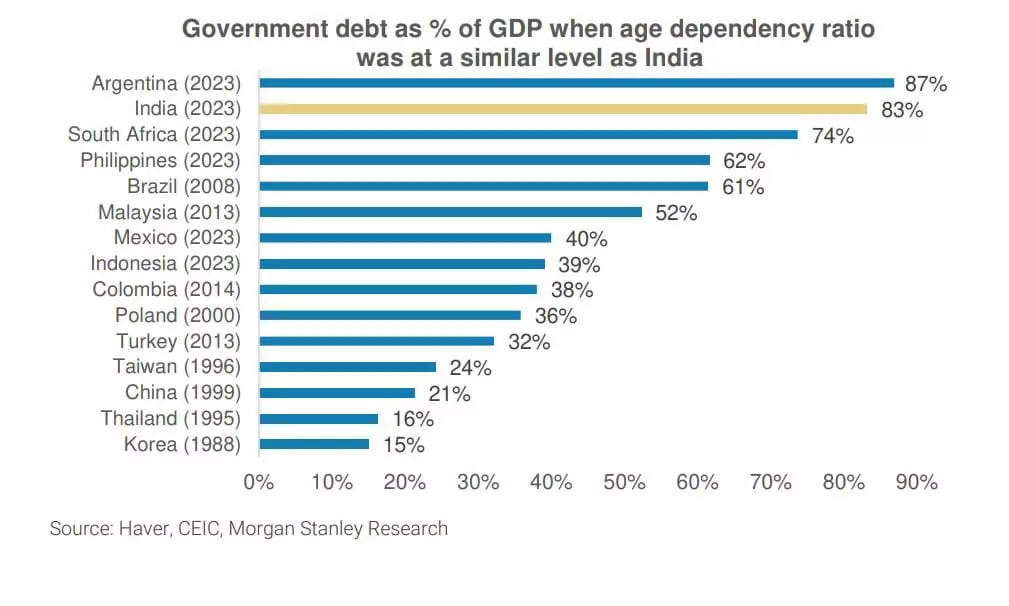

At the starting point, India’s public debt to GDP ratio is still very high. At 83 per cent of GDP, it is much higher than its pre-Covid level of 70.5 per cent. Based on other Asian economies, it is believed that this ratio should be at 60 per cent or even lower, taking into account the age dependency ratio and current stage of development, highlighted the Morgan Stanley report.

Further, fiscal authorities should operate in a prudent manner, keeping overall fiscal deficits and public debt low. In addition to creating a conducive environment for investment, fiscal authorities are also building up significant buffers at a time when their demographic trends are still favourable, in preparation for an eventual higher fiscal burden when the economies age.

India’s ratio of government debt to GDP is higher when compared with other EM economies when they were at similar levels of age dependency.