London based prime-of-prime broker and liquidity solutions provider iSAM Securities (UK) Limited has reported its financial results for FY 2024 (year ended June 30, 2024), indicating a healthy rise in profitability despite slowing Revenues.

On the top line, Revenues at iSAM Securities came in at £27.0 million (USD $35.0 million) in 2024, down by 14% from £31.6 million in 2023. However thanks to a more than doubling of Interest Income (from £3.6 million in 2023 to £7.7 million), as well as increased transfer pricing income representing a share of profits from iSAM Securities Limited registered in the Cayman Islands, Net Profit rose in 2024 to £9.6 million (USD $12.4 million) from £6.2 million the previous year.

iSAM’s improved results are from its first full year after a consolidation and rebranding from iS Prime and iS Risk Analytics to iSAM Securities, as well as a change in executive leadership under Managing Director Alexander Lowe following the 2023 departures of longtime managers Jonathan Brewer (now with GCEX) and Raj Sitlani.

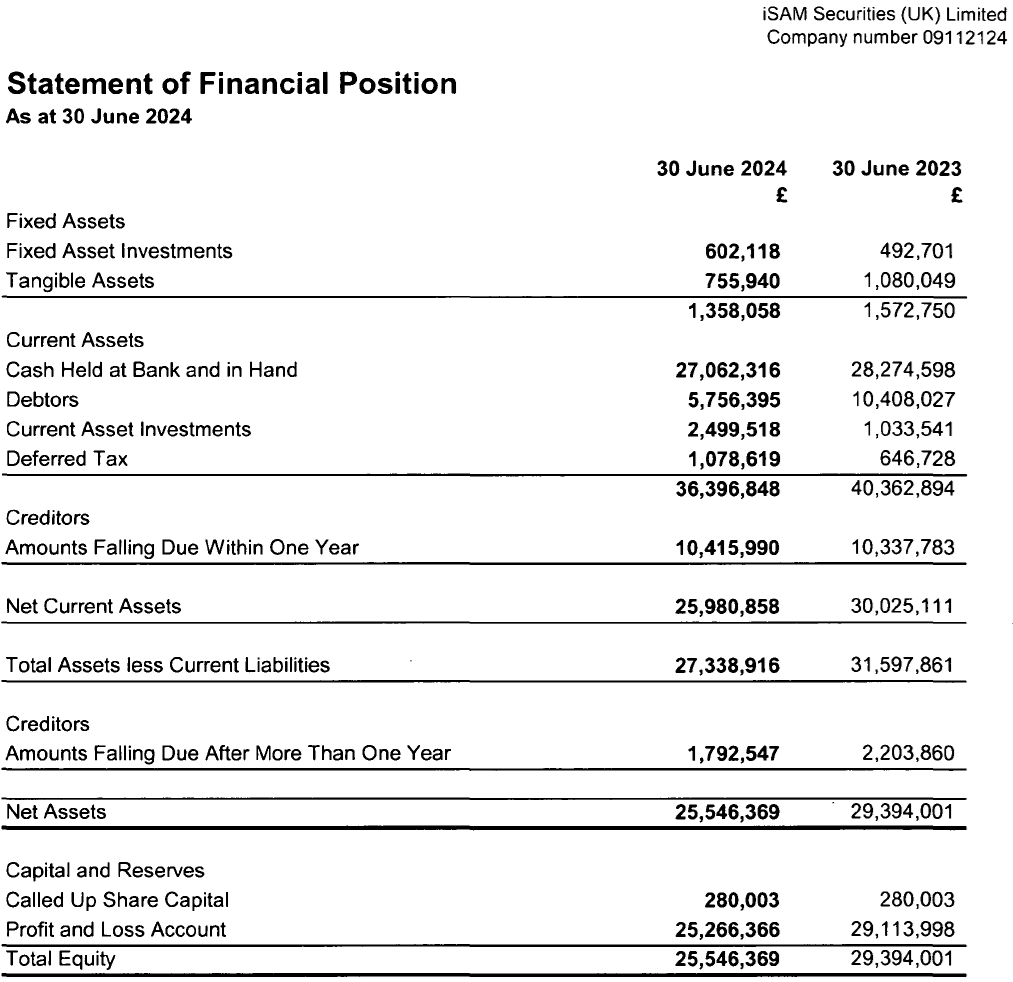

iSAM Securities’ 2024 income statement and balance sheet follow below.

About iSAM Securities

iSAM Securities, regulated by the FCA, SFC, and CTFC, and CIMA registered, is a leading algorithmic trading firm and trusted electronic market maker, providing liquidity, technology and prime services partner to institutional clients and trading venues globally. The firm offers full-service prime brokerage and execution via its cutting-edge proprietary technology, as well as market leading analytics, cleared through the group’s bank Prime Brokers.

The iSAM Securities brand includes entities iSAM Securities (UK) Limited, iSAM Securities (HK) Limited, iSAM Securities (Global) Limited, iSAM Securities (USA) Inc., and iSAM Securities Limited.