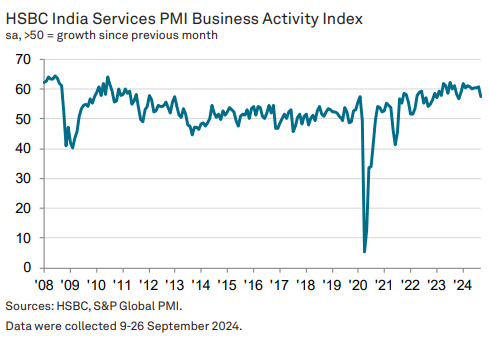

India’s Services PMI for the month of September followed the trend in Manufacturing PMI, dips to 57.7 from 60.9 in August, the report by S&P Global showed on Friday.

India’s services sector witnessed a slower rate of expansion in September 2024, according to the latest HSBC India Services Purchasing Managers’ Index (PMI) compiled by S&P Global. The PMI fell from 60.9 in August to 57.7, marking the slowest growth since November 2023 which was recorded at 56.9.

Businesses grappled with competition, evolving consumer preferences shifting toward online services, and escalating cost pressures. Despite these challenges, the sector continued to expand, with robust domestic demand. Finance & Insurance recorded the highest increases in both output and new orders.

The headline Business Activity Index fell below 60 for the first time in 2024, but we note that at 57.7, it was still much above the long-term average. The new business index followed a similar trajectory as the headline figure, indicating the possibility of softer output growth in the coming months.Pranjul Bhandari, Chief India Economist at HSBC

However, export demand told a different story, with growth weakening to its slowest pace this year. Subdued international sales from key regions, including Asia, Europe, and North America, contributed to this decline.

Services companies’ margins have likely been squeezed further, as prices charged rose at a slower pace when input cost inflation intensified. A long period of robust new business growth has led to strong labour demand, Bhandari added.

Movement of Services PMI in FY25

On the employment front, the services sector continued its upward trajectory, with businesses citing strong demand and new business gains as driving factors for increased hiring.

Input cost inflation remained significant, primarily driven by increases in energy and material costs, businesses reported the weakest rise in selling prices in over two and a half years. This pressure was particularly felt in the consumer services segment, while the finance and insurance sectors saw the fastest rise in selling prices.

A PMI reading above 50 indicates growth or expansion in the sector compared to the previous month.