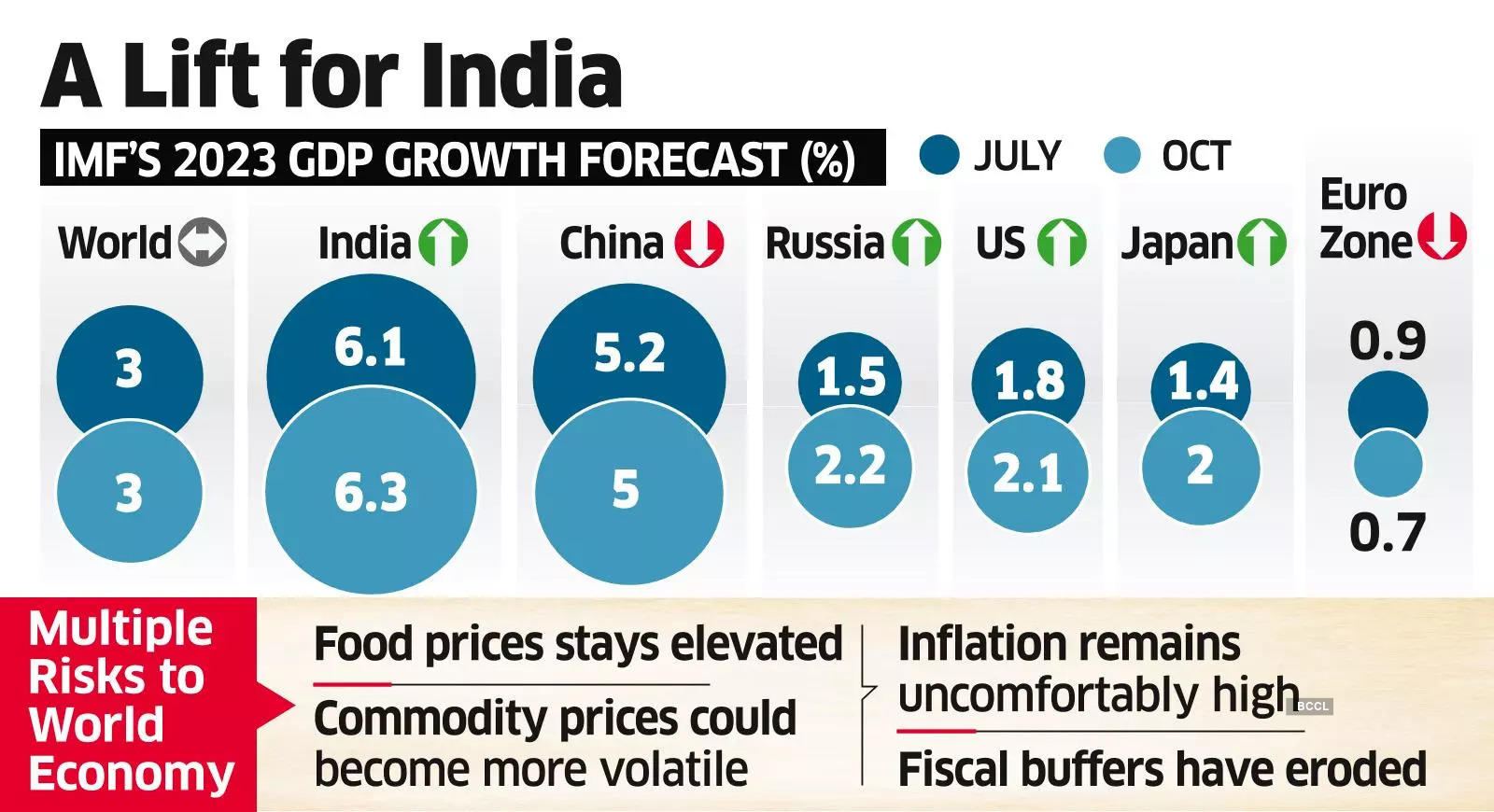

The International Monetary Fund (IMF) has bumped up India’s growth forecast for FY24 to 6.3% from 6.1% estimated earlier, hailing the country as one of the “growth engines in the world economy”.

The upward revision reflects “stronger-than-expected consumption during April-June”, IMF said in the World Economic Outlook (WEO) released Tuesday. The outlook for FY25 is unchanged at 6.3%.

IMF’s upgrade is the latest after other forecasters including Moody’s, Morgan Stanley, and Nomura raised their FY24 growth estimates for India. “It (India) has been doing better for a while now. And we’ve mentioned that India is, in fact, one of the growth engines in the world economy,” IMF chief economist Pierre-Olivier Gourinchas said, responding to a query from ET.

Inflation pegged at 5.5% now

India will continue to be the fastest-growing major economy. Real per capita output is seen up 5.5% in FY23, IMF said.

The Reserve Bank of India has projected 6.5% growth for this fiscal.

The projections do not consider the impact of the latest geopolitical developments in West Asia after the Hamas attack on Israel and the latter declaring war.

“We are monitoring the situation very carefully in terms of the economic impact that it may have…but it is too early to assess the impact,” Gourinchas said. “It broke out when the current projections were closed. We have to wait a little bit more,” he said.

He pointed out that oil prices had increased by about 4%, which is seen when there is geopolitical instability. “This reflects potential disruption on oil prices,” Gourinchas said, adding that a 10% increase in oil prices will weigh down global output by about 0.15% and increase inflation by 0.4% points.

“But it’s too early to jump to any conclusion,” he added.

India’s economy grew 7.8% year-on-year in the April-June quarter.

The latest revision represents a 0.2 percentage point increase from the IMF’s April forecast. The World Bank has also forecast 6.3% growth for India in FY24.

IMF has projected inflation at 5.5%, up from its earlier forecast of 4.6%.

“We do expect the inflation to come down to 5.5%, well inside that target range of 2-6% this year and 4.6% next year, so well inside the band,” Gourinchas said. “But that is conditional on the monetary policy continuing to be very focused on delivering price stability while preserving financial stability.”

Daniel Leigh, head of the World Economic Studies division in IMF’s research department, which produces the World Economic Outlook (WEO), highlighted the need for a continued data-dependent approach.

“What will also support this effort is more fiscal consolidation, especially in terms of a medium-term plan to reduce debt, which would also support the monetary policy and reduce inflation,” Leigh said.

Uneven global growth

The multilateral lender expects the global economy to slow to 3% in 2023 from 3.5% in 2022 and further to 2.9% in 2024, which is a downward revision from 3% in its July projection.

IMF has raised the growth forecast for emerging economies such as Brazil, Russia and Mexico among others while that for the United States is projected 0.3% points higher at 2.1% in 2023.

The upward revisions compensate for a cut in China’s growth forecast to 5% in 2023 from 5.2% estimated earlier.

After a strong initial rebound from the depths of the Covid-19 pandemic, the pace of global recovery has moderated, IMF said, flagging widening growth divergences across regions. “The latest projections confirm that the global economy is slowing as inflation declines from last year’s multi-decade peak,” it said.