Once upon a time in the YNABverse, making a plan for your money was an individual sport. You linked accounts (or didn’t), practiced YNAB’s Method, and gradually life got less stressful. You felt more in control. You saved for a down payment, paid down your debt, or bought hot dog finger gloves. And you felt great about it.

But maybe you wished that you could share the power of YNAB with your partner, your teenage children, or use it to help manage an elderly parent’s finances. It changed your life, but what about the people you care the most about? Sure, everyone could share passwords and pretend their name is Tanya, but who has the time for it?

That’s why we launched YNAB Together, our solution for partners, families, and other close-knit groups of up to six people who want to share in YNAB and take on their dreams—all for the price of a single subscription!

Each member of your YNAB Together group will receive:

- their own secure login and YNAB account

- the ability to create and edit as many money plans as their li’l heart desires

- the ability to share those plans with other group members

- access to our award-winning customer support team

(This is our Oprah moment: “You get YNAB! You get YNAB!”)

Money isn’t everything, but it’s still an important part of our relationships. YNAB Together allows YNAB to serve its rightful place as a life-planning and communication tool. No more stressful conversations filled with judgments and vague goals that lack accountability. When you use YNAB Together, your conversations about money are centered on priorities and actual numbers.

What’s more, you’ll see how your decision-making, and that of your group members, is increasingly guided by our simple four rules.

Here are some examples of YNAB Together in action.

Managing Money with a Partner

Only 44% of Americans say they are very comfortable talking to their partner about money. Some avoid the subject, some experience repetitive conflict, and others wonder if they’ll ever get on the same page. We designed YNAB Together for a wide spectrum of partner situations including:

- new and soon-to-be partners (congrats!)

- partners who manage money together or separately

- partners who manage money together reluctantly

- partners who feel secure knowing they can take their YNAB plans with them in the future

- longtime YNAB Jedis ready to take co-YNABing to the next level (these are the features you’re looking for)

(Here’s a Support article that shows how to use YNAB Together in different partner scenarios.)

The good news is that YNAB offers a framework and tool to having productive conversations about money, priorities, and life goals. It all begins with inviting your partner to YNAB Together.

It’s easy for them to create their own secure YNAB account. You won’t have to hold their hand either (unless you like that), since we’ll guide them through our time-saving and fun email onboarding series.

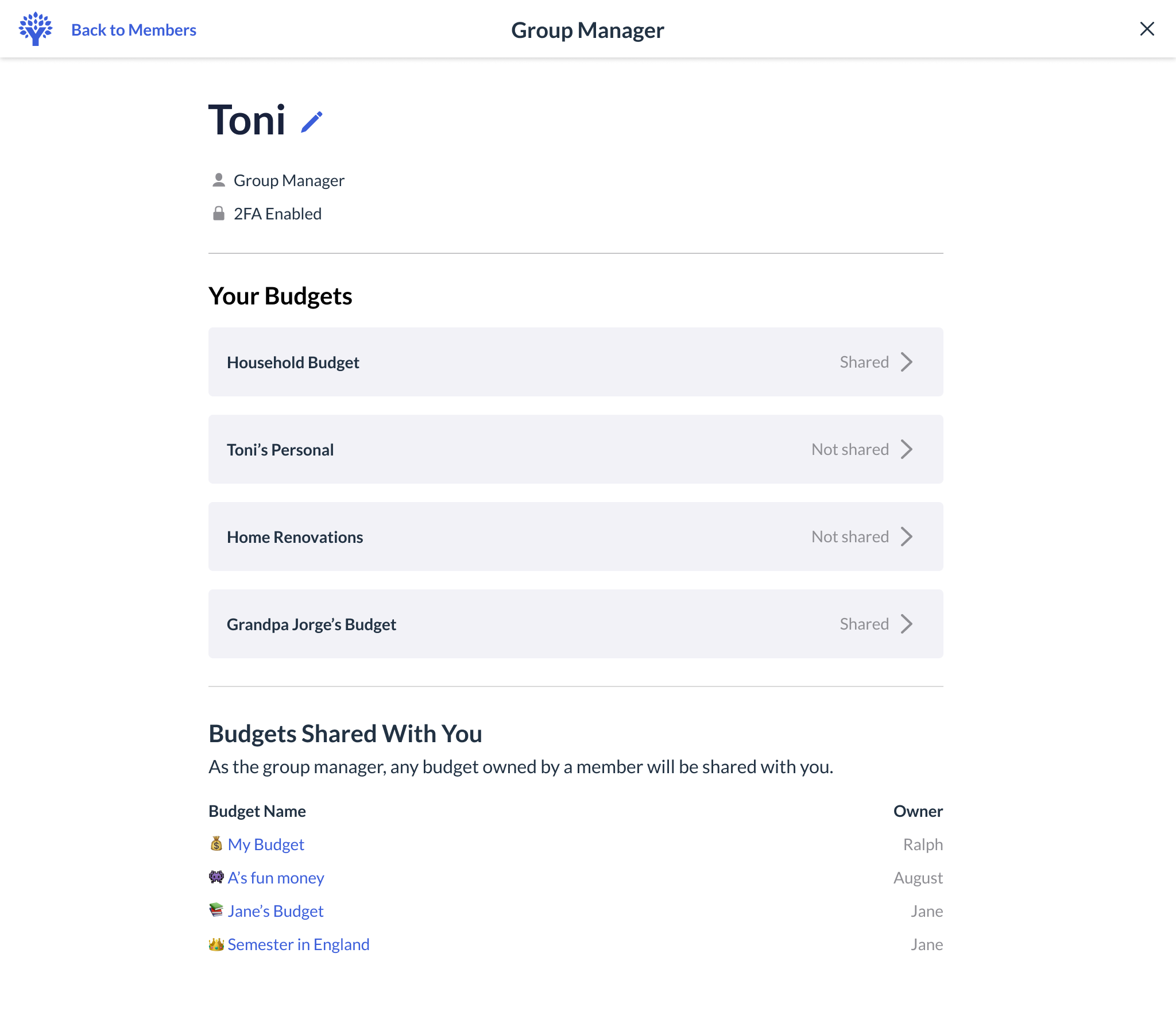

YNAB Together allows you to pick and choose the plans you share with individual group members. For instance, Toni can share the “Household Plan” with her partner Ralph, while keeping that plan private from Grandpa Jorge and her teenagers.

.png)

YNABing With Your Teenager

Teenagers today… When we were growing up, we didn’t have fancy personal finance apps in our pocket. Nope. We spent what we felt like, listened to jazz music, and never thought about giving any dollars a job.

Imagine if our kids could avoid the money mistakes we did?

With YNAB Together, teenagers:

- learn to make a plan for their money using the YNAB Method through our email onboarding series and other resources

- receive a separate login and YNAB account

- cannot see any details of their parent’s money plan, though parents can view the teen’s plan

- have their YNAB account paid for by their parent’s subscription

Here’s an example. August and Jane are teenagers that are part of their mom Toni’s YNAB Together group. Using YNAB allows the teenagers to absorb the Four Rules and apply it to their allowance, savings, and part-time income.

Since Jane has her own YNAB account (but is still on her mom’s subscription!), she can also create additional plans at any time down the road, like a plan for studying abroad in college.

We all want our children to enter adulthood on secure financial footing and thrive. Now, your teenager can get a full dose of YNAB, an education from our teachers, and with as much (or little) of your involvement as you wish.

Managing Someone Else’s Finances

Caregiving is complicated, handling their finances shouldn’t be. YNAB Together allows you to be the sole manager of your loved one’s finances, yet can also facilitate coordination between siblings or other stakeholders.

YNAB Together:

- provides a comprehensive, real-time view of your loved one’s finances

- is a money management app, not a banking app, so while YNAB provides total transparency on financial activity, there is no risk of unwanted transactions or charges by the group members you invite

- allows you to accurately plan for future expenses and easily make adjustments as priorities and needs change

- means you can share the relevant plan(s) without sharing any of your personal details

Here, the group manager, Toni, can create a plan, “Grandpa Jorge’s Finances,” which is separate from her household plan and also would not be shared with her teenagers. (Since Toni can invite up to five members to her YNAB Together group, she could still invite an adult sibling to join the group and share “Grandpa Jorge’s Finances” without ever sharing any of her household or teenagers’ plans.)

YNABers, you can invite members to your YNAB Together group today from within the Settings drop-down in YNAB. So, who’s getting your first invite?

Have more questions? Read our in-depth YNAB Together Help Doc or check out our FAQs below.

FAQ

Who is YNAB Together for?

We believe that making a plan for your money is an essential life-planning tool and we want you and the important people in your life to have access to YNAB. But not, like, everybody you’ve ever met. YNAB Together is meant for families, partners, and other close-knit groups that have a financial aspect to their relationships. (How close-knit? Close enough that everyone is comfortable with the group manager having access to their plans .)

But, if our answer had to take the form of a haiku…

Who is YNAB Together for?

A relationship with heart,

also one in which money plays a part.

How much does YNAB Together cost?

YNAB Together features are included in the price of a single YNAB subscription! The group manager’s subscription can be managed through YNAB directly, Apple, or Google.

How many people can be in a YNAB Together group?

You can invite up to 5 additional people to join you! A YNAB Together group can be 2-6 people total.

Can I accept an invite to YNAB Together if I have an existing user account and/or subscription?

You bet! If you have a current YNAB managed subscription, we’ll cancel it for you and refund you for any remaining time. If you have an Apple or Google managed subscription, please reach out to our Support team for guidance.

Can I invite my kids?

Yes! People ages 13+ in the U.S. and 16+ everywhere else can be invited to YNAB Together, up to 6 members in total. If they don’t already have a YNAB account, invited members can create one to join the group.

Can I join more than one YNAB Together group?

Currently, you’re only able to be a part of one group at a time with the same email address. You can create or join more than one group by using a different email address.

What is the difference between a group manager and member?

A group manager is the person who subscribes to YNAB and is responsible for billing. Group members are individuals who are invited to share the group manager’s subscription.

Will my own YNAB plans be shared within my YNAB Together group?

- Group managers can choose to share (or not) any of their money plans.

- If you are a new user that joins a YNAB Together group, any new plan you create will be accessible by your group manager.

- If you are an existing user that joins a YNAB Together group, any plans that you bring with you (from a previous trial or subscription) will be shared with the group manager, as well as any new plans you create.

- Sharing plans among group members is optional.

If I share my plan with another group member, what can they do with it?

Any group member you invite to share your plan can do everything within the plan except manage sharing with other members, delete the plan, or make a Fresh Start of the plan. This means that they can see all accounts and transactions within the plan, and they can disconnect, or edit notes for any connection regardless of whether they created it. However, members cannot fix or troubleshoot connections they do not own. If a connection needs attention, they’ll need to reach out to you (the owner of the connection).

Can I share a plan with someone that isn’t a part of my YNAB Together group?

At this time, sharing only happens between members of a YNAB Together group.

What does it mean to be an owner?

The person who creates the plan is by default the owner. If desired, this ownership can be transferred to another member on the plan at any time. Only owners can delete the plan or Fresh Start the plan. Plans belong to user accounts, not subscriptions. This means that any plans you own will remain with your account whether you are a part of a group or not.

Can I make someone else the owner of a plan?

Yes! You can transfer ownership of any plan to another member of your group.

Ready to achieve your financial dreams together? Try YNAB for free for 34 days. No credit card or commitment required to start!