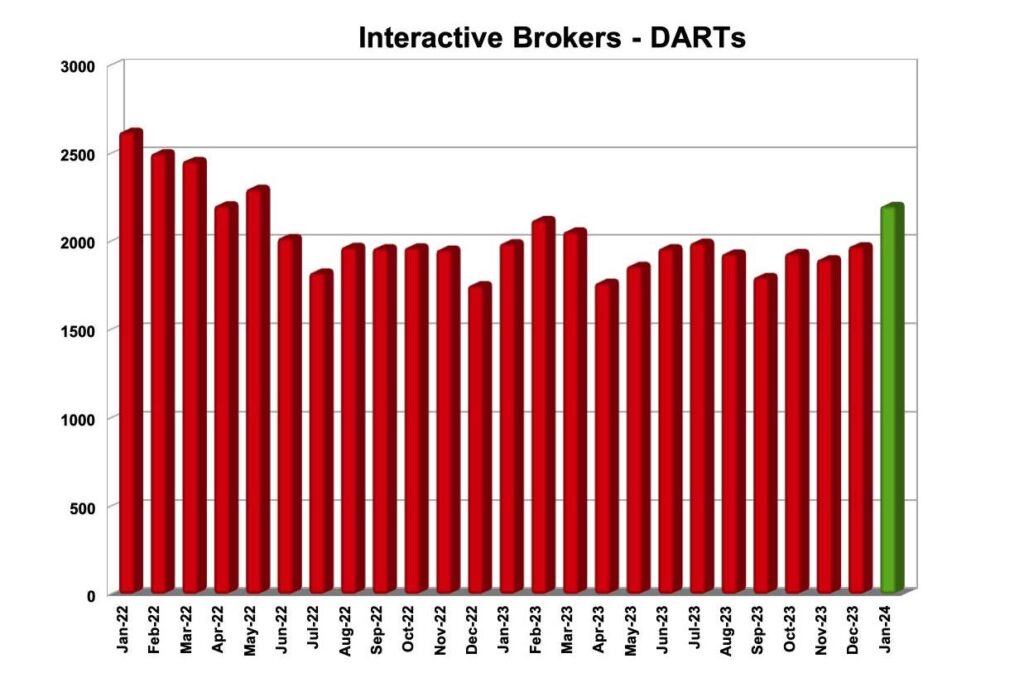

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just posted its key operating metrics for January 2024.

Interactive Brokers registered 2.201 million Daily Average Revenue Trades (DARTs), 11% higher than in January 2023 and 12% higher than in December 2023.

Ending client equity amounted to $424.0 billion, 26% higher than prior year and about even with prior month, whereas ending client margin loan balances reached $44.3 billion, 12% higher than prior year and about even with prior month.

The company registered 2.63 million client accounts, 23% higher than prior year and 2% higher than prior month.

The average commission per cleared Commissionable Order was $3.03 including exchange, clearing and regulatory fees.

Interactive Brokers has recently reported its financial metrics for the final quarter of 2023.

Reported net revenues were $1,139 million for the fourth quarter of 2023 and $1,149 million as adjusted. Reported income before income taxes was $816 million for the final quarter of 2023 and $831 million as adjusted.

Commission revenue increased 5% from the year-ago quarter to $348 million. Customer trading volume was mixed across product types with options and futures contract volumes up 21% and 4%, respectively, while stock share volume was down 22%.

Net interest income increased 29% from the fourth quarter of 2022 to $730 million on higher benchmark interest rates, customer margin loans and customer credit balances.