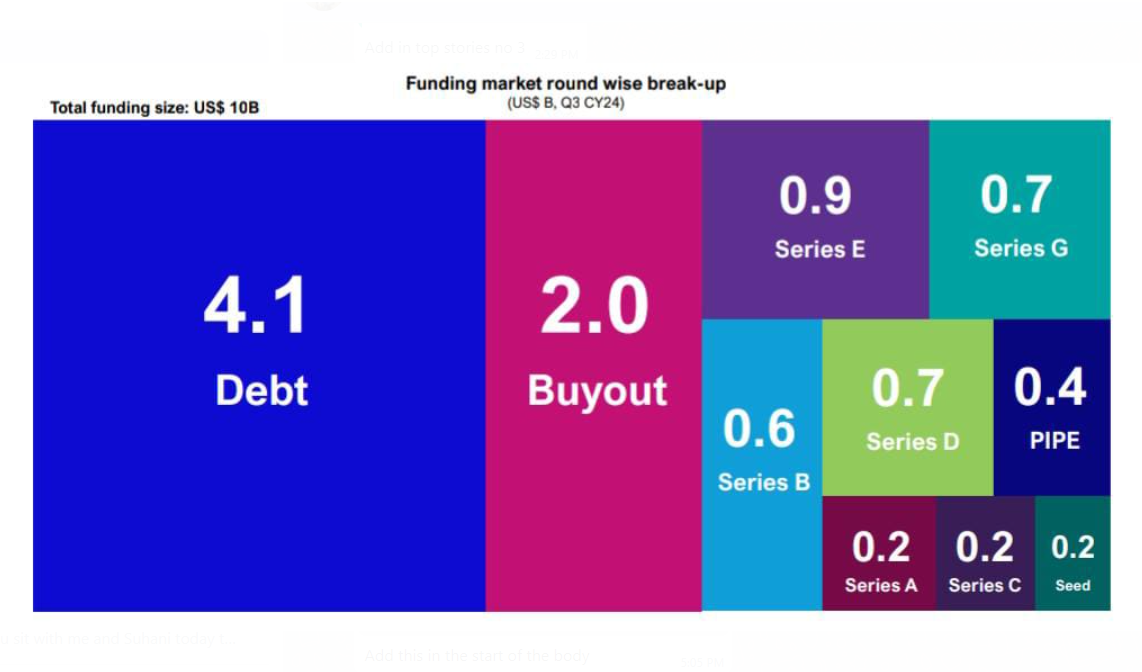

Startups in India raised USD 10 billion across 229 deals in Q3 CY24, signaling a decline in total funding ( approximately 15 per cent) on a QoQ basis. The deal volume

also decreased from 318 to 229 deals (about 30 per cent) compared to Q2 CY24, revealed a latest report by 1Lattice.

Banking, Financial services and Insurance (BFSI) sector received the highest funding of USD 3.5 billion followed by Telecom sector receiving a funding of USD 2 billion and SaaS/AI sector receiving funding of USD 1.2 billion.

Investments across early stage experienced a decrease in volume by approximately 5 per cent in the third quarter compared to the second quarter.

Early-stage deal volume slightly decreased from approximately 55 per cent to 45 per cent and debt deals volume increased from 15 per cent to 30 per cent, indicating that

the VC/PE firms are looking to be more interested in safer options due to continuing global uncertainty & geopolitical tensions, said the report.

Average deal size increased by approximately 20 per cent to USD 43.6 million compared to the previous quarter. NaBFID (under BFSI) raised the second-highest in the third quarter, with a funding of USD 599 million.

Accel, Venture Catalyst, Kalaari Capital and Blume Ventures were the most prominent investors for early-stage investments in Q3

CY24 with 4 deals each, the report added.

IFC, WestBridge Capital and Nexus Venture Partners were the most prominent investors for growth-stage investments in Q3 CY24

with 3 deals each.

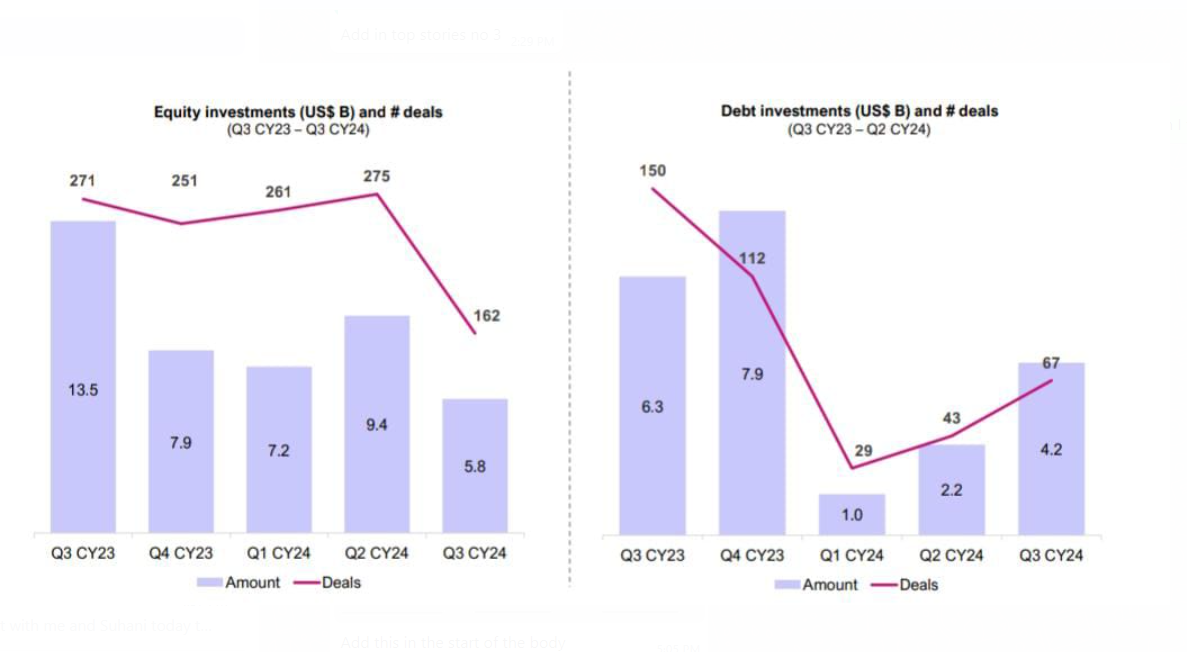

Equity & Debt Investments

Debt (USD 4.1 billion) and Buyout round (USD 2 billion) funding were the highest contributors to overall funding raised in Q3 CY24. Investments in the third quarter of CY24 have declined, breaking the trend from Q1 CY24 to Q2 CY24, the report revealed.

Equity investments saw a drop from previous quarters to USD 5.8 billion, while there was

a surge in debt deals to USD 4.2 billion in Q3 CY24. Debt deals grew from approximately USD 2.2 billion to USD 4.2 billion compared to the previous quarter:

Growth stage deals amounted to USD 2.3 billion in Q3 CY24. Average deal size rose to USD 44 million from USD 36 million with total deals dropping to 229, down from 318 in Q2 CY24.