Hurun India, in collaboration with Axis Bank, has come out with the third edition of the Hurun India 500, which is a tally of the country’s 500 most aspirational and successful companies.

This year, the list — titled Burgundy Private Hurun India 500 (Burgundy Private is Axis Bank’s private banking business) — features companies with a minimum value of Rs 6,700 crore, up by 13% from Rs 5,947 crore last year.

As per Hurun’s data, these companies employ 1.3% of India’s organised workforce. Hurun described the employment impact of these companies as significant, supporting the livelihoods of 7 million Indians — an average of 15,211 employees per company.

The 500 companies in the list collectively have a valuation of Rs 231 lakh crore, which “surpasses the GDPs of numerous prominent nations”. These entities are spread across 44 cities and towns, up from 36 in last year’s list.

The rankings covered not just major economic centres like Mumbai and Bengaluru but also showcases the importance of cities like Thrissur, Kochi, and Surat, Hurun India said. Geographical distribution wise, Mumba leads with 156 companies, followed by Bengaluru with 59 and New Delhi with 39. The top three cities contributed 254 entrants – compared to 264 entrants in the 2022 India 500.

The list includes very old as well as very new companies — in Hurun India’s own words, “spanning from the venerable 235-year-old EID-Parry to startups founded as recently as 2021”.

According to Hurun, list reflects the multifaceted nature of India’s economy as the companies are spread across a large number of sectors — from finance and healthcare to consumer goods, IT, and automotive, with leading companies like HDFC Bank, Sun Pharma, ITC, and Tata Motors — “exemplifying the breadth and depth of India’s industrial prowess”.

61 new companies made their debut on this year’s list. Industrial products sector led with 16 new entrants, followed by financial services with 10. The presence of women on the boards of 437 of these companies was a big highlight, Hurun said.

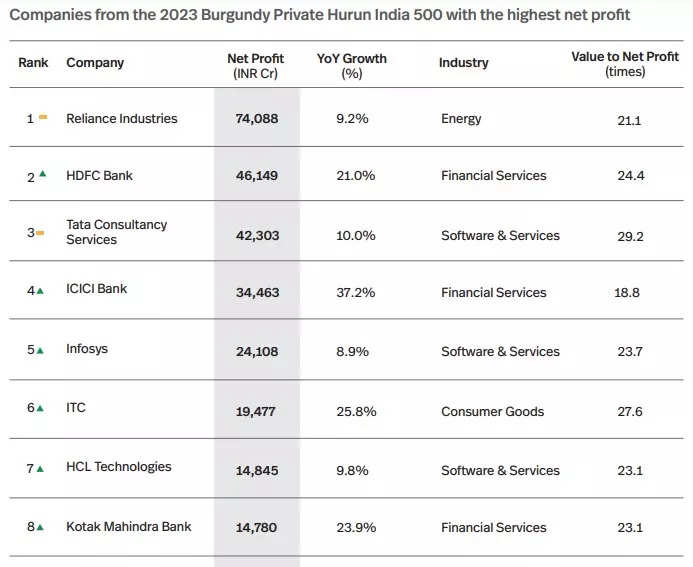

As per the list, Reliance continued to be the most valuable company in India with a value of Rs 15.6 lakh crore, followed by Tata Consultancy Services with Rs 12.4 lakh crore and HDFC Bank with Rs 11.3 lakh crore. This is Reliance’s third consecutive year at the top.

HCL Technologies and Kotak Mahindra Bank made their return to the top 10 list.

Startup funding and valuation continued their downward trajectory. Startups in the list cumulatively lost Rs 4 lakh crore led by Byjus, Dealshare, and Pharmeasy (the last one is not on this year’s list).

Not all was gloomy for Indian startups during the year, though. The cumulative value of the 6 unicorns listed on Indian exchanges gained Rs 62,837 crore — a marked improvement compared to the valuation loss of Rs 1,66,013 crore in 2022.

Adani Group’s eight companies constituted 4.3% of the total value of 500 top companies with a combined value of Rs 9.9 lakh crore during the year. During the review period, the value of the Adani Group companies fell by 50% or Rs 9,92,953 crore amid the Hindenburg row. However, since the Supreme Court’s favourable ruling, Adani Group regained Rs 4,72,636 crore in value (as on 17th January 2024).

Here are some of the other highlights of the keenly-watched report:

- Jio Financial Services secured an impressive rank of 28 after demerging from Reliance Industries.

- 179 of these companies have professional CEOs.

- In 2023, these 500 companies delivered a 13% sales growth, registering a combined sales of $952 bn.

- 342 companies saw an increase in value — up from 310 in the previous year. Of these, 18 companies saw their value doubling during the year. Three companies saw their value grow by Rs 1 lakh crore.

- More than half of these companies registered a value growth of more than Rs 1000 crore over the last year. Among them, 75 companies registered a value growth of more than INR 10,000 crore.

- Megha Engineering (up by 150%), manufacturing services startup Zetwerk (up by 100%) and Bennet Coleman (up by 100%), led the value growth (%) amongst the unlisted companies in the list.

- Suzlon Energy, which registered a YoY value growth of 436%, dominates the list of fastest growing (%) companies in list, followed by Jindal Stainless and JSW Infrastructure which grew by almost 5 times and 4 times respectively over the year.

- 26% of companies featured in the 2023 Burgundy Private Hurun India 500 are unlisted, a 6% fall from last year.

- Serum Institute of India continues to be India’s most valuable unlisted company.

- 44% of the companies in the list sell services; 56% sell physical products.

- 66% of the companies are consumer-facing, 34% are B2B.

- With a value of $1.1 billion, Incred Finance is India’s newest unicorn to debut in the 2023 Burgundy Private Hurun India 500.