So you’re dreaming of your next vacation: a cozy cabin getaway, or a wide-open sandy beach: something to just get you away from your current grind. The location is almost set, now you just need to save money to get you there.

Imagine this: what if you could pay for all of your travel costs without bumping up your credit card debt by a single penny? You can! Here’s how to use YNAB to plan that breath of relaxation, adventure, and save for a vacation free of money stress.

1. Name Your Vacation

Turn your dream vacation into a reality by giving it a name, and a spot to park some dollars.

When and where are you going? Write it down. Boom, just like that your mystical someday vacation feels instantly like it’s going to happen and you’ll be there soon to send a postcard.

While some personal finance gurus might recommend opening a dedicated vacation savings account or checking account, wouldn’t it be simpler not to? We track all of our vacation funds in YNAB—it’s a zero-based budget app where you can earmark your travel funds in digital envelopes without having 15 different bank accounts.

You can download a money-saving app like YNAB to plan for your vacation and save for it at the same time.

Try YNAB for Free

2. Set Your Savings Goal

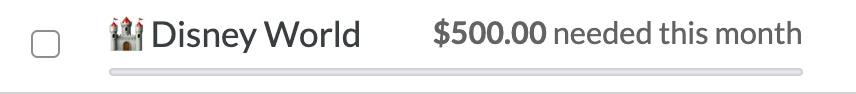

What’s your travel budget? Maybe you want to go to Disney, where the average cost for a family of four is just shy of $6,000.

Try breaking down your family vacation costs into smaller monthly savings. In YNAB, we make this easy! You can set a target for how much you want to earmark in total for your Disney vacation. YNAB will do the math for your and create your monthly savings plan according to your inputs.

In this example, the family wanted to save $6,000 for their Disney vacation next summer.

YNAB’s built-in calculators lets them know they’ll need to stash away $500/month leading up to the trip.

That can feel certainly more doable than a mountain of $6,000 all at once. If this target amount isn’t realistic for where you are right now, try pushing the date out a bit, shortening your trip, or make a plan to bring in extra money. Keep adjusting until it feels right for you.

Each month, you’ll set this chunk of money aside and you’ll see your progress toward your next trip in your monthly budget.

3. The Fun Part: Do Some Research

Now this is when the fun really starts: time to do some research. Check out those beautiful, affordable, can’t-miss, unique places to eat, sleep, see, and do, and then start planning your fun around the things you’re most excited about. Then, don’t forget to check out costs for airfare, hotel stays, and other travel-related costs.

You’ll start to get a picture of the financial pieces of your vacation. If it’s seeming more expensive than you originally planned, check out budget-friendly travel tips, get creative with food costs (Costco groceries?), or even get creative with travel rewards programs to cut down on airline costs.

With everything laid out in front of you, it’s the perfect view to tweak and prioritize where your dollars need to go for your vacation planning. Maybe you set your lodging budget as low as possible because you’ll be out and about anyway! Or, you could sacrifice on other areas and splurge on an onsite property (with a pool! Yes, please!).

At this point, maybe you even threw in the towel entirely on your original plan and go for a low-cost road trip or staycation instead! This vacation plan is up to you, and you’ll know the route you want to take.

4. Firm Up Your Plan

Once you’ve done your research and have a good idea of how much you’ll spend, you can get a little more granular with your expenses. If you’re still saving up the full amount for the vacation, you can set targets on these categories to track your progress. Or, if you already have the money set aside, go ahead and start assigning the dollars to the categories they need to go to.

5. Record Your Spending

Once you start paying deposits or buying tickets, you can record your spending in YNAB and it will keep a running list of your balances—no need to do any mental math!

Sometimes you’ll have money left over in categories, or sometimes you’ll go over in other categories. We call this “rolling with the punches” and you can move money from one category to another to cover overspending or spread the excess.

You can also keep things like confirmation numbers, travel rewards credit card information, phone numbers and Airbnb host names in the notes section of YNAB so they’re easy to reference. Your budget works even when you’re offline so it’s a reliable place to keep information you might need at any moment.

6. Enjoy a Stress-Free Vacation

When you finally take that dreamy vacation, you can feel completely relaxed and completely at peace with spending while on vacation (just how it should be). You’ll know the vacation is funded in cash, you’re not going in credit card debt while we scarf down an incredible soft pretzel, and as a major added plus…your notes save the day for trip details when you’re short on a wifi connection.

Post Vacation: All the Memories, None of the Debt

Once the vacation is over you might actually have a few dollars left available! YNAB makes it easy to move money around to your next exciting trip or priority, and you can hide the category so you still have all the data. This might come in handy when you want to remember the name of the Airbnb, how much the rental car was, or where you had that delicious pulled pork sandwich.

Each trip can be archived or hidden in YNAB and it’s fun to have a record of all the fun trips you’ve been and thinking about where you’ll go next. It also brings back great memories just looking at all the places you’ve been and thinking about where you’ll go next. And you know what the best way to end a vacation is? Planning your next one.

Happy Budgeting!

Want some more vacation budgeting inspiration? Watch as Ashley takes us through how to save for a dream vacation in YNAB, plus all the tools you need for effortless planning.