There has been a significant change in terms of interest rates in consecutive monetary policy announcements for both US and India, where both the countries have increased their rates over past few months consecutively. This has had an impact over the banking sector, and for US, there has been a financial stress, a banking stress.

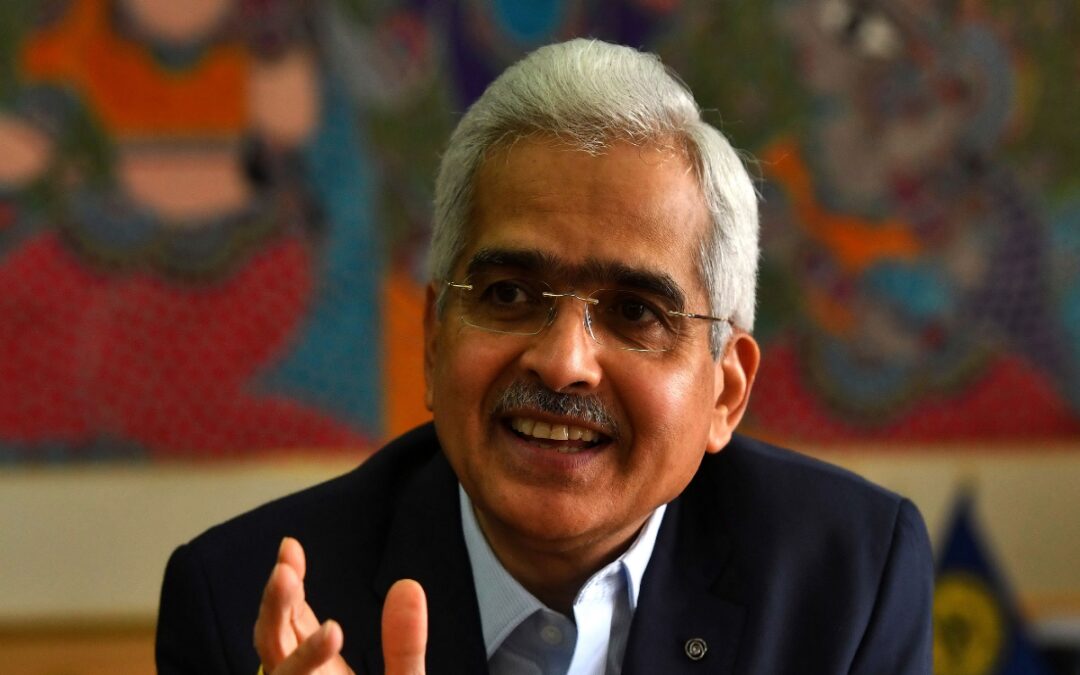

RBI governor Shaktikanta Das on Wednesday highlighted how both India and US dealt with the situation.

“In US what happened is interest rates increase of very high order in quick succession led to a situation where banks and other lending institutions came under stress. High inflation is a challenge in the US economy, and Fed was completely focussed on inflation but the financial institutions and banks had not adequately factored for the change in the cycle, there was a belief that ‘low for long’ interest rates will continue to remain so for eternity, which is a wrong assumption,” he explained.

The Apex bank governor asserted that one has to always keep his balance sheet so resilient that it is able to withstand the shocks which may originate when the cycle turns.

Citing an example of how the Indian regulator and banks dealth with this situation he said, “We have prescribed capital and liquidity requirements and we’ve made them uniformly applicable to all scheduled commercial banks irrespective of their asset size and exposure. We also have investment fluctuation reserves required which banks are supposed to create and they have created.”

“So in India, we didn’t see the financial stress or banking stress because our regulatory requirements ensured that the banks themselves had taken the required steps and they were ready for a change in cycle,” Das stated.

The Reserve Bank of India governor asserted that the Indian banking sector continues to be resilient backed by improved capital ratios, asset quality and robust earnings growth. Financial indicator of NBFCs are also in line with that of the banking system.

While Indian banks and NBFCs are in a good place today, the RBI governor also cautioned them and said that banks and NBFCs should strengthen their risk management in this time and build additional buffers to face any adversities in the business cycle.

“While banks and NBFCs are showing good performance now, sustaining it requires concerted effort. In good times like this, banks and NBFCs need to reflect and introspect as to where potential risks can originate. Now is the time for them to further strengthen their risk management practices, build additional buffers to face the situation if the business cycle turns adverse in the future. Good governance would be to remain prepared and be resilient in all situations,” the central bank governor further stated.

Reserve Bank of India governor Shaktikanta Das was speaking at FIBAC 2023 in Mumbai.