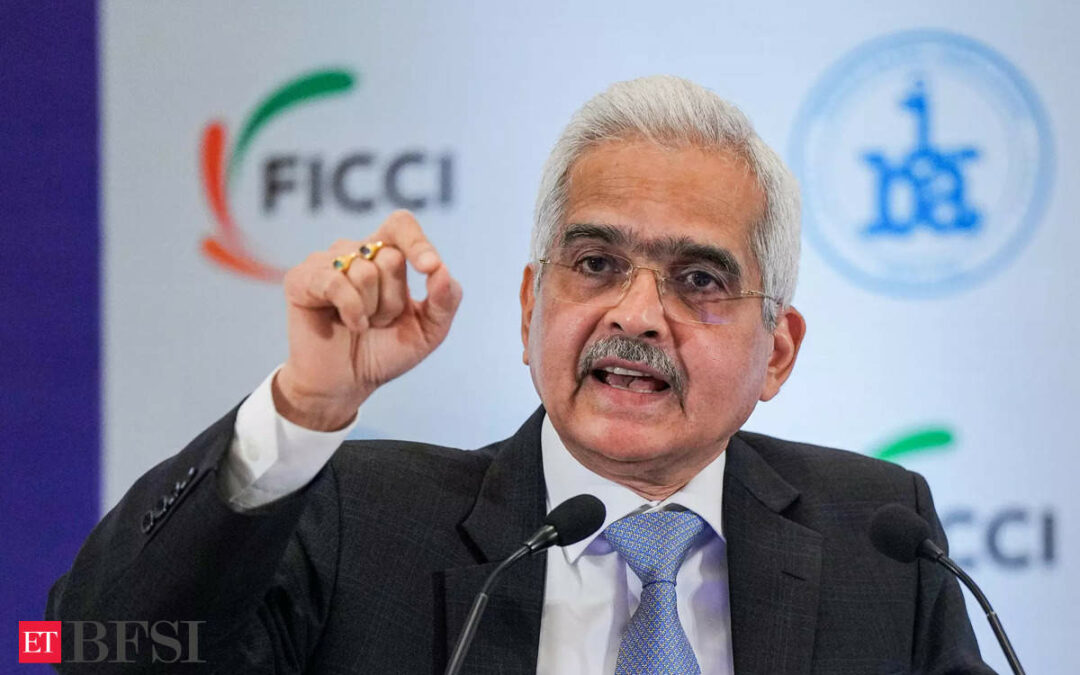

A few days after the Reserve Bank of India (RBI) has tightened norms on unsecured lending, Governor Shaktikanta Das highlighted that the recent move is a preemptive, and targeted and is in the interest of sustainability.

“We have also very recently announced a few macro prudential measures in the overall interest of sustainability. These measures are pre-emptive in nature. They are calibrated and targeted,” he said.

“We continue to focus on strengthening governance and assurance functions, ensuring effective risk management and robust lending practices,” he said.

Last week, in a circular, the central bank has said that on a review, it has been decided that the consumer credit exposure of NBFCs – outstanding as well as new – categorised as retail loans, excluding housing loans, educational loans, vehicle loans, loans against gold jewellery and microfinance/SHG loans, shall attract a risk weight of 125%. NBFCs’ loan exposures generally attract a risk weight of 100%.

Another key announcement that the RBI has made in terms of credit exposure is to increase the risk weights on exposures of SCBs to NBFCs by 25% points, over and above the risk weight associated with the given external rating, in all cases where the extant risk weight as per external rating of NBFCs is below 100%.

Industry players have believed that the increase in risk weights will affect the capital adequacy ratio of lenders, thereby making them set aside more capital for such loans.

Since majority of online lending apps cater to consumer loans, the overall demand for such loans might go down as they are non-essential in nature.

Also Read: RBI increases risk weight on consumer credit, bank credit to NBFCs

Precautionary measures advised by the Governor

In his speech, Das advised banks and NBFCs to take certain precautionary measures.

Banks and NBFCs may take due care to ensure that credit growth at the overall, sectoral and sub-sectoral levels remain sustainable and all forms of exuberance are avoided.

NBFCs are large net borrowers of funds from the financial system, with their exposure from the banks being the highest. They maintain borrowing relationships with multiple banks simultaneously.

“Needless to state that such concentrated linkages may create a contagion risk. Though the banks are well capitalised, they must constantly evaluate their exposure to NBFCs and the exposure of individual NBFCs to multiple banks,” he said.

He further advised the MFIs to bear in mind the affordability and repayment capacity of the borrowers.

It is indeed for micro finance lenders to ensure that the flexibility provided to them in setting interest rates is used judiciously. They are expected to ensure that interest rates are transparent and not usurious, the Governor said.