- CADJPY remains within a range despite hitting new high

- Upside risks exist above 111.50; bears could take the lead below 110.40

- BoC rate decision at 13:45 GMT is the highlight of the Canadian calendar

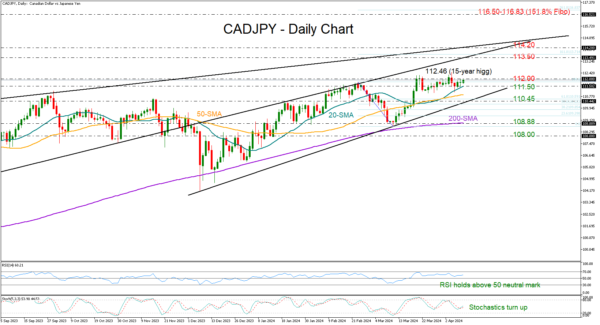

CADJPY remained stagnant after entering the 112.00 area, keeping its weak momentum despite reaching a new high of 112.46 last week – the highest level since the beggining of 2008.

The market’s ability to stay resilient above the 20-day simple moving average (SMA) has been a positive development this week, feeding optimism for a bullish breakout above the 112.00 mark. The RSI and the stochastic oscillator are also providing a ray of hope for a positive session ahead as the former continues to hover above its 50 neutral mark and the latter is set for an upside reversal.

If the bulls manage to break through the 112.00 border, the long-term uptrend could continue towards the resistance area of 113.50-114.20, which includes two ascending lines drawn from the 2023 summer highs. Even higher, the 2007 barrier of 116.50 and the 161.8% Fibonacci extension of the September-December 2023 downleg at 116.83 could keep traders busy, delaying any extensions towards the 118.20 constraining zone taken from July 2007.

Selling pressure may remain under control if the price continues to trade above the shorter-term SMAs and the support trendline at 110.45. Otherwise, the bears might target the 200-day SMA at 108.88, a break of which could would worsen the short-term outlook below November’s low. In this case, the way would clear towards the 108.00 restrictive territory.

Overall, CADJPY is in a wait and see mode, with a potential for a bullish continuation into the 113.50-114.20 are following the latest rebound on the 20-day SMA. Alternatively, the consolidation phase could continue unless the bears crack the 110.45 floor.