Electronic trading major Interactive Brokers continues to expand the capabilities of the recently launched IBKR Desktop platform. Version 0.07 of IBKR Desktop includes a raft of enhancements.

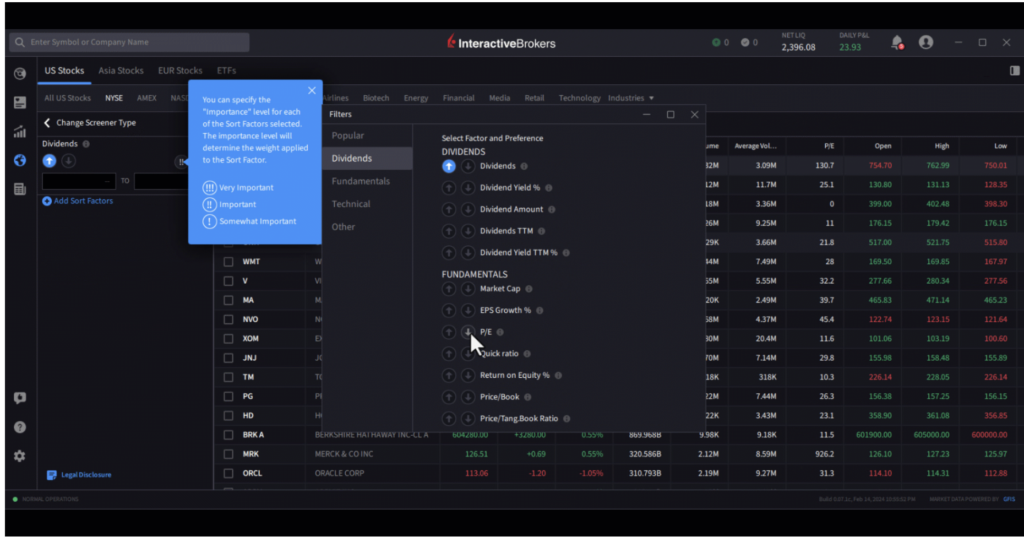

MultiSort Screeners enables users to find and sort data using multiple factors simultaneously. This is essential for traders and investors who need to evaluate diverse information, such as fundamental data, past performance, and technical indicators. MultiSort makes it easy to input multiple preferences, and quickly returns the most relevant results.

Choose up to 10 sort factors, and use the up/down arrows to specify whether a lower or higher value is most desirable. For example, you might want to see stocks with high dividend yield but low P/E ratio.

Once you have selected the factors on which to sort your screener, you can specify the “Importance” level of each factor. By default each is set to Important, but you can modify to be “Somewhat Important” or Very Important.” Use the “!” icons to set importance.

! = Somewhat Important

!! = Important (default)

!!! = Very Important

As you modify factors, the screener updates in real time.

To create a Multisort Screener:

- Select the Screeners icon from the left navigation panel.

- In the Screener Type panel, click MultiSort.

- From the Filters box, select up to 10 factors. Use the DOWN arrow selector to indicate lower values are prioritized. Use the UP arrow to prioritize higher values. Close the Filters box after all desired factors have been selected.

- In the factor list, modify “Importance” if desired by clicking the exclamation point icon in the factor description.

- Add factors at any time by clicking “Add sort factors” at the bottom of the factors list.

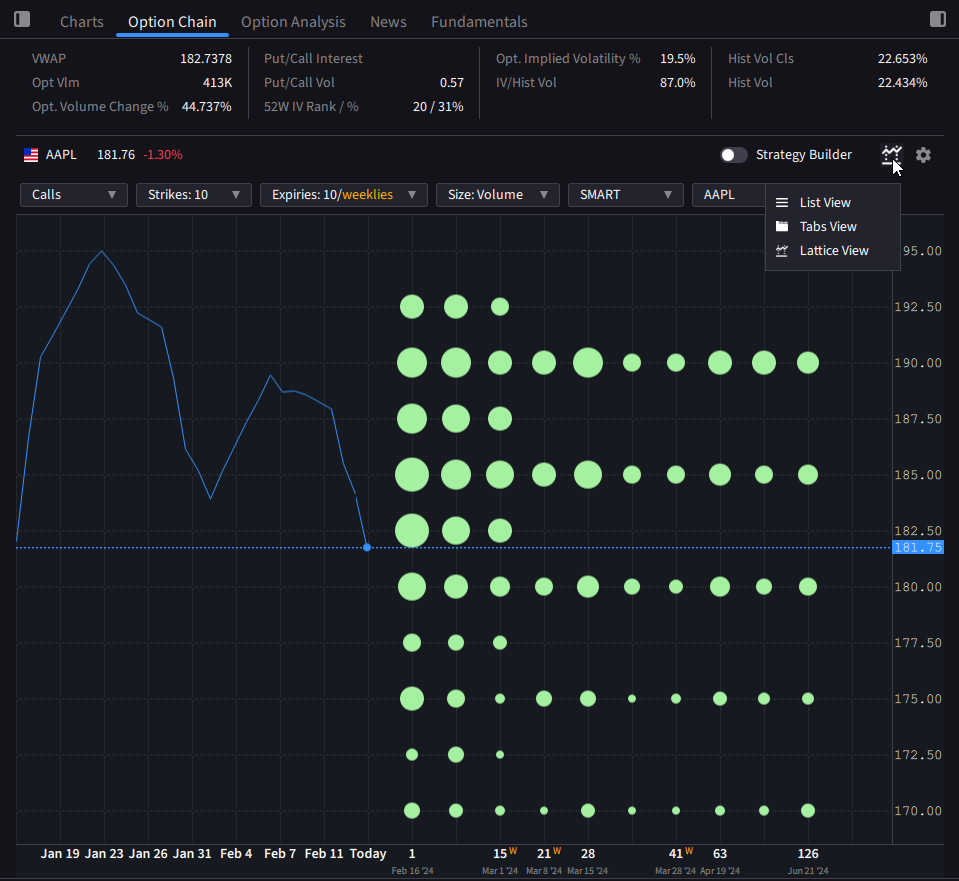

Option Lattice, a graphical options chain display highlighting potential outliers in key metrics like Implied Volatility, Open Interest, Volume, or Last Price, allow users to easily compare option contract metrics across expiry dates.

To view the Option Lattice:

- From the left navigation panel, click the Quote icon.

- From the tabset along the top of the page, select Option Chain.

- Click the View icon to the left of the gear icon, and select Lattice View.

- Modify display attributes like Calls/Puts, number of strikes, number of expiries, key metric (volume, open interest, last, implied volatility) and more.

- Turn on the Strategy Builder to create calendar and other spreads.

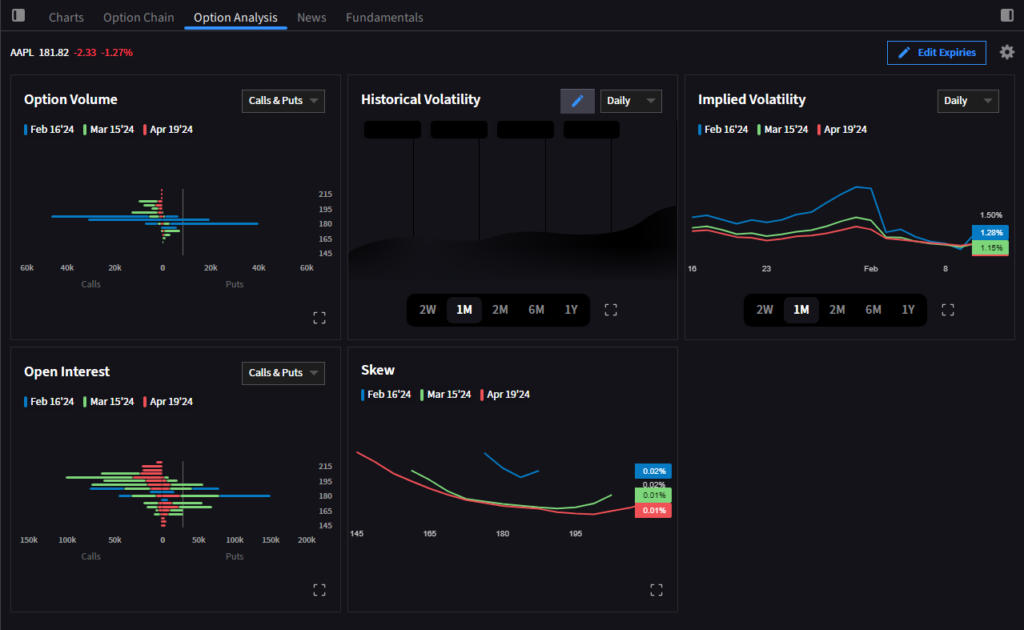

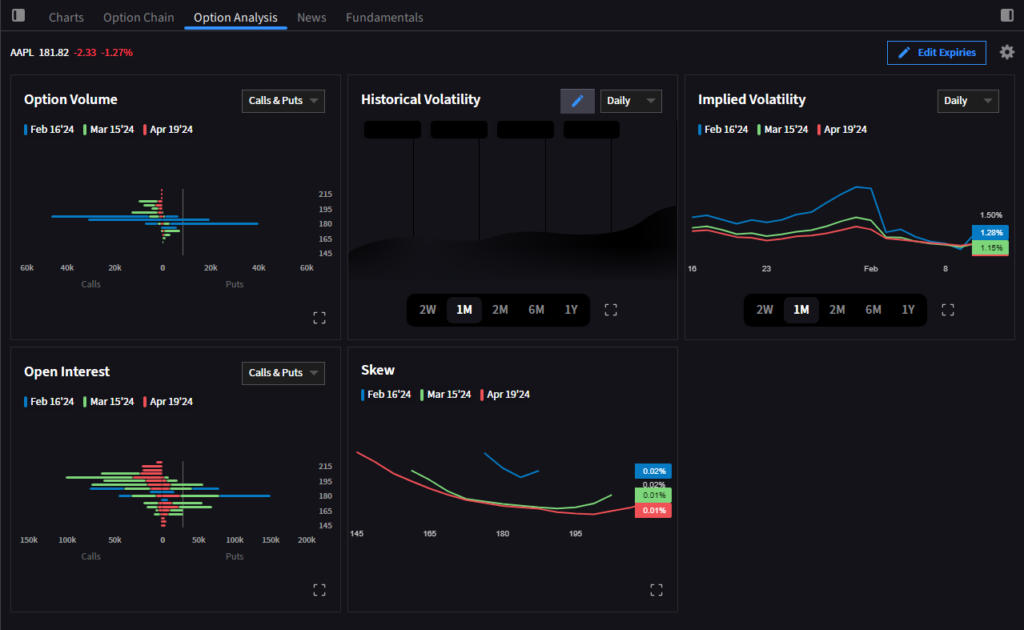

Option Analysis provides a visual and editable in-depth analysis of a single underlying across key metrics including Option Volume, Historical Volatility, Implied Volatility, Open Interest, and Skew.

To open Option Analysis:

- From the left navigation panel, click the Quote icon.

- From the tabset along the top of the page, select Option Analysis.

- Edit Expiries for all metrics in the top right corner. Modify other metrics as applicable. Add, remove, and rearrange metrics displays using the gear icon in the top right corner to Customize Layout.

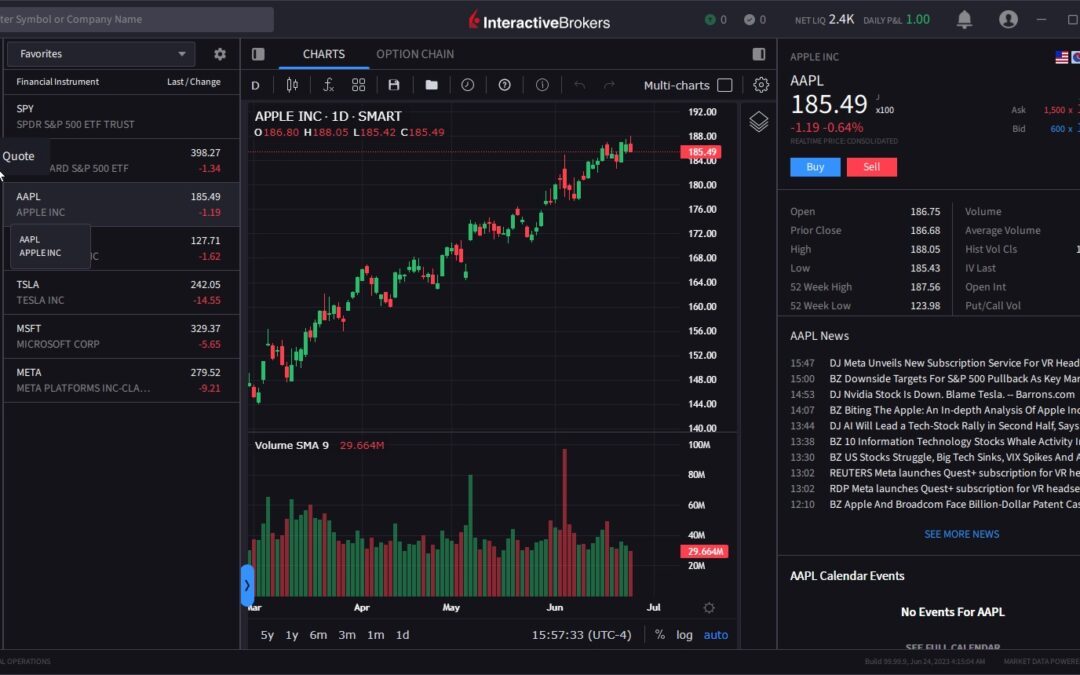

IBKR Desktop is built from the ground up using a more modern UI framework with simplified navigation. The perfect alternative for active clients who prefer a more lightweight platform, IBKR Desktop includes the most popular tools from our flagship TWS with the same great order execution.