- The eurozone inflation report for February on the menu this week

- Most ECB members worry about the growth outlook after the mixed PMIs

- The euro continues to suffer again against the pound

- German CPI will be published on Thursday; Eurozone on Friday 10:00 GMT

With global stock markets attracting lots of interest due to their consecutive all-time highs, the countdown to the March 7 ECB meeting has commenced. This gathering is considered to be a key one as, apart from the overall rhetoric that could shape market expectations, the updated quarterly staff projections could lay the path for a more accommodative monetary policy stance for the rest of 2024.

The usual “quiet period” for ECB members has started with both the hawks and the doves trying to set the basis for the upcoming closed-doors discussion in Frankfurt. Most members agree that the next move will probably be a rate cut but there is an open debate on the actual announcement date. The doves are pushing for a move as early as possible, even in March, while the hawks preach patience.

The weak growth outlook creates worries at the ECB

Since price stability is the ECB’s only target, this week’s inflation report will be closely scrutinized. However, there appears to be a growing concern, especially among ECB doves, about the growth outlook. Last year was a challenging one with the eurozone avoiding technical recession on the back of the stronger Italian and Spanish growth levels. In the meantime, German growth remains a serious problem for the ECB.

The preliminary PMI surveys for February, which were released last week, probably depict accurately the current mixed growth picture across the euro area states. The French PMI figures managed to produce sizeable upside surprises with the manufacturing component jumping to an 11-month high.

On the contrary, the German PMI manufacturing survey disappointed as it dropped again with the recent farmers’ protests probably impacting heavily on this result. Nevertheless, it remains at an extremely low level, confirming the current weak economic momentum in Germany, after a very weak 2023, possibly amplified by the 2024 budget shenanigans.

German and eurozone CPIs are expected to ease further

Returning to inflation and the preliminary CPI report for February will be published this week. On Thursday, we will get the German and French figures with the eurozone aggregate print coming on Friday. The German headline CPI is expected to further slow to 2.6% year-on-year change, which if confirmed, will be the lowest annual increase since June 2021, almost three years ago.

Similarly, the eurozone headline CPI figure is seen dropping to 2.5%, cancelling out the last two months’ pickup in inflation. More importantly, the focus would be on the core indicator as this has proved stickier lately. Economists are looking for a 2.9% print, a level that is unlikely to please certain ECB doves looking for a rate move as early as in March.

Should inflation confirm expectations, the ECB doves will try to get an agreement at the March meeting on the date of the first rate cut. However, stronger inflation this week along with the weak growth outlook means that stagflation will continue to describe the current eurozone situation. This will most likely deepen the developing rift in the ECB ranks as the hawks will most likely resist any rate cut discussion.

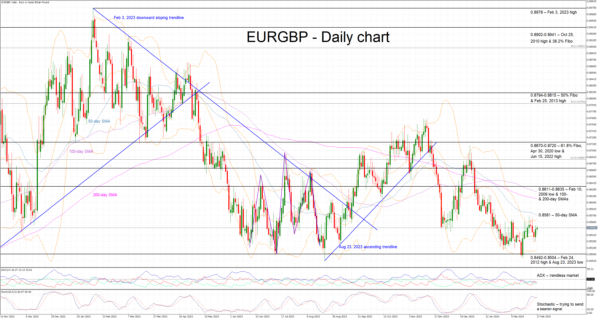

Euro remains on the backfoot against the pound

Last week’s data releases highlighted the fact that there is an economic divergence developing between the UK and the eurozone. This is also depicted in the euro/pound pair remaining near its 2024 low and validating the recent bearish trend.

A stronger set of inflation figures this week could lead the euro/pound pair higher with the 0.8581 level being the first plausible target. On the flip side, a plethora of downside surprises could reignite the market expectation for a more aggressive rate cut cycle by the ECB. Such an outcome could increase the current downside pressure with euro/pound moving lower and potentially retesting the recent 0.8497 low.