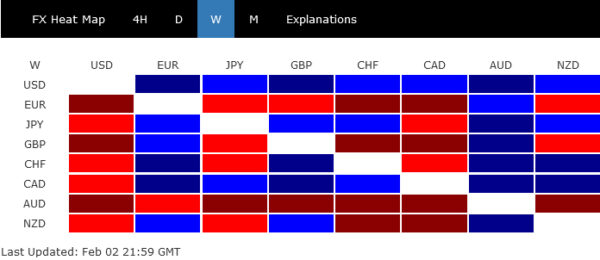

This past week in the financial markets has been nothing short of a rollercoaster, with Dollar clinching the title of the strongest currency amidst considerable volatility. The narrative that dominated was the dissipating likelihood of a March rate cut by Fed. But at the same time, investor sentiment took an unexpectedly optimistic turn, propelling stock markets to reach records. This unusual alignment of stock market exuberance with a strengthening Dollar raises questions about the sustainability of such a trend, considering their historically contrary movements.

Australian Dollar found itself languishing at the week’s end, primarily bogged down by disappointing inflation data. Moreover, Aussie’s woes were compounded by fresh downturn in China’s stock markets, renewing concerns over economic stability in the country. Conversely, Euro and Sterling, while initially struggling, demonstrated remarkable resilience as the week progressed. Both currencies managed to recoup losses in crosses.

In the broader currency market, following Dollar’s lead, Canadian Dollar and Yen captured the markets’ favor and ended as the second and third strongest. However, Yen’s position appeared precarious amid rebounding global yields. Swiss Franc and New Zealand Dollar, meanwhile, navigated through the week with mixed fortunes.

A Turbulent Week: Powell’s Hawkish Tone and Robust Job Data Reset Fed Expectations

In a week filled with significant economic events and market volatility, the US financial markets saw an extraordinary turn of events, marked by a complex interplay of steadfast messaging from Fed, strong labor market data, and sector-specific developments. Together they fostered a climate of cautious optimism and strategic reevaluation among investors.

S&P 500 and DOW not only rebounded from their mid-week dips but soared to new record highs at 4958.61 and 38654.42, respectively. This surge in stocks was paralleled by a dramatic recovery in 10-year Treasury yield, which bounced back from a low of 3.817 to close the week above 4% handle, after having its most vigorous rally in over twelve months on Friday. Dollar index also resumed recent rebound to close at 103.92, with the greenback ending as the best performer in the currency markets.

The pivotal moment came during Fed Chair Jerome Powell’s press conference following FOMC meeting, where he unequivocally dismissed the possibility of a rate cut in March. His firm stance initially set the markets on the edge. However, it was the surprisingly strong NFP figures that solidified market sentiment, with job growth exceeding 330k in consecutive months and wage growth accelerating to 0.6% mom in January, compelling a reevaluation of the timing for Fed’s policy easing.

This reassessment significantly impacted the odds for a March rate cut, which plummeted from nearly 40% to a mere 20% following the NFP release. Furthermore, the expectation for a rate cut in May, previously priced in with high certainty, now appears overly optimistic given the labor market’s strength and wage inflation’s persistence.

Amidst these adjustments in monetary policy expectations, the resilience of the stock market, particularly the tech and communication sectors, was a standout. Meta’s impressive earnings report spurred a surge in its stock price by more than 20% on Friday and catalyzed gains across the communication sector by 4.5%. This rally, which propelled S&P 500 to new heights, suggested a potential decoupling of tech stocks from the broader narrative surrounding interest rates, allowing them to trade more on the merits of their fundamentals.

Concurrently, concerns surrounding the banking sector flared up, notably with New York Community Bancorp’s unexpected financial results stirring memories of last year’s banking anxieties. This development contributed to the mid-week dip in 10-year yield on safe-haven flows and exerted downward pressure on Dollar. Nonetheless, these concerns appeared transient, with market’s focus quickly back on adjusting to the revised outlook for Fed policy and absorbing the implications of the robust labor market data.

Technically, SPX should have overcome 100% projection of 3808.86 to 4607.07 from 4103.78 at 4901.99. Focus now turns to 5000 psychological level. Some resistance could be seen there to bring correction. But break of 4845.16 support is needed to indicate short term topping first. Otherwise, near term outlook will stay bullish. Sustained trading above 5000 could prompt upside re-acceleraton to 138.2% projection at 5206.91.

Friday’s strong rebound in 10-year yield suggests that it’s possibly now in the third leg of the sideway consolidation pattern from 3.3785 already. While further rise could be seen in the near term as range trading extends, strong resistance is expected from 38.2% retracement of 4.997 to 3.785 at 4.247 to limit upside. Downside breakout is still expected eventually, but delayed to a later stage.

Dollar Index’s outlook is unchanged. The favored case is still that rise from 100.61 is the third leg of the consolidation pattern from 99.57. Break of 104.26 resistance will strength this bullish case and target 107.34 next. However, break of 102.77 support will suggest that the rebound is completed, and bring another fall back to 100.61, and possibly below.

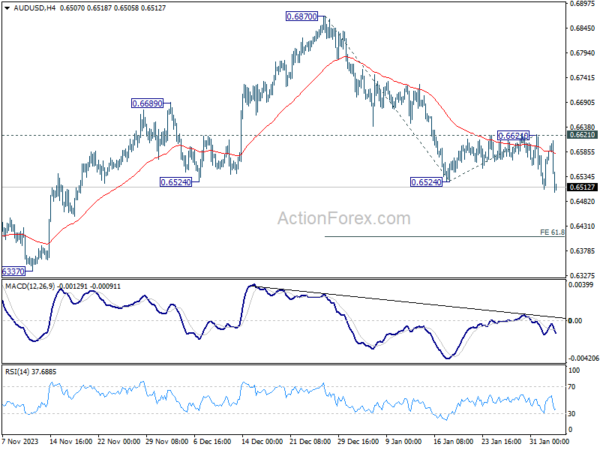

AUD’s Tough Week: Between RBA’s Rate Cut Speculations and China SSE’s Loss

Last week saw the Australian Dollar taking a significant hit, making it the weakest performer, amidst a complex web of economic and external factors. Domestically, the underwhelming Q4 CPI data from Australia has solidified market consensus that RBA will not alter its policy stance in the imminent session. Furthermore, the anticipation has now shifted towards identifying the timeline for rate reductions, with a majority of economists pointing towards August, conditional upon disinflation trend in the coming months.

Externally, the Aussie was further burdened by the persisting vulnerabilities in China’s stock market. Despite a momentary uplift following PBoC decision to cut the reserve requirement ratio in the prior week, optimism was short-lived as Shanghai SSE Composite recorded significant losses last week, marking its most considerable weekly decline since October 2018.

This downturn underscores the fleeting impact of policy measures on investor confidence and highlights the ongoing concerns surrounding China’s troubled real estate sector, Hong Kong Court’s liquidation order for Evergrande was far from offering a resolution, but reignited concerns over the sector’s broader stability and raised pressing questions about the future prospects of similarly distressed developers.

A pressing question for the SSE now is whether there would be enough support from around, or above, 2550.91 long term projection level (100% projection of 3731.68 to 2863.64 from 3418.95) to help the index bottom. Or, it will need to dive through 2440.90 (2018 low) to find enough bargain hunter. But in any case, break of 2924.30 resistance is needed to indicate short term bottoming, or near term outlook will stay bearish.

As for Aussie, AUD/USD was the top mover last week, ended down -0.97%. Rejection by 55 D EMA (now at 0.6606) is strengthening that bearish case that decline from 0.6870 is another falling leg of the corrective pattern from 0.7156. Near term outlook will stay bearish as long as 0.6621 resistance holds. Next target is 61.8% projection of 0.6870 to 0.6524 from 0.6621 at 0.6407.

Euro and Sterling Dip but Display End-Week Recovery

Euro and Sterling found themselves trailing near the bottom of the currency performance chart, yet their overall performance was far from disastrous. Both currencies managed to claw back some lost ground as the week drew to a close, particularly against the backdrop of evolving central bank narratives and key economic data releases, albeit with exceptions against Dollar and Canadian.

ECB officials suggested a timeline for the initial rate cut somewhere between April and June, with the latter appearing more probable. This cautious stance finds support in the latest economic data: Eurozone’s GDP remained flat in Q4, skirting recession by the narrowest of margins. Additionally, January’s headline and core CPI readings, though decelerating, were above market expectations. This juxtaposition of data might embolden ECB’s hawkish faction to advocate for a delay in monetary easing.

BoE meeting painted a picture of an institution not yet poised for rate reductions. Notably, the meeting concluded with a three-way split vote – a rarity not seen since 2008, featuring two hawks pushing for a hike and one dove advocating for a cut. Subsequently, Chief Economist Huw Pill underscored that rate cuts were “some way off,” citing an insufficient evidence base pointing towards inflation returning to target levels.

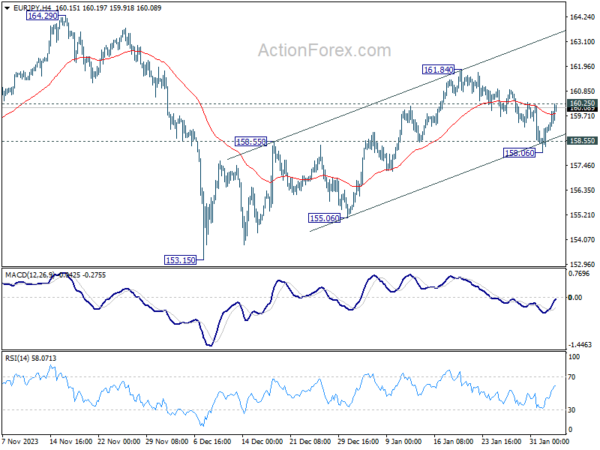

EUR/JPY rebounded strongly after dipping to 158.06, after drawing support from near term rising channel and 158.55. A break above 160.25 minor resistance will suggest that the pull back from 161.84 was compelted, and rise from 153.15 is ready to resume through this resistance.

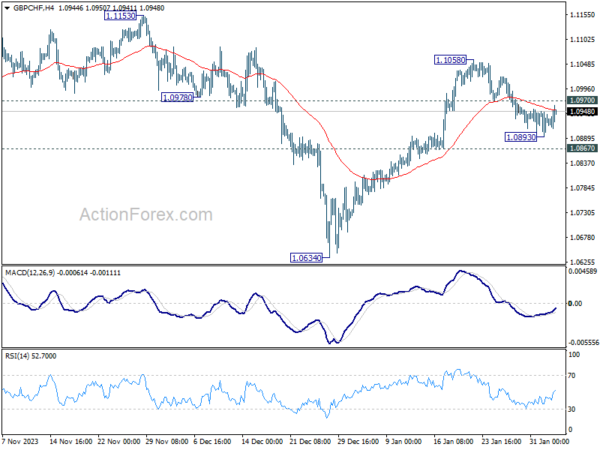

GBP/CHF’s pull back lost momentum after dipping to 1.0893, ahead of 1.0867 minor support. Rise from 1.0634 is still in favor to continue. Firm break above 1.0970 minor resistance will argue that this rally is ready to resume through 1.1058 resistance.

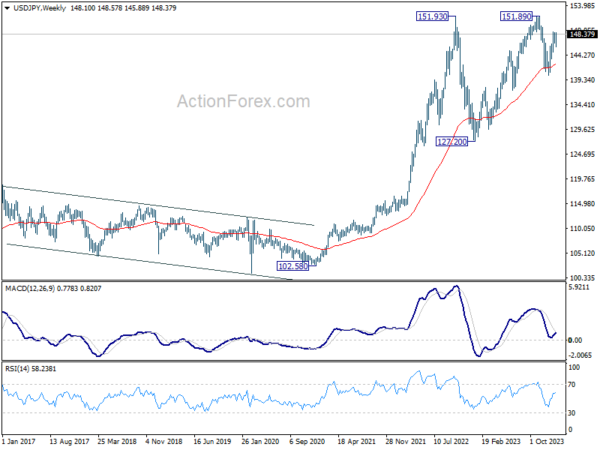

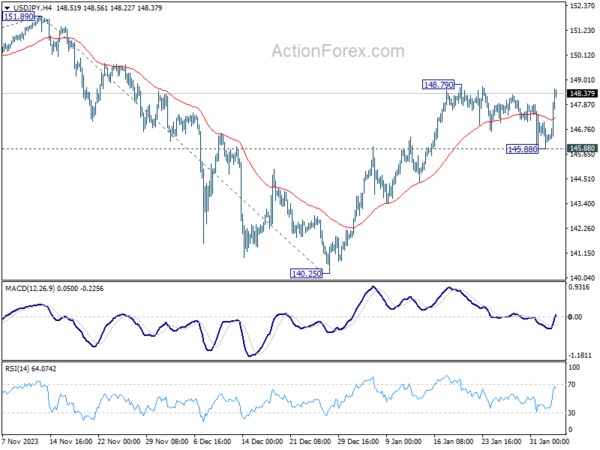

USD/JPY Weekly Outlook

USD/JPY dipped to 145.88 last week as consolidation from 148.79 extended, but rebounded strongly since then. Initial focus now on 148.79 this week. Firm break there will resume the rally from 140.25 to 151.89/93 key resistance zone. For now, further rise will remain in favor as long as 145.88 holds, in case of retreat.

In the bigger picture, fall from 151.89 is seen as a correction to the rally from 127.20, which might have completed at 140.25 already. Firm break of 151.89/93 resistance zone will confirm up trend resumption next target will be 61.8% projection of 127.20 to 151.89 from 140.25 at 155.50. This will now remain the favored case as long as 140.25 support holds.

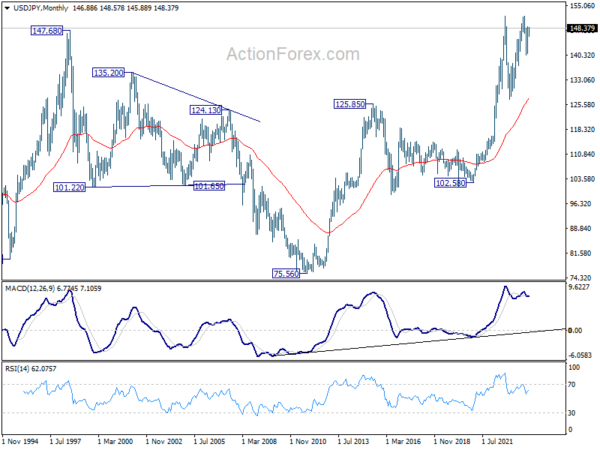

In the long term picture, as long as 125.85 resistance turned support holds (2015 high), up trend from 75.56 (2011 low) is still in favor to continue through 151.93 (2022 high) at a later stage.