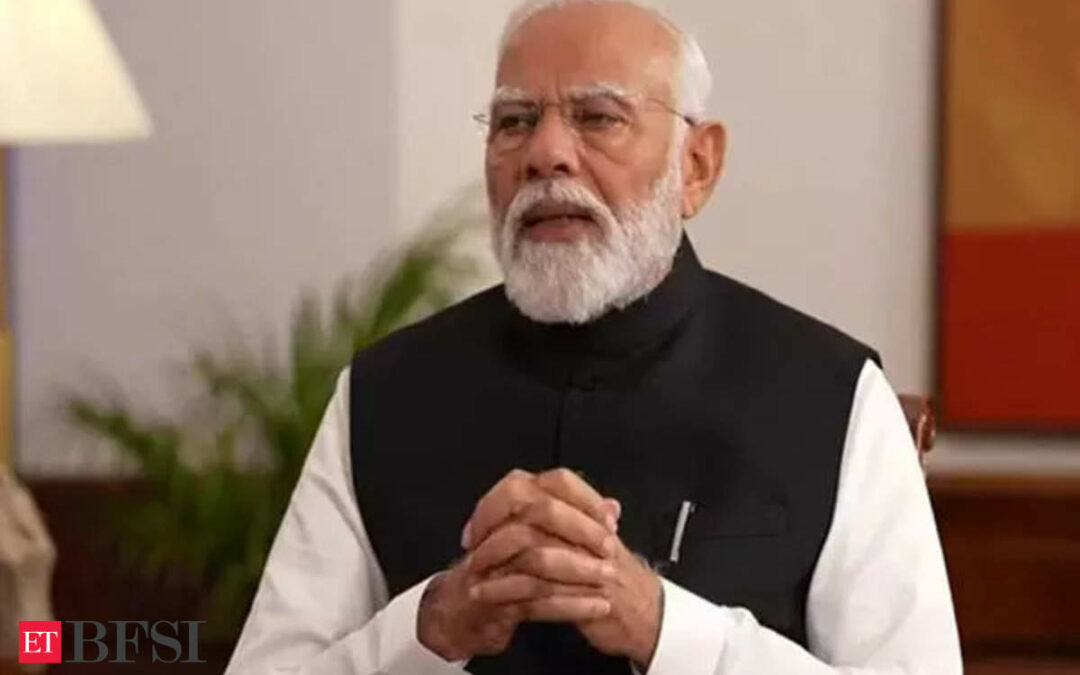

Driven by digital public infrastructure (DPI) models like unified payments interface (UPI), the country is now leading the global fintech ecosystem and several countries are ready to embrace the ‘India Stack’ solutions to empower the masses, Prime Minister Narendra Modi told IANS on Monday.

In an exclusive interaction at his official residence in the national capital, PM Modi said when he kicked off the ‘Digital India’ movement, opposition parties made allegations that this was being done to serve the needs of the service providers.

“They could not understand how big this area is and the 21st century is a technology-driven century. Moreover, technology today is driven by artificial intelligence (AI),” PM Modi told IANS.

The digital revolution, driven by UPI and QR-code-based payments, has shown to the world that DPIs like UPI, Aadhaar, and DigiLocker can transform millions of lives.

The UPI platform processed 13,115 crore transactions in FY24, aggregating to nearly Rs 200 lakh crore in value, compared with 8,376 crore transactions worth Rs 139 lakh crore in FY23. The transactions via UPI are expected to breach 100 crore transactions per day by FY27.

PM Modi told IANS that UPI has played a huge role in the world of fintech and due to this, “several countries are ready to embrace UPI because this is the era of fintech and India is now leading the fintech ecosystem”.

The third largest globally, India’s fintech ecosystem is poised to reach nearly $70 billion in annual revenue by FY30, according to reports. India is home to more than 10,000 fintech companies working in diverse sectors and segments.

Last month, UN General Assembly (UNGA) President Dennis Francis said India exemplifies how the digital revolution can be made accessible to millions and become “a fundamental driver of social transformation and progress”. Speaking at a conference on Digital Public Infrastructure (DPI) hosted by India’s UN mission, the UNGA President noted that in just seven years, India’s DPI model has achieved over 80 per cent financial inclusion for its citizens and now accounts for more than 60 per cent of all digital transactions worldwide.

The G20 summit in New Delhi last year recognised the transformative power of DPI and following this, India took the initiative to establish a global repository for DPIs, currently housing over 55 DPIs from 16 countries. The country has pledged $200 million to a social impact fund that will accelerate DPI adoption worldwide, especially in developing countries.