The U.K. has just experienced two consecutive quarters of negative economic growth, which meets whatâs commonly called the technical definition of recession.

On a quarter-over-quarter basis, U.K. gross domestic product fell by 0.3% in the fourth quarter and fell 0.1% in the third quarter.

In the U.S., thereâs a group that meets to determine whether there is a recession, the National Bureau of Economic Research.

They look at a variety of indicators, and really are looking for, in their words, âa significant decline in economic activity that is spread across the economy and that lasts more than a few months.â (The 2020 two-month recession was the exception to the rule, because of the depth of the downturn in activity.)

Applying that concept to the U.K. shows it wouldnât be an obvious call.

The datapoint that most suggests the U.K. is not in recession is jobs. Apart from a one-month decline between July and August, employment in the U.K. has steadily grown.

Median pay meanwhile is up 6.4% compared with the same period of last year. Even accounting for the fastest inflation in the developed world, at 4%, the average worker is bringing in more money.

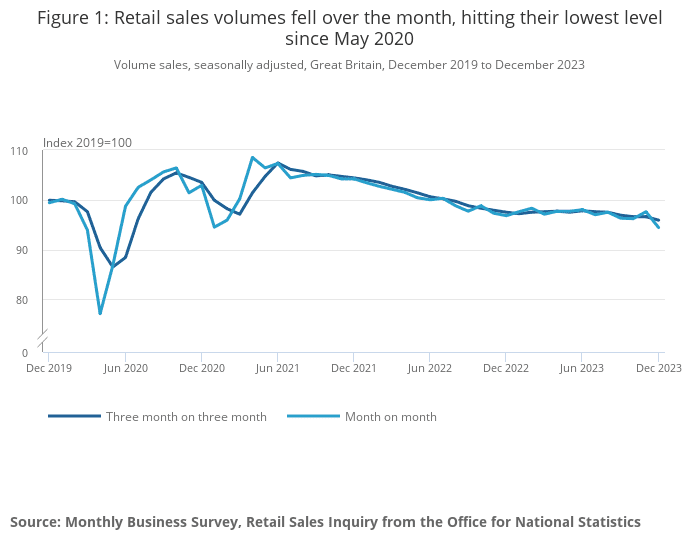

The retail sales picture however isnât so great. Looking just at volumes, sales peaked nearly three years ago.

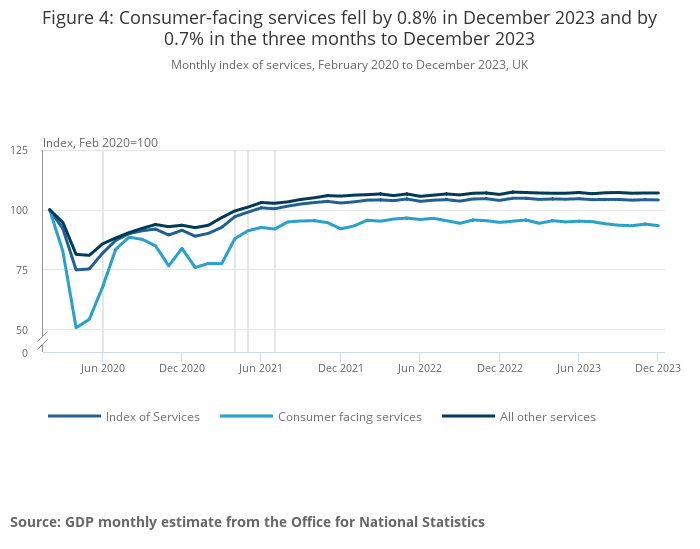

A broader examination of the services sector shows itâs flat-lined for about two years now.

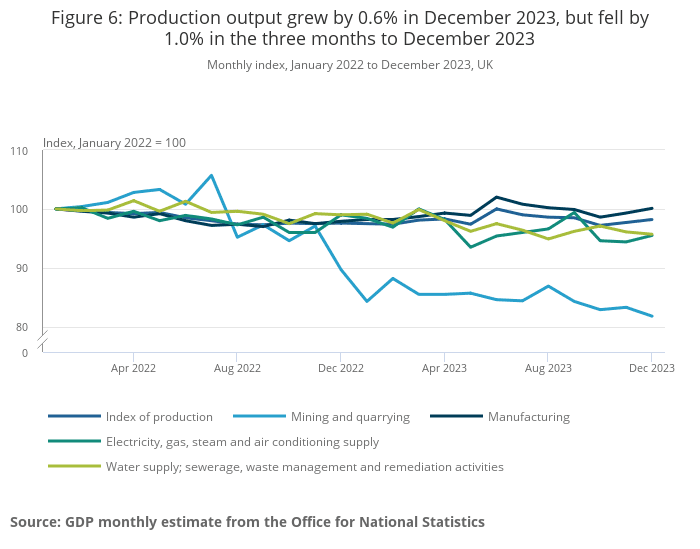

The production sector, and manufacturing in particular, also is stagnant.

Going back to the NBER definition, itâs a weird situation where the business side of the economy is basically flat, while households continue to see more employment and wage growth.

What is clear is the U.K. isnât providing a great backdrop for corporate profits, and thatâs reflected in the data. According to Citigroup data, U.K. stocks trade on just 11.2 times 2023 earnings â compared to 20 in the developed world and 23.5 in the U.S.

Economists at Nomura donât expect the U.K. recession to last long, but also say economic growth isnât primed to accelerate.

âWe think this is the end of the U.K. recession and growth will stagger into positive territory but only slowly and return to trend only in 2025,â they said in a note to clients.

The pound

GBPUSD,

was trading at $1.2554, and the 2-year gilt

BX:TMBMKGB-02Y

was at 4.56%.