India’s fiscal year 2024 is showing more and more signs of the decoupling of the Indian Economy from the rest of the world. In a period when the US has witnessed declining manufacturing and services PMI, the US 2-year, and 10-year rates are close to peak backwardation and the Fed has raised the FOMC interest rate to a median of 5.36%. Indian GDP is expected to grow at 6.5% and the RBI has maintained the repo rate.

The Indian manufacturing, services and Composite PMI all are in expansion mode and showing no signs of a slowdown. Inflation especially due to food is marginally inching up to 5.4% but within the healthy band of 4-6%.

Taking a cue from this, the stock markets are moving from strength to strength, with the midcap and small-cap indices up an average of 30% since April 2023 and largecap at 17%.

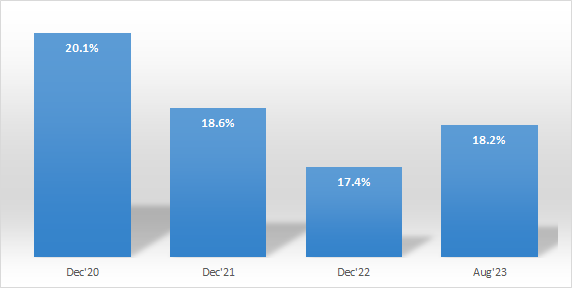

Our calculation suggests FIIs ownership has slipped by almost 200 bps in the last two and half years from 20% to 18% currently, despite the market growing a staggering 65% in this period. This is despite them incrementally having pumped in as much as US$ 18 billion during the last four months. (Source- JM Financial research)

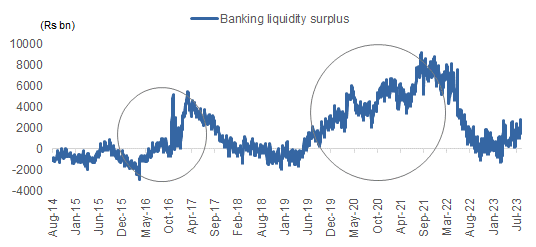

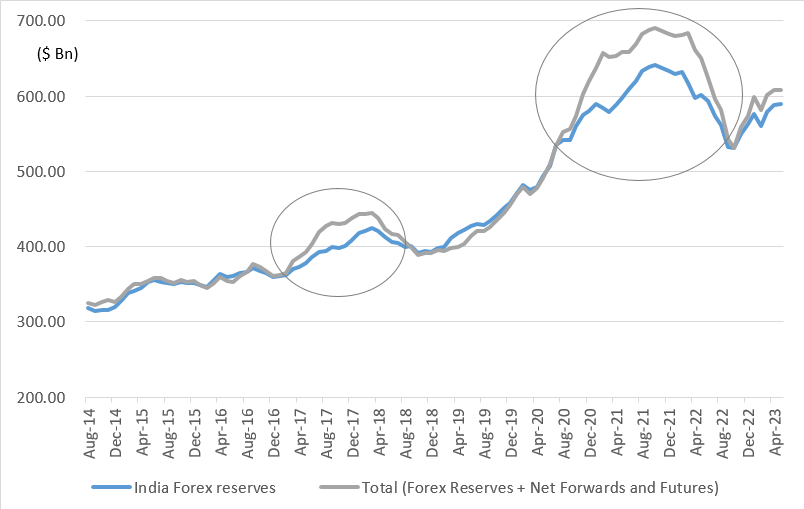

At one end FII inflows have increased Forex reserves for India, at the other end, RBI has increased its one year forward of US$ by almost US$ 20 billion, reducing almost Rs 1.7 trillion of liquidity which would have found its way in the banking system liquidity. Despite that the system is currency flushed with almost Rs 2 trillion worth surplus, partly aided by the Rs 2000 note being deposited by people since RBI has withdrawn it from September 2023. The RBI announced a 10% increase in CRR to restrain the possible liquidity deluge.

Historically when the forex reserves increase, liquidity in the banking system rises and the Indian rupee appreciates and capex increases. During 2003-2008 India Inc’s profitability increased at a cagr of 25% and the currency appreciated by 10%. Since then this is the first time we have seen double-digit growth in earnings for 3 years in a row and we expect the growth momentum to sustain at least in the next two years

India Inc. earnings had fallen to almost 1.3% of GDP pre-COVID and now stands at over 4.5%. The Increasing Earnings trajectory is now being driven by Telecommunications, Automobile, capex related sectors along with the Financial banks; as against global facing sectors and the financial services space earlier. Our team expect a 19% CAGR in earnings in most indices F2023-F2025 with even higher growth in the smallcap and midcap due to their higher exposure to capex-related companies. (Source- JM Financial research)

Themes to play in the current market environment

The themes we would like to be invested in the current environment are largely domestic facing sectors as against global. In the domestic facing sectors, we believe India’s growing per capita income, as well as demographics, augur well for both the financial sector and consumption space or “Finsumption”. With the Indian government focused on increasing capex both at the state and central levels, the Industrial and Capital goods space is our favourite. The Indian government in the Budget 2023 announced an increased impetus towards capex. Based on our estimates the capex spends by the government including the Public Sector Companies in F2024 should increase from 4.1% of GDP to 4.9%. Five sectors where we can witness capex cycle playing off are a) Defence; b) Power; c) Railways; d) Water treatment and e) PLI-led Manufacturing.

The next theme we are focused on is MAKE IN INDIA which either is directly into niche exports where India has an edge or those companies replacing exports like defence, pharmaceuticals and chemicals.