After witnessing a hazy macro environment for five straight quarters, India-centric IT services firms saw green shoots in the first quarter of this fiscal. While experts were still uncertain about the continuity of tech spending, Q2 (July to September) earnings belied the doubts of the naysayers.

Discretionary spending may not be back across all sectors, but IT companies are seeing growth in more verticals and geographies than before. Some have predicted higher revenues for the current fiscal and others have seen a decent uptick in their net headcount.

Now with Donald Trump winning the US elections and analysts predicting lower business taxes, the ongoing AI revolution is likely to take the tech spends northward for the Indian IT sector to capitalise on.

Four key takeaways from the Q2 earnings point to revival of tech spends: Improvement in the BFSI (banking, financial services and insurance) sector in North America; a resurgence in hiring; upward revision in revenue guidance; and growing artificial intelligence (AI) deals.

BFSI on recovery path, North America gains ground

BFSI is the largest revenue generator for the over $250-billion Indian IT industry and also the biggest technology spender. The rise in discretionary spends, especially in the financial vertical and North America, has led to growing optimism among both companies and analysts.

While some experts say that the spending increase is linked to regulatory compliance, others point out that projects previously put on hold are resuming.

Peter Bendor- Samuel, chief executive of the consulting and research firm Everest Group, said that the BFSI sector is witnessing a rebound following the post-Covid slump. “BFSI typically leads other industry segments, so this is an encouraging sign for the rest of the IT industry,” he said.

Salil Parekh, CEO of Bengaluru- based Infosys, India’s second-largest IT services company, said during the company’s earnings call: “The financial services segment in the US is seeing increased discretionary spending, particularly in capital markets, mortgages and the cards and payments sub-segments.”

Even for cross-town rival Wipro, things are looking up. Its chief executive Srini Pallia said Americas 2 (strategic market unit) recorded sequential growth of 0.8%, supported by robust demand and strong execution in the BFSI sector.

For HCLTech, the BFSI vertical grew at about 4% sequentially in dollar terms, excluding the impact of its divestment of a joint venture with US-based State Street.

The crisis in US based-regional banks last year was one of the triggers that resulted in enhanced discretionary deals for Indian IT firms, pointed out LTIMindtree COO Nachiket Deshpande. Also, with Europe facing a decelerating economy, the scales seem to have tipped in favour of North America.

Headcount as companies buck trend

In a reversal of the declining headcount trend in the Indian IT industry after nearly seven quarters, five of India’s top six IT companies- Tata Consultancy Services, Infosys, Wipro, Tech Mahindra and LTIMindtree- collectively hired over 17,500 employees in the September quarter.

HCLTech was the only outlier: Its workforce reduced by 780 people last quarter, and largely due to the State Street divestment.

While the industry shed a record number of employees- more than 70,000- in FY24, the first quarter of this fiscal year saw a cumulative decline of 1,750. Companies temporarily ceased fresher hirings and reduced headcount amid business growth for four to five quarters after seeing a couple of quarters of pandemic-induced high growth tech spends.

But with demand recovery in sight, especially now that the US elections are over, hiring trends are witnessing a turnaround.

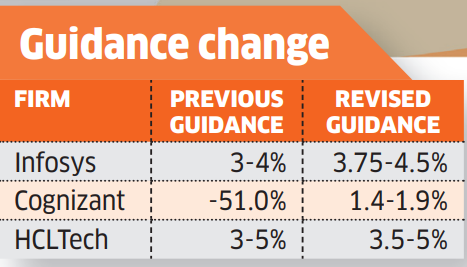

Upward revenue guidance

Infosys revised its FY25 revenue guidance after seeing better- than-expected Q2 earnings. It now expects revenue growth between 3.75-4.5% in constant currency for the current fiscal, which is higher than its earlier guidance of 3-4%. The company had earlier increased its guidance in the June quarter from the 1-3% range it gave at the start of the year.

Riding on an uptick in discretionary demand, Cognizant crossed the $5-billion quarterly revenue mark in its third quarter. Boosted by its performance and its recent acquisition, the IT major also revised its FY24 annual revenue guidance up to 1.4% to 1.9% in constant currency (this assumes approximately 200 basis points of inorganic contribution), from its earlier guidance of -0.5 to 1%.

Similarly, better-than-expected performance in the first half gave India’s third-largest software services firm, HCLTech, the confidence to increase the lower end of its revenue growth guidance for the fiscal year to 3.5-5.0% from the earlier range of 3.0- 5.0%.

AI deals go northward

With AI becoming more than just a buzzword, IT firms are registering a rapid growth in the number of AI engagements, including large deals. For instance, TCS has seen a doubling of its AI/GenAI TCV (total contract value of deals) every quarter since the past three quarters .

K Krithivasan, chief executive at TCS, said, “We have not been disclosing the AI/ GenAI TCV, but it has been improving very well, almost doubling every quarter, and the pipeline also remains very strong.”

As of Q2, TCS has more than 600 engagements in AI/Gen AI (including POCs [proof of concepts], POVs [proof of values], and projects which have matured to production stage). In Q1, the same metric was 270.

Accenture’s Q4 Gen AI new bookings stood at $1 billion, and the figure for the full year was $3 billion. In Q3, its Generative AI new bookings were over $900 million. In Q2 and Q1, the same were $600 million and $450 million, respectively.

HCLTech garnered about a third of incremental demand from data and AI verticals. Capgemini, which has a majority of its employees in India, last month disclosed that its GenAI bookings were pegged at 600 million euros as of Q3.

Infosys’s Salil Parekh said during the Q2 earnings call, “Almost every large deal or significant deal has some Gen AI component related to productivity. While the whole deal is not AI, a part of the deal becomes Gen AI.”

Recently, LTIMindtree’ s Deshpande told ET that it won the largest deal in the company’s history due to its AI approach, without disclosing the deal value.

New dynamic post US elections

Avinash Vashistha, chairman and CEO of Tholons and former chairman of Accenture India, said the bold trifecta play of reciprocal tariffs, stricter immigration and lower business taxes, under Donald Trump’s administration will be a boon for IT firms.

“While tariff impact should be minimal for IT companies, stricter immigration could squeeze talent acquisition in the US, and therefore, could see more offshoring of works to Indian GCCs and alliance IT partners.

Similarly, lower taxes are a clear win, potentially boosting the $29-trillion US GDP and attracting foreign investment.

Combined with the AI revolution, the projected tech spend of $1.3 trillion by 2027 is likely to go up. GCCs and IT service providers must forge strong partnerships to capitalise on this dynamic landscape and drive innovation,” Vashistha said.

Pareekh Jain, chief executive of engineering insight platform EIIRTrend, said that once Donald Trump becomes US president, two things will play out as far as IT firms are concerned.

“With tech leaders like Elon Musk on Trump’s side, the new president will go more after unskilled immigration and will be softer on skilled migration. Secondly, his views of lowering corporate taxes will help enter prises go for larger discretionary spends — a boon for IT firms,” he predicted.