US hiring picked up along with hourly earnings at the end of 2023, though some metrics in the closely watched jobs report and a separate services survey tempered optimism about the labor market.

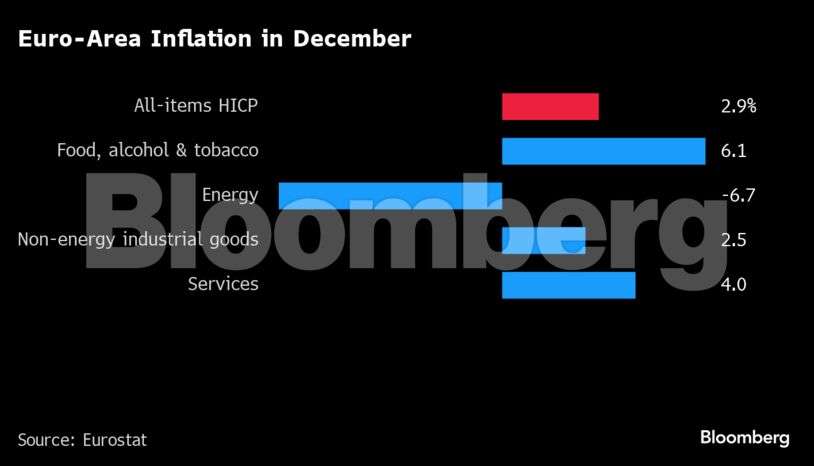

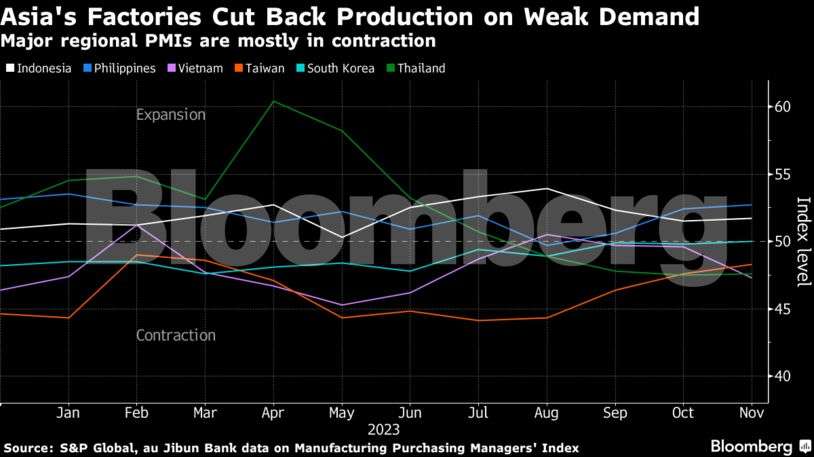

In the euro zone, inflation quickened last month on an annual basis for the first time since April. Manufacturers in most of Asia saw a slowdown in orders and production amid tepid customer appetite for goods.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

US

US job growth picked up in December and wage gains exceeded expectations in a mostly solid report that included some caveats about the strength of the labor market.

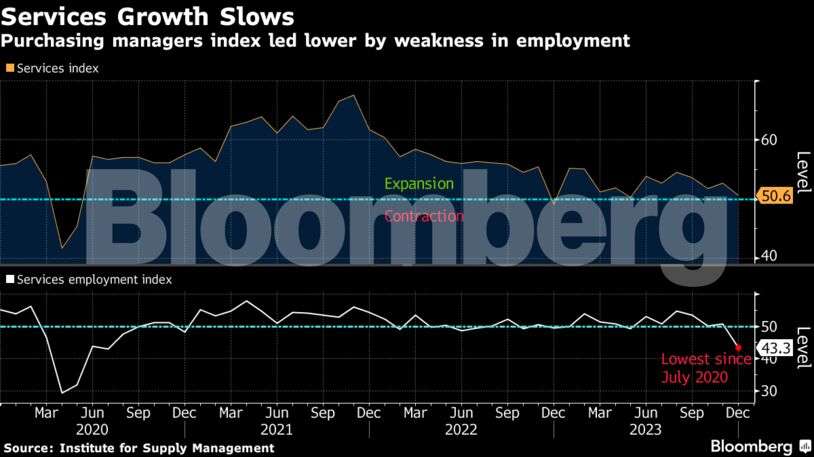

The US service sector came close to stagnating at the end of 2023 as a gauge of employment showed the biggest contraction in more than three years. A sustained slowdown in services would raise concerns about the risk of a broader cooling of the economy.

A US factory gauge remained stuck in contraction territory for a 14th month at the end of 2023, restrained by weaker orders and extending the longest stretch of shrinking activity since 2000-2001.

Europe

Euro-zone inflation picked up in December, highlighting the rocky path back to 2% foreseen by the European Central Bank as governments remove support for lofty energy costs.

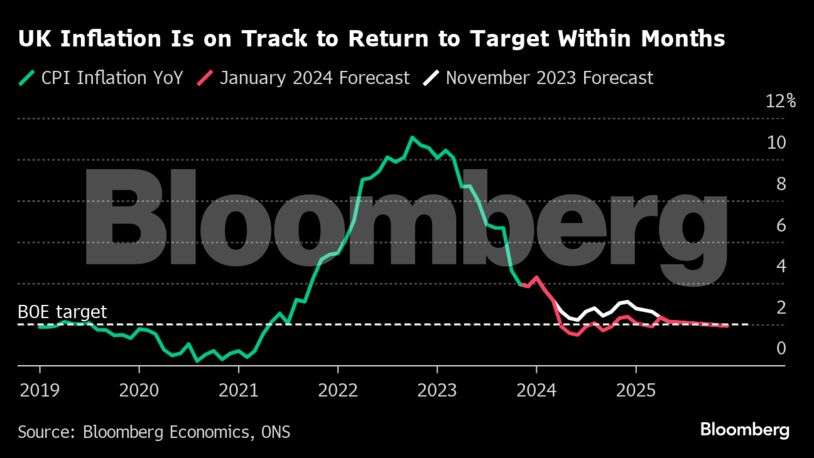

Britain’s economic prospects brightened with a pickup in lending and two prominent forecasters anticipating stronger growth and rate cuts early this year. Goldman Sachs and Bloomberg Economics both upgraded their outlook for growth and predicted the Bank of England will reduce borrowing costs starting in May.

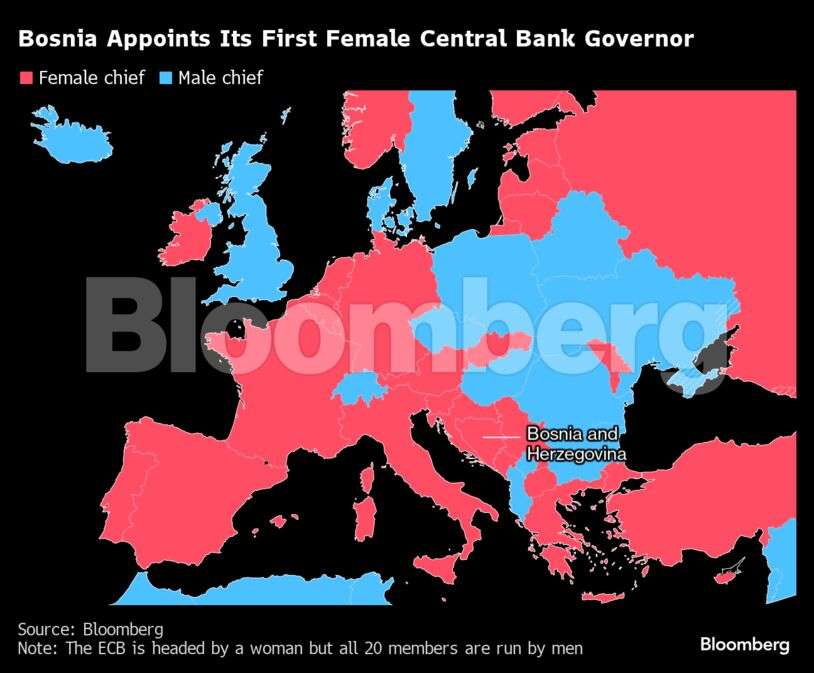

Bosnia-Herzegovina’s central bank has named economist Jasmina Selimovic as its new governor, making her the first woman to head the institution. Bosnia is now the fourth country in the western Balkans with a woman at the helm of its central bank, following Serbia, North Macedonia and Montenegro.Asia

Manufacturing in Asia ended 2023 on a weak note as sluggish economic activity in China and other developed markets dampened demand for the region’s goods. Most of Asia saw a slowdown in new orders and production volumes in December amid tepid customer appetite.

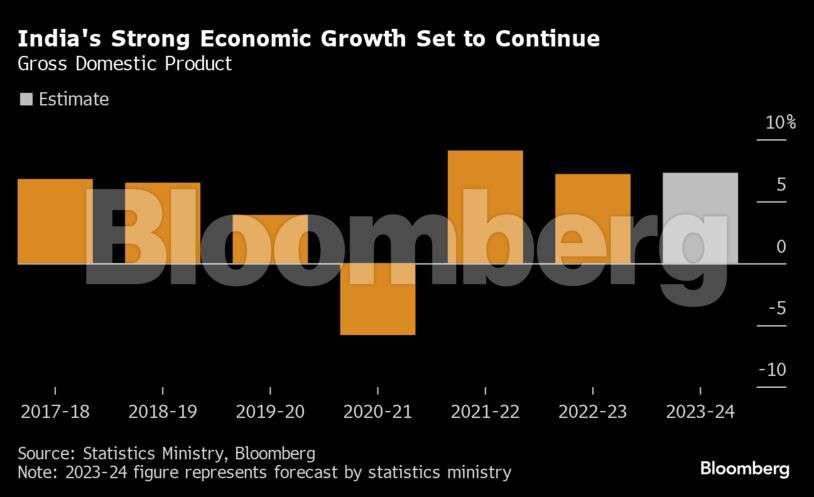

India forecasts growth will outstrip the consensus by a wide margin, as a boom in private and government expenditure keeps the South Asian nation on track to be the world’s fastest-expanding major economy. Strong consumer and government spending, a robust services sector and a boost in manufacturing have helped buoy India’s economy in the face of a weaker global economy and six rate hikes by the central bank since 2022.

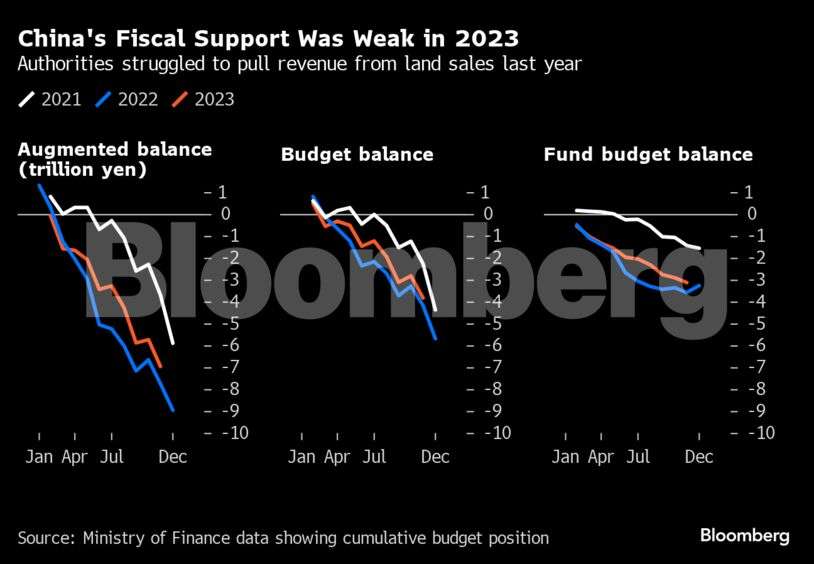

China’s government spending will rise this year, the nation’s Minister of Finance said, as authorities look for ways to bolster domestic demand and help the world’s second-largest economy regain momentum. Government fiscal support was generally weak last year as authorities struggled to pull revenue from selling land, a consequence of the property crisis.Emerging Markets

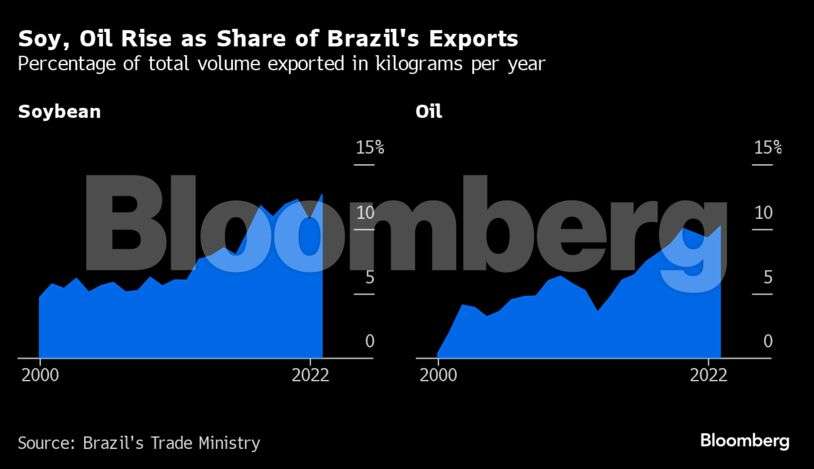

Brazil’s exports proved so strong in 2023 that they are rekindling memories of the commodities bonanza that briefly catapulted Latin America’s largest economy to unusually fast growth rates in the early 2000s.

World

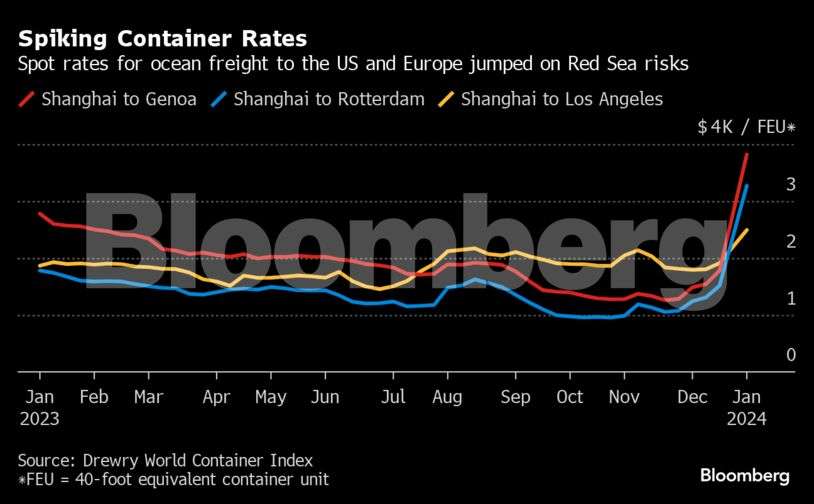

Short-term rates for container shipping between Asia, Europe and the US are climbing on reduced capacity caused by the threats to cargo vessels in the Red Sea. The spot rate for shipping goods in a 40-foot container from Asia to northern Europe now tops $4,000, a 173% jump from just before the diversions started in mid-December, Freightos.com, a cargo booking and payment platform, said late Wednesday.