The fortunes of the Adani business empire have come full circle in just about 12 months. Last January, when shortseller Hindenburg Research shocked investors with charges of wrongdoings by the power-to-ports conglomerate, it looked like the Adani edifice, built on debt and puffed-up stock valuation, was about to crumble.

A year later, it has probably emerged stronger—both financially and legally — than it was prior to those public accusations. The Supreme Court’s dismissal, on January 3, 2024, of a demand for a special investigation into the alleged wrongdoings and the Adani Group’s nearly $5 billion fund-raise through share sale have allowed it to set sail on a longer voyage.

“Our sense is that the Hindenburg saga has proved to be a blessing in disguise for the Adani Group as the company has aligned its corporate strategy with the larger, shareholders’ interest,” says Manish Chowdhury, head of research, StoxBox. “The company has initiated several effective steps and worked on the profitability front, reduced leverage and pledge and enhanced institutional outreach.”

Investors appear confident rather than worried. Four of the ten listed stocks have fully recovered from their lowest since Hindenburg triggered the crash. Adani Power has more than doubled, while Adani Ports has gained 52%. ACC and Ambuja Cement have also recovered to the pre-Hindenburg level. However, Adani Wilmar, Adani Energy Solutions and Adani Total Gas still trade 33-73% lower.

Hindenburg charges

On January 24, 2023, Hindenburg Research, a firm that specialises in picking holes in companies’ financials and selling them short, rocked the Adani boat with allegations ranging from violation of securities laws to money laundering and stock price manipulation. It sought answers to 88 questions.

This not only punctured the stock valuations but also brought in regulatory glare. The Securities & Exchange Board of India (Sebi) began its probe on the charges by Hindenburg under the watch of the Supreme Court, which gave a thumbs-up to Sebi’s progress on Wednesday.

But much had happened in Adani’s world in the aftermath of Hindenburg’s allegations. A share sale, which was to raise ₹20,000 crore in a few days, was scrapped. The group’s valuation, which had made its chairman Gautam Adani Asia’s richest man, crashed by over 66% in two weeks— from ₹19.2 lakh crore to ₹6.7 lakh crore. There were questions about the group’s survival. Adani’s battle had just begun.

Over the years, Adani was envied more for the market valuations of his companies than for the gigantic ports or power plants he built. Holding companies’ price-to-earnings ratio in general is at a discount to that of operational companies, but Adani Enterprises defied that rule. Total SA’s $2 billion investment in Adani Green in January 2021 grew to $11 billion by April 2022, when the company’s market capitalisation reached an all-time high of $58 billion. Adani Total Gas had traded at 619 times the price-to-earnings ratio, when TotalEnergies, 500 times bigger in revenue, was at 14 times. Almost every group company had been an exception to established market valuation norms.

It all came crashing down when the Adani Group’s 10 listed companies lost more than half their value in days. While Gautam Adani lost the crown of Asia’s wealthiest man, investors who had missed the bus were suddenly eager to jump on. “The steep correction in the valuations of many Adani Group stocks post the Hindenburg report made them more appealing to investors,” says Deven Choksey, MD, KRChoksey Shares and Securities. “Those who comprehend the infrastructure sector and its long-term potential will likely find Adani stocks an attractive investment opportunity.”

The share prices have recovered since, though not fully. The overall market capitalisation has rebounded by ₹8.5 lakh crore from the February 2, 2023, lows, but it still remains ₹4 lakh crore below its value on January 24 last year.

Investors rush in

Seasoned, long-term investors believe every asset turns attractive, and is worth owning, at a particular price. That time arrived for many. The fallen Adani companies, which owned some of the best ports, airports and power plants in the country, drew investors such as GQG Partners with assets of over $100 billion.

The promoters raised ₹39,325 crore by selling their stakes in group companies such as Adani Enterprises, Adani Green Energy, Adani Energy Solutions and Adani Ports. Rajiv Jain’s GQG Partners and Qatar Investment Authority (QIA) were the two big institutional investors that bet on Gautam Adani’s ability to turn the situation around.

That seems to have paid off. GQG’s $4.21 billion investment in various Adani stocks in March-August 2023 has more than doubled by now, while QIA’s $474 million investment in Adani Green has yielded a 74% return so far.

“I think the current problems are not at the company levels,” Jain had told ET in an interview after buying into the group companies. “It’s the pledging that was a concern, right? And this actually reduces that risk. The companies have 20-, 25-year visible growth, but at the promoter level, there was, maybe, a little more tightness.”

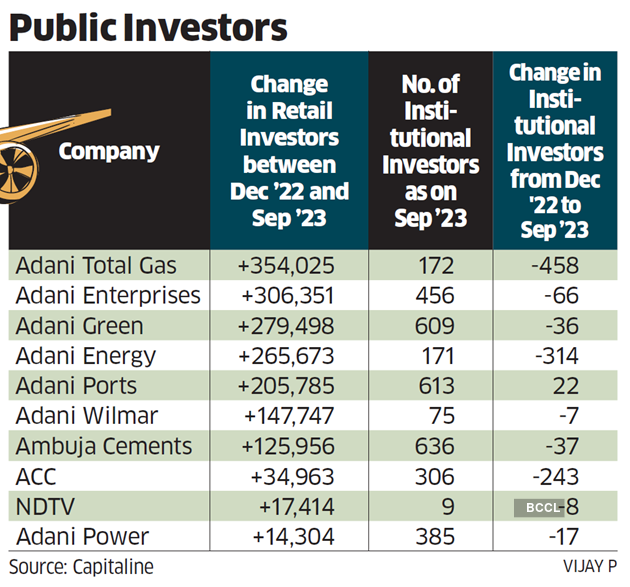

It wasn’t just the likes of Jain. Thousands of retail investors, who had earlier baulked at the astronomical valuations of the group’s firms, also jumped in. In the nine months to September, individual investors increased their stakes in all 10 group companies, show regulatory filings. Retail investors in Adani Enterprises went up by more than 3 lakh. In Adani Total Gas, they went up by 3.5 lakh and in Adani Green by 2.8 lakh.

However, many institutional investors sold off, fearing governance issues. In Adani Total Gas, 458 or 73% of institutional investors exited by September. In Adani Energy, 65% left and in ACC 44%.

A significant proportion of mutual funds investing in the Adani Group companies are passive or arbitrage funds. Funds managed by Goldman Sachs, Vanguard and BlackRock still own stake in companies such as Adani Power, Adani Port and Adani Green, according to filings.

Our sense is that the Hindenburg saga has proved to be a blessing in disguise for Adani Group as it has aligned its corporate strategy with the larger, shareholders’ interest. The company has initiated several effective steps and worked on the profitability front, reduced leverage and pledge and enhanced institutional outreachManish Chowdhury, Head of Research, StoxBox

Gautam Adani: Road to riches

Gautam Adani was born into a family of textile merchants. He dropped out of college to have a career of his own. He started as a diamond sorter in Mumbai, but moved on to become an entrepreneur and started his commodities trading business in the late 1980s. When the Indian economy opened up, he saw opportunities in infrastructure and began building ports. Not only did he build, but he also acquired assets, including L&T’s port in Dhamra and GVK’s airport in Mumbai.

On the way to building 15 ports, 13,650 MW power stations and 7 airports, Adani accumulated a net debt of $25 billion as of FY23, and that turned into group net debt-toebitda (earnings before interest, taxes, depreciation and amortisation) ratio of 4.2, a balance sheet that was overleveraged.

Hindenburg said the key, listed Adani companies had taken on substantial debt, and had even pledged their inflated stock for loans, putting the entire group on a precarious financial footing.

“In this report, we highlight what we believe to be one of, if not the most egregious example of corporate fraud in history. We have uncovered evidence of brazen accounting fraud, stock manipulation and money laundering at Adani, taking place over the course of decades. Adani has pulled off this gargantuan feat with the help of enablers in government and a cottage industry of international companies that facilitate these activities,” Hindenburg said.

Deleveraging exercise

When mur murs of leverage and overstretching by Adani came out in the open through Hindenburg, the group lost its glory, but it opened a window for redemption.

The investment by GQG and QIA at reduced valuations achieved what Adani Enterprises’ abandoned public share sale would not have even if it had gone through.

The fund raised at the promoter level was ₹38,600 crore, Adani told ET in mid-October. Out of this, ₹34,700 crore was invested by GQG and the rest by QIA. TotalEnergies has also committed an investment of $300 million for renewable power projects in the JV with Adani Green.

The group’s combined net debt-to-ebitda at the end of September fell to 2.5 times from 3.3 times at the end of March 2023. Run-rate ebitda is calculated by annualising the profit contribution of the projects that were commissioned during the year. That was 7.6 times in 2013. Net debt-to-equity fell below 1 for the first time in a decade.

“We have been consistently deleveraging, and the debt was not a problem before or after,” Adani had said. “With net debt-toebitda of below 3x, we are one of the least leveraged infrastructure portfolios and the highest rated infrastructure portfolios in India.”

In February, the promoters prepaid loans worth $1.1 billion ahead of their maturity in September 2024, reducing promoter-pledged shares in Adani Ports, Adani Green and Adani Transmission (now Adani Energy Solutions).

In aggregate, the promoters paid back $2.15 billion share-backed financing and released all promoter pledges. Any residual pledged shares related to loans taken by operating companies. Adani also prepaid a $500 million loan facility for acquiring Ambuja Cements.

“I think a lot of the issues are kind of solved in my opinion,” said GQG’s Jain. “So, we are taking a five-plus-year view, and hopefully we can own this for a long time. This is not a twoyear trade at all.’’

The steep correction in the valuations of many Adani Group stocks post the Hindenburg report has made them more appealing to investors. Those who comprehend the infra sector and its long-term potential will likely find Adani stocks an attractive investment opportunity”Deven Choksey, MD, KRChoksey Shares and Securities

The path ahead

Even as the Adani Group battled on the market and legal fronts, the business has been slowly moving, with investments in joint ventures, to data centres and more ports.

It has invested more than ₹5,000 crore in airports in the first half of the fiscal year, with the total target being ₹11,000 crore, Robbie Singh, CFO of Adani Enterprises, told investors in a call.

“In Adani New Industries, our commitment of having 10 GW of integrated manufacturing ecosystem is well underway,” added Singh.

“Adani New Industries has produced the first wafer in India. The 2 GW of ingot wafer plant is scheduled to be commissioned by the end of this financial year.”

Total of France strengthened its business partnership with the Adanis last month with an investment of $300 million in a joint venture to produce 1,050 MW of green energy.

Adani Group’s acquisitions returned to life with a winning bid for the bankrupt Coastal Energen and a stake in a media company.

For the first time in nearly a year, it met wealthy individual investors in Pune recently, marketing its businesses and their potential to create wealth.

“Our humble contribution to India’s growth story will continue,” Gautam Adani tweeted after the Supreme Court ruling.