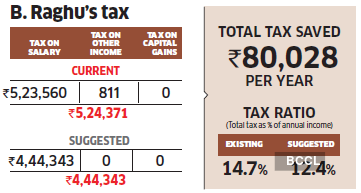

Bengaluru-based software professional B. Raghu earns well, but almost 15% of his income goes in tax. TaxSpanner estimates that Raghu can reduce his tax by Rs.80,000 if he opts for the NPS benefit offered by his company, and his pay structure is rejigged to include some tax-free perks.

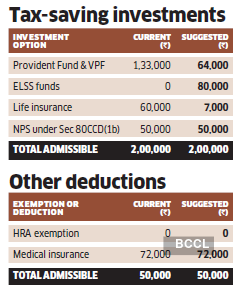

Raghu should start by opting for the NPS benefit. Under Section 80CCD(2), up to 10% of the basic salary put in the NPS on behalf of the employee is taxfree. If his company puts Rs.9,992 (10% of his basic) in the NPS on his behalf every month, his tax will reduce by Rs.37,500. Since he already invests in the NPS under Sec 80CCD(1b), Raghu knows how the scheme works and the asset allocation that suits him.

Next, he should explore the possibility of replacing the taxable emoluments in his salary with tax-free perks, such as a gadget allowance and meal coupons. Under Section 17(2), gadgets bought in the name of the company and given to the employee for personal use are taxed at only 10% of their value. If Raghu buys items like computers, furniture and ACs worth Rs.1.2 lakh in a year (Rs.10,000 per month), his tax will be reduced by Rs.33,700. Meal coupons worth Rs.26,000 (Rs.2,167 per month) will cut the tax further by around Rs.8,000.

Raghu’s company provides group health cover to his family, but he has bought health insurance for himself, his wife and mother separately as well. He pays a premium of Rs.72,000, but gets deduction of only Rs.50,000 under Section 80D because his mother is below 60. When his mother becomes a senior citizen, Raghu can claim tax deduction for the entire premium paid.

WRITE TO US FOR HELP

Paying too much tax? Write to us at etwealth@ timesgroup.com with ‘Optimise my tax’ as the subject. Our experts will tell you how to reduce your tax by rejigging your pay and investments.