India’s Goods and Services Tax (GST) has remained a central focus in India’s economic discussions and this time around as well, finance minister Nirmala Sitharaman is expected to take the GST figures into consideration before presenting her upcoming Budget in July.

The GST collection hit a new milestone of Rs 2.1 lakh crore in April 2024 signalling the strength of the economy. Robust GST collections have eased the burden on govt coffers. Strong tax collection, both direct and indirect, has been a major factor behind the Modi government sticking to the fiscal glide path.

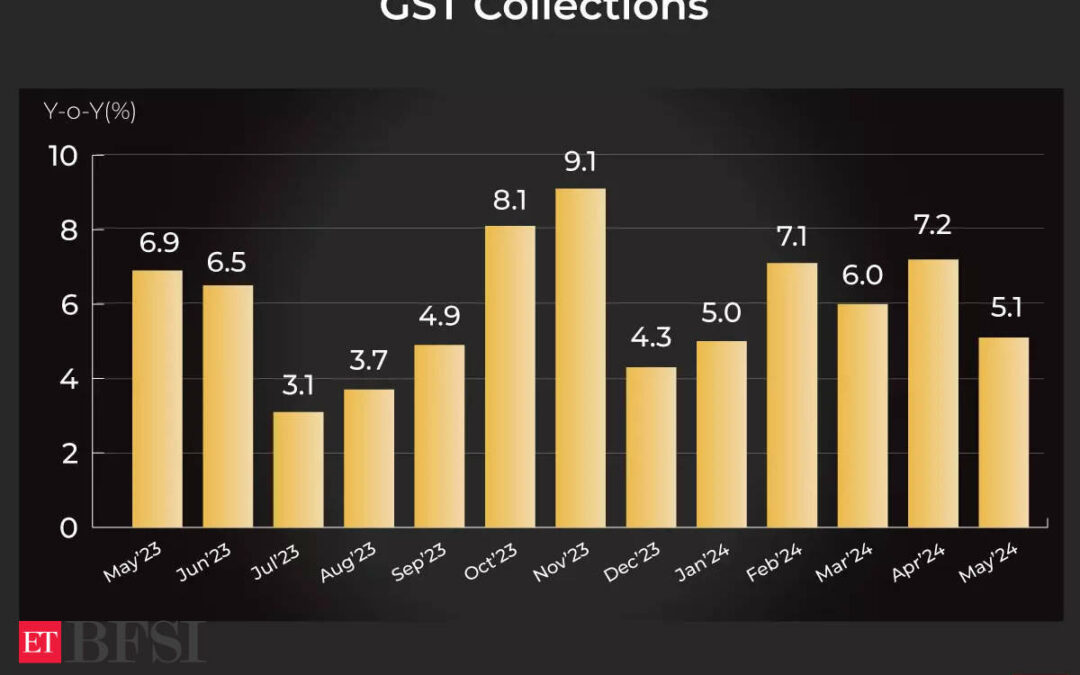

May GST collections also came in at Rs 1.73 lakh crore showing a maturing of the system amid growing compliance. It provides a platform to further streamline the tax slabs.

Strong economic momentum will ensure that GST collections continue to hit new milestones in the coming months helping the government in focusing more on its capex agenda. Coupled with sale of public assets and record RBI dividend, the government can fire on both fronts — capex and welfarism.

GST, which was introduced in 2017, is a major indirect tax reform that helped unify a plethora of taxes. According to the latest Budget documents, out of every 1 rupee that comes to the government’s coffers, 18 paise comes from just the GST.

As the government gears up for Budget ’24, existing policies in taxation, investment incentives, and welfare programs will play a critical role. The principle of continuity and strategic realignment is likely to guide budgetary decisions, ensuring a seamless transition while addressing evolving economic demands.

With a coalition government now in place, the budget will need to balance growth objectives with coalition partners’ priorities, aiming to maintain economic stability and foster development.

It will also mark the first full budget of the newly formed Modi 3.0 government.

This budget is expected to be a pivotal document, shaping India’s economic future amid a dynamic political landscape.