In order to make it easier to track unclaimed deposits from several banks in one location, the Reserve Bank of India (RBI) launched a consolidated web portal dubbed as UDGAM (Unclaimed Deposits – Gateway to Access inforMation). The RBI has been urging the public to locate and contact their local banks to claim unclaimed deposits through these campaigns.

How to register to check for unclaimed deposit at UDGAM portal

Step 1: Visit website UDGAM https://udgam.rbi.org.in/unclaimed-deposits/#/register

Step 2: Register your phone number. Enter your name.

Step 3: Set a password. Enter Captcha code

Step 4: Tick the Check box and click Next. Enter OTP to verify.

How to check unclaimed deposit at UDGAM portal

Here’s how to use the portal to look for your unclaimed deposits.

Step 1: Visit website https://udgam.rbi.org.in/unclaimed-deposits/#/login

Step 2: Enter your phone number, password, captcha code. Enter the OTP received.

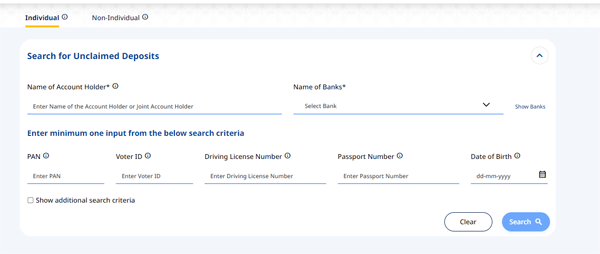

Step 3: In the next page, Name of Account Holder is mandatory field. Select the banks from the list.

Step 4: Enter minimum one input from the below search criteria.

- PAN

- Voter ID

- Driving License Number

- Passport number

- Date of Birth

Step 5: Click on search option. It will display if there is any unclaimed deposit account.

The seven listed banks are:

1. State Bank of India

2. Punjab National Bank

3. Central Bank of India

4. Dhanlaxmi Bank Ltd.

5. South Indian Bank Ltd.

6. DBS Bank India Ltd.

7. Citibank N.A.\

The search feature for the remaining banks on the portal would be rolled in by October 15, 2023.

What is an unclaimed deposit?

The term “Unclaimed Deposits” refers to funds in savings or current accounts that have not been used for 10 years or in term deposits that have not been repaid within 10 years of the maturity date.

What is Depositor Education and Awareness

According to the provisions of this Section, any money held in an Indian bank account that has not been used for ten years or more, or any deposit or money that has been unclaimed for more than ten years, must be credited to the fund within three months of the ten-year mark having passed.