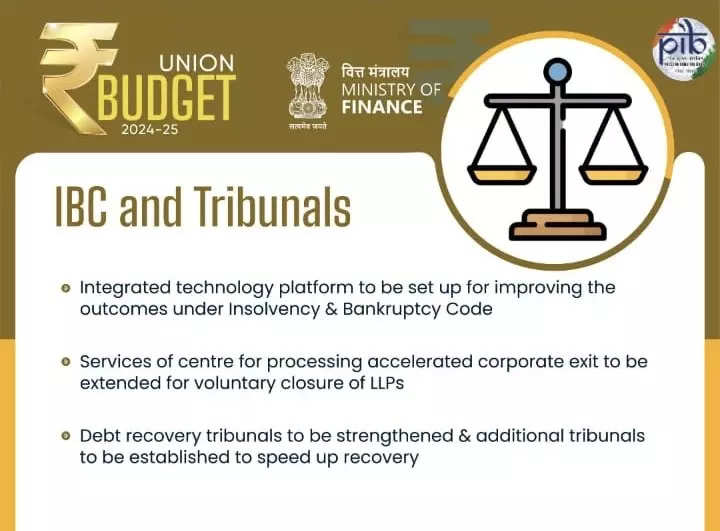

Union Budget 2024 Updates: The Finance Minister announced a significant reform aimed at enhancing the transparency and efficiency of the Insolvency and Bankruptcy Code (IBC). An integrated tech platform will be established to improve outcomes under the IBC, aiming for greater consistency, transparency, and better oversight for all stakeholders, including the National Company Law Tribunal (NCLT).

The IBC has been instrumental in resolving over 1,000 companies, resulting in a direct recovery of ₹3.3 lakh crore to creditors. Additionally, 28,000 cases involving over ₹10 lakh crore have been disposed of prior to admission. Introduced to strengthen the corporate insolvency regime, the IBC has set timeframes for resolving corporate insolvencies, which have been crucial in improving the corporate debt landscape in India.

However, the tribunals have faced criticism due to delays in case disposal. As of January 2023, the 15-bench NCLT had over 21,000 pending cases, with close to 13,000 related to the IBC. In 2023, it took an average of 643 days for a case to be resolved, significantly longer than the 270 days prescribed by the code.

“One of the hindrances to the success of IBC was the delays from the judiciary system. Setting up additional tribunals to deal with IBC cases is a welcome step which will expedite the resolution process. While the details are yet to be released, an integrated technology platform will also help in the timely dissemination of information and bring in efficiencies in the IBC process,” Samir Sheth, Partner & Head, Deal Advisory Services, BDO India said.

Despite these challenges, the Economic Survey 2023-24 praised the IBC for addressing ₹10.2 lakh crore of underlying defaults at the pre-admission stage, highlighting its impact on improving debtor behavior and benefiting banks and other lending institutions.

The Finance Minister’s announcement of a unified technological platform to enhance the effectiveness of the Insolvency and Bankruptcy Code (IBC) is being welcomed by the industry as a forward-thinking initiative.

“We recognize the critical role that technology plays in streamlining complex processes and improving outcomes. The introduction of this platform is a significant step towards modernizing the IBC framework. By leveraging technology, this platform will not only make the insolvency resolution process more efficient but also ensure higher levels of transparency and accountability,” Abhishek Gupta, Founder and Managing Partner at Pierag LLP Consulting said.

The businesses are advised to navigate the IBC process to embrace this technological advancement, as it will likely lead to smoother and more predictable outcomes. Overall, this initiative represents a significant advancement in the IBC process, and we look forward to witnessing its positive impact on the resolution of insolvency cases and the overall health of the financial sector, he added.

Also Read: FM unveils ₹1.48 lk Cr for education, jobs, and skills

The IBC has facilitated the successful closure of 4,131 Corporate Insolvency Resolution Processes (CIRPs) until March 2024. Of these, 3,171 corporate debtors have been rescued, with 947 cases resolved through approved resolution plans, resulting in a realizable value of ₹3.36 lakh crore. Creditors recovered approximately 32 percent of their claims, which amounts to 85 percent of the fair value and 162 percent of the liquidation value of assets.

The impact of the IBC on the financial markets is significant, as it has become the dominant recovery route for Scheduled Commercial Banks (SCBs). According to the RBI’s Report on Trends and Progress of Banking in India, 2022-23, the IBC accounted for 43 percent of the total amount recovered by SCBs in FY23. Over the past six years, the IBC has enabled over ₹3 lakh crore recovery for SCBs, more than what has been recovered through Lok Adalats, Debt Recovery Tribunals (DRTs), and the SARFAESI Act.

As of March 2024, 2,476 CIRPs ended in liquidation. Around 77 percent of these corporate debtors were defunct at the beginning of the process and were, on average, valued at 7 percent of the outstanding debt. The liquidation process provides a final opportunity for asset revival through going concern sales, compromise, or arrangement to maximize the value rescued. Around 50 businesses have been rescued at this last resort, and 586 firms were dissolved at the end of the liquidation process, releasing resources for alternate uses.

The IBC has been recognized as an effective solution for the twin balance sheet problem, addressing the stress of non-performing assets (NPAs) in banks and the over-leveraging of corporates. It mandates early intervention in financial distress, with insolvency professionals conducting the process and running the operations of distressed corporate debtors. The committee of creditors steers the resolution process, making significant decisions and reducing further erosion of value during the process.

The Code balances the needs of all stakeholders, providing corporate debtors an avenue to resolve their debt and exit failed business endeavors honorably. This promotes ease of doing business and encourages entrepreneurship. The IBC has significantly reduced Gross Non-Performing Assets (GNPAs), aiding in the recovery and reconstruction of distressed assets, and providing fresh impetus to the financial markets and the real sector.

In conclusion, the Finance Minister’s announcement of an integrated tech platform for the IBC is a step towards greater transparency and efficiency in India’s insolvency processes, ensuring a more robust and resilient economic framework for the future.