Individual retirement accounts (IRAs) are designed to help you save for retirement, but what happens if someone passes away with money in an IRA?

When you start contributing to an IRA, you can choose a beneficiary to inherit your IRA if you pass away. If you don’t select a beneficiary, your estate will be the beneficiary by default.

An inherited IRA can play a key role in estate planning. You can even choose how much each beneficiary receives. Read on to learn more about inherited IRA rules and how you can plan for the future.

What is an inherited IRA?

An inherited IRA is an IRA also known as a beneficiary IRA. When someone who’s contributed to an IRA passes away before withdrawing their money, that IRA can be passed on to a beneficiary designated by the original account owner.

If you don’t name a beneficiary for your IRA, your estate will be the default beneficiary. This means that a representative of your estate will decide who receives a portion of your IRA and how much they receive.

When you contribute to a Roth IRA, you can designate more than one beneficiary. For example, you may want to designate both your spouse and child as beneficiaries of your IRA. You can also decide how much each beneficiary receives.

Different retirement plans have different rules when it comes to designating a beneficiary. Remember to follow the procedures according to your retirement plan. You may also be required to designate certain beneficiaries, such as a spouse or child.

The beneficiary inheriting an IRA typically has the freedom to take a lump-sum distribution from the inherited account when they choose to.

IRS rules & tax implications for inherited IRAs

When you save for retirement, planning for the unexpected is key. Designating a beneficiary and understanding how that designation works can help you keep your loved ones prepared.

Whether you’re the child or a spouse inheriting an IRA, you have to follow the inherited IRA rules. Beneficiaries may still be subject to required minimum distribution (RMD) rules and must pay taxes on withdrawals.

Who can be a beneficiary of an IRA?

Anyone can be designated as a beneficiary of an IRA. That said, depending on which category someone falls into: eligible designated beneficiary or designated beneficiary, the rules of how that inherited IRA is handled will differ.

Eligible beneficiaries are:

- Spouses

- Minor children

- Disabled or chronically ill individuals

- Individual who isn’t more than 10 years younger than the IRA owner or plan participant

A designated beneficiary on the other hand, is anyone else who has been selected as the beneficiary of an IRA plan.

Eligible designated beneficiaries can take distributions based on their own life expectancy or the account holder’s life expectancy. Alternatively, they can follow the 10-year rule if the account owner dies before the required distribution date.

Do RMDs apply to inherited IRAs?

Generally speaking, the beneficiaries of a retirement account are still required to take RMDs. However, the specific requirements depend on the:

- Age of the account owner upon death

- Date of the death

- Relationship between the account owner and beneficiary

If the death of the account owner occurs before RMDs begin, spouses can use the five-year rule (empty the account by the end of the 5th year following the year of the account holder’s death) or take distributions based on their own life expectancy. They can also roll the account over into their IRA.

Inherited IRA rules for spouses vs. nonspouses

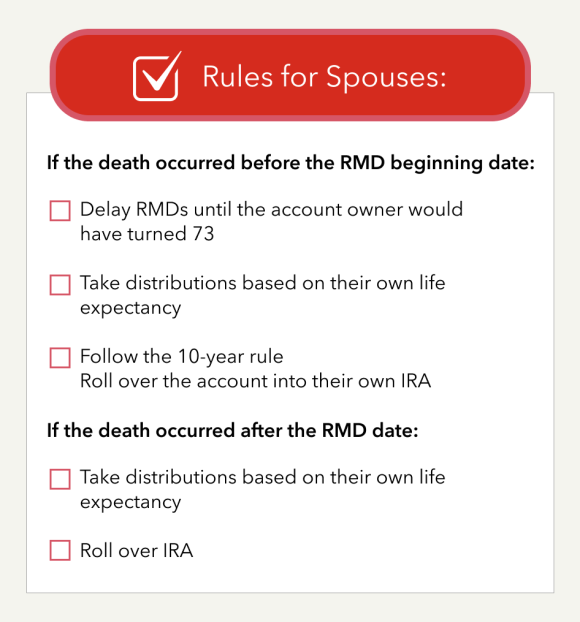

If the death of the account holder occurred in 2020 or later, spouses have several options. If the death occurred before the RMD beginning date, spouses can:

- Delay RMDs until the account owner would have turned 73

- Take distributions based on their own life expectancy

- Follow the 10-year rule

- Roll over the account into their own IRA

When the death of the account holder occurs after the RMD date, spouses must take distributions based on their own life expectancy or roll over the IRA. Nonspouses can choose to follow the five-year rule or take distributions based on their own life expectancy. Nonspouses have more options in 2020 and beyond as long as they’re an “eligible designated beneficiary.”

Beneficiaries who inherit a Roth IRA are also subject to certain Roth IRA rules. If you’re not sure what to do after inheriting a retirement account, speak with a tax expert or attorney to learn more about your responsibilities.

The SECURE Act & its impact on inherited IRAs

Saving for retirement has been a challenge for working-class families for several decades, resulting in people working beyond retirement age to pay the bills.

Inherited IRA accounts were an even bigger challenge. RMD rules made it difficult for beneficiaries to manage inherited retirement accounts — especially if they weren’t a spouse or child of the deceased account holder.

In 2019, the Setting Every Community Up for Retirement Enhancement (SECURE) Act was signed into law. This act was designed to make it easier for people to plan and save for retirement.

The new inherited IRA distribution rules under the SECURE Act only apply to retirement accounts of individuals who passed away after January 1, 2020. Retirement accounts inherited from owners who passed before this date are subject to old RMD rules.

The SECURE Act offers more options for people who inherit retirement accounts, including nonspouses. Under the SECURE Act, more individuals can qualify as an eligible designated beneficiary when inheriting an IRA.

Anyone who qualifies as an eligible designated beneficiary can take distributions over the longer of their own life expectancy or the life expectancy of the deceased account holder. Alternatively, they can follow the 10-year rule.

The 10-year rule dictates that all the money from an inherited retirement account must be distributed within 10 years of inheritance. This was another rule that was introduced when the SECURE Act was passed.

If the account owner’s death occurred before the SECURE Act went into effect, you have to follow the five-year rule. This is essentially the same rule but you only have five years to withdraw the money.

The SECURE Act changes only apply if the death of the account holder occurred after January 1, 2020. If the death occurred before that date, the original RMD rules apply.

SECURE 2.0 Act

With the SECURE 2.0 Act, An adjustment was made to the previous age requirement for RMDs. As of 2023, the age for RMDs was raised to 73 years old.

Managing your inherited IRA: Options & strategies

When you’re designating a beneficiary for your IRA, you want to make it easy for that beneficiary to manage your account. Choosing the right beneficiary can simplify the RMD process after your IRA is inherited.

Keep in mind that inherited IRA rules are also different if your beneficiary isn’t an individual.

If you need help choosing a beneficiary and making sure your loved ones are prepared if something happens to you, consider working with a financial advisor who can provide investing and estate planning tips.

Differences between pre-tax & Roth inherited IRAs

There are two types of IRAs: Roth IRAs and traditional IRAs. Traditional IRAs are funded with pre-tax money, so the money is taxed upon withdrawal. Roth IRAs are funded with post-tax money, which means there’s no tax upon withdrawal.

These same tax implications apply if you inherited a traditional or Roth IRA. With a traditional IRA, the withdrawals you take from your inherited IRA will be added to your gross income and taxed accordingly.

If you inherit a Roth IRA, you don’t have to worry about paying taxes when you make withdrawals. The money was already taxed before it was contributed to the retirement account, so you don’t have to pay taxes a second time.

If you’re planning for retirement and having trouble choosing between a traditional and Roth IRA, consult a financial advisor. Both plans have pros and cons that you should consider when planning for retirement.

No matter what moves you made last year, TurboTax will make them count on your taxes. Whether you want to do your taxes yourself or have a TurboTax expert file for you, we’ll make sure you get every dollar you deserve and your biggest possible refund – guaranteed.