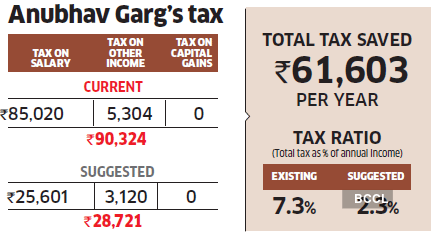

Meerut-based PSU bank manager, Anubhav Garg, pays low tax because his pay structure is tax-friendly, but there is scope to reduce the tax outgo further. TaxSpanner estimates that Garg can save more than Rs.60,000 in tax if he takes a home loan, his company offers him the NPS benefit, and his salary includes some basic tax-free components.

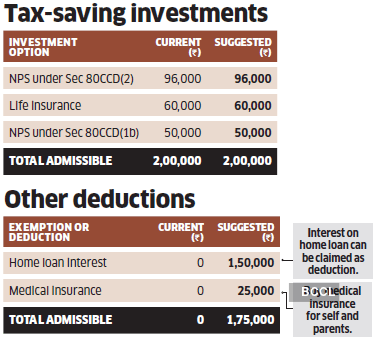

Garg’s bank offers the NPS as a retiral benefit to its employees, and he also invests Rs.50,000 in the scheme on his own. He should also seek the NPS benefit under Section 80CCD(2), wherein up to 10% of the basic salary put in the NPS on behalf of the employee is tax-free. If his company puts Rs.5,389 (10% of his basic) in the NPS every month, his tax will reduce by almost Rs.13,500.

Big tax savings await Garg if he takes a home loan. As an employee, he is entitled to a loan from his employer at favourable terms. Garg should use this opportunity to build an asset as well as reduce his tax liability. A loan of Rs.25 lakh for 20 years at 7% will require an EMI of about Rs.20,000 and an annual interest of around Rs.1.5 lakh. This can cut his tax by almost Rs.31,000.

Though PSUs are rigid in their pay structures, Garg should explore the possibility of getting some tax-free allowances. The taxable medical allowance can be replaced by leave travel allowance or reimbursement of books and newspaper bills. This can save him almost Rs.9,500 in tax.

He should also buy health insurance for his parents. An annual premium of Rs.25,000 will reduce his tax by Rs.5,200.

WRITE TO US FOR HELP

Paying too much tax? Write to us at etwealth@ timesgroup.com with ‘Optimise my tax’ as the subject. Our experts will tell you how to reduce your tax by rejigging your pay and investments.