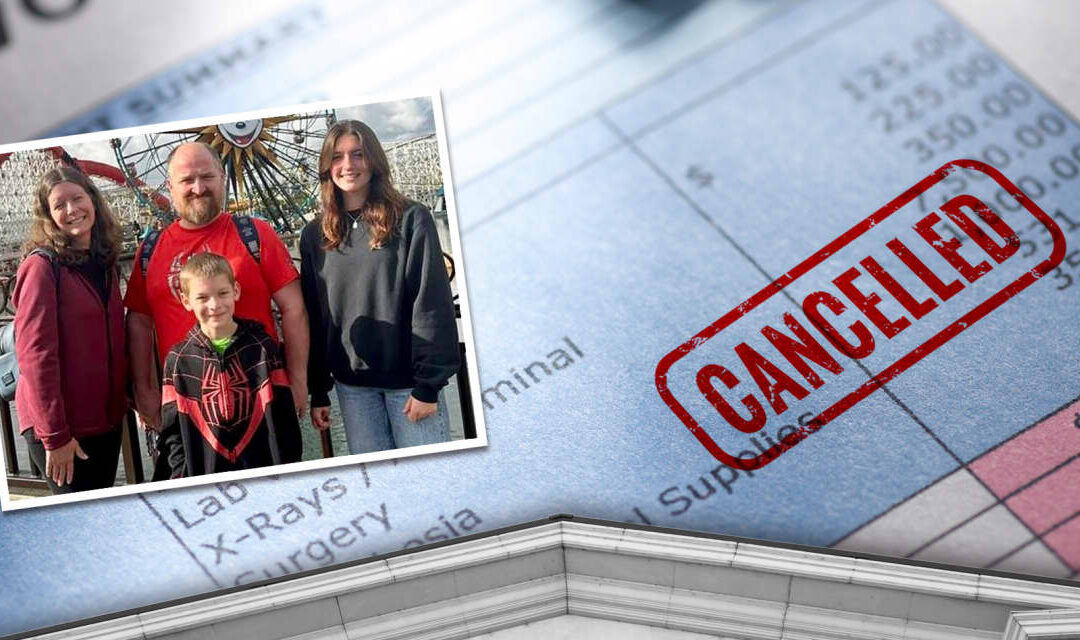

When Amber Clapsaddle found out that she would have about $1,500 in medical debt canceled, she cried, posted a picture of the letter with the news on Facebook and called her husband.

Clapsaddle, 44, had heard several months before about efforts in Toledo, Ohio, where she and her family live, to wipe out medical debt. At the time, she said, she was “praying that I would randomly get a bill” canceled.

So when she got the letter in the mail in October, “I couldn’t believe it,” she said. “I was like, ‘oh my gosh, it actually happened to me.’”

The relief came after the debt had been hanging over her family for about five years. Clapsaddle’s household engages regularly with the healthcare system because her husband and some of her children have complex medical conditions.

But it wasn’t until Clapsaddle began the years-long process of being diagnosed with and managing fibromyalgia herself that her family started to fall behind on medical bills. “I’ve always been a very responsible person to pay my bills,” she said. At the time the household incurred the bill that was ultimately canceled, for an ultrasound for her daughter, Clapsaddle was working part-time as she strove to get her own condition under control.

“I became one of those people that just put the bill in the pile but knew it was there,” she said. “It caused a lot of anxiety.” Ultimately, getting the bill canceled “was a relief,” she said.

Clapsaddle is one of hundreds of thousands of people around the country who have had nearly $418 million in medical debt canceled so far as part of efforts by cities, states and other municipalities to buy up and wipe out medical debt. Momentum around the idea has been building for years and, most recently, New York City became the largest jurisdiction to do it, announcing a plan to cancel more than $2 billion in medical debt for up to 500,000 New Yorkers.

The initiatives could help make the case for a similar effort at the national level. Policy makers have increasingly been paying attention to medical debt as concerns mount about its impact on Americans’ health and financial well-being.

The Consumer Financial Protection Bureau estimated in 2022 that Americans had $88 billion in medical bills on their credit reports. Medical debt is a top reason people file for bankruptcy protection, and it can also become an obstacle to people seeking care, advocates and policy makers say.

The process of canceling medical debt involves using public or philanthropic funds to purchase debt held by hospitals, debt buyers and others that is tied to bills for medical care, and then essentially tearing up the IOUs. The debt can often be purchased for pennies on the dollar.

“Until we can get debt canceled at the federal level, it’s great to see cities and states doing it,” said Rep. Ro Khanna, a California Democrat. Khanna and Sen. Bernie Sanders, a Vermont independent, are planning to introduce a measure that would cancel medical debt nationally. “So much of our best government ideas come from cities and states,” Khanna said. “They’re the laboratories of democracy.”

Khanna noted how local efforts to make public college free eventually bubbled up to proposals in Congress and from presidential campaigns to do the same thing nationally. “Now you’re seeing this movement to forgive medical debt,” he said. “It’s an issue that I find unifies many different wings. People feel you shouldn’t go into medical debt if you have a heart attack, if you get sepsis, if you get COVID.”

From Chicago to Toledo, a new approach

It was federal funds that helped to kick off these efforts at the local level. Cook County, Ill., which is home to municipalities including Chicago, was the first local government to launch a medical-debt cancellation program. The idea came as county staffers were researching the best ways to spend the money the county would receive as part of the American Rescue Plan Act, the COVID-relief funds sent by Congress to local jurisdictions, said Toni Preckwinkle, the president of the Cook County Board of Commissioners.

As part of their research into how the county would spend the funds, Preckwinkle’s staff brought forward the idea of buying up and canceling medical debt. Staffers had seen philanthropists do similar work and they thought a local government could try it as well, Preckwinkle said.

“Needless to say it resonated with the rest of us, with the administration, since it fit neatly into our values and our agenda” to serve the most vulnerable in the community, she said. So far, the county has eliminated $348 million in medical bills for about 200,000 residents. It has set aside another $12 million that has the potential to cancel about $1 billion worth of bills.

One thing that’s particularly appealing about buying up and canceling medical debt, according to Preckwinkle: “In terms of bang for the buck, this is an incredible value,” she said.

That’s part of what inspired Michele Grim, now an Ohio state representative, to push for Toledo to do something similar when she was a member of the city council in 2022. Grim said she particularly appreciated that recipients of Cook County’s relief didn’t have to apply — rare for a social-service program, which often require beneficiaries to jump through significant hoops.

But the “bang for the buck,” as Preckwinkle put it, was also a significant driver, Grim said.

“You can’t think of anything that has such a high return on investment,” Grim said. The city and county have allocated about $1.6 million to cancel up to $240 million in debt. “It’s basically a penny-to-the-dollar return on investment. We’re doing something really good for lots of people because it’s just such a good return on investment.”

The reason cities and counties can spend so little to cancel so much debt has to do with the dynamics of the secondary market for debt, said Allison Sesso, the president and chief executive officer of RIP Medical Debt, the nonprofit organization working with these local governments to implement the debt-cancellation initiatives.

“The reality is, especially for medical debt, people that owe the debt tend to not have the ability to pay it,” she said. “The people are low-income and struggling to make ends meet oftentimes, or the debt is very large relative to their means.”

That means when a debt buyer purchases the unpaid bills from a healthcare provider with the intention of collecting on the debt, they’re taking a risk, because “you can’t get blood from a stone,” she said. As such, the debt buyers are only willing to pay a price that’s low compared with the value of the debt in order to maximize their chances of earning a profit.

RIP Medical Debt’s model is to use philanthropic and government money “to take advantage of that pricing and to get rid of the debts once we get our hands on them,” Sesso said.

The debate over medical-debt cancellation

To skeptics, the dynamic that allows medical debt to be bought for so little raises questions about whether canceling it is a good use of government dollars.

“They can buy debt at extremely low prices like pennies or a penny on the dollar precisely because collections agencies do not expect most people to pay this,” said Benedic Ippolito, a senior fellow at the American Enterprise Institute, a conservative think tank. If most of it isn’t getting repaid anyway, then it’s not clear how much the debt is actually affecting people’s finances or whether canceling it actually improves households’ cash flow, Ippolito said.

A group of researchers are studying the impact of these cancellation efforts, but the results aren’t expected to be published until later this year.

In addition, one of the main consequences of not paying medical debt — having it appear on your credit report — may soon be eliminated, thanks to the CFPB. Already, credit-reporting agencies have dropped about 70% of medical debt from Americans’ credit reports. That makes Ippolito even more skeptical about the value of devoting resources to canceling such debt, he said.

“We spend a ton of time focused on medical bills that are not paid and sent to collections and other forms of medical debt,” he said. “It’s not obvious to me that this is a bigger problem than many of the really, really expensive medical bills that are paid. There’s lots of people out there who really struggle to pay bills, but they do pay them. Is that person necessarily less important from a policy perspective than people who incur medical debts?”

Even proponents of buying up and canceling medical debt acknowledge that what they’re doing won’t prevent new debt from continuing to accrue. “We recognize that what we do is not going to fundamentally solve this problem of medical debt,” RIP Medical Debt’s Sesso said. “It is absolutely critical to the individuals that we help. We’re having a real impact, but we’re also intentional about leveraging what we do to tell a larger story around medical debt.”

In 2020, an estimated 17.8% of American adults had medical debt in collections, according to a study published in the Journal of the American Medical Association in 2021. The debt was particularly concentrated among people living in low-income ZIP codes, and particularly in low-income areas in states that didn’t expand Medicaid as part of the Affordable Care Act, the study found.

Initiatives organized by RIP Medical Debt, including the efforts by local governments, are focused on people earning up to 400% of the poverty level or people for whom medical debt is 5% or more of their annual income.

In order to get at the issues causing medical debt in the first place, Sesso’s group and others advocate for more comprehensive and affordable insurance coverage that is likely to actually cover people’s healthcare costs; financial-assistance policies at healthcare providers that are more robust and easier to access; and limits on extraordinary collections activities, like seizing bank-account funds and garnishing wages.

Khanna, Sanders and others also say that Medicare For All, a bill under which government insurance would pay for healthcare, would help mitigate medical debt by providing a safety net for Americans and pushing costs down at providers.

Regardless of the approach, Americans on different sides of the ideological spectrum tend to view medical debt as a systemic and not an individual problem, according to polling by RIP Medical Debt, the American Cancer Society Action Network and the Leukemia and Lymphoma Society.

“It’s very clear that medical debt is viewed by a pretty substantial majority of people as a systemic issue,” Sesso said. “They expect the government to do something about it.”