Summary

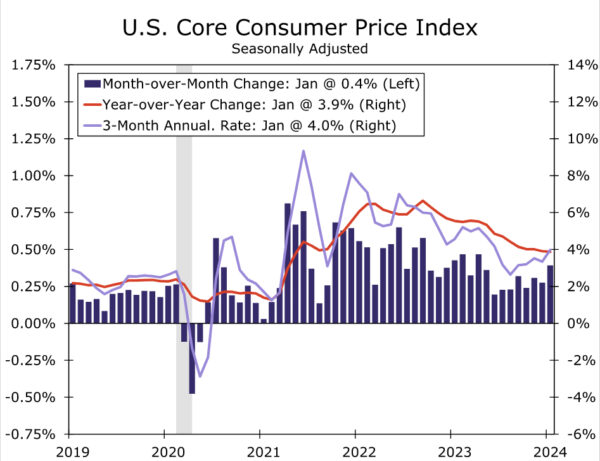

The January CPI data came in hotter than expected and did little to give the FOMC the “greater confidence” it needs to start imminently cutting rates. Gasoline prices declined for the fourth month in a row, but an outsized jump in energy services and food prices tempered any enthusiasm from the decline in fuel prices. Excluding food and energy, core CPI rose 0.4% in the month, a tenth stronger than the consensus forecast. Core goods prices remained in deflationary territory amid the ongoing normalization between supply and demand for many of the subcategories, such as used autos. However, core services inflation came in hot at 0.7%, the largest gain in 16 months, amid a move higher in price growth for owners’ equivalent rent, medical care services and travel-services such as airfares and hotels.

On a month-to-month basis, the inflation data can be noisy, and this is particularly true in January when businesses adjust prices at the start of the calendar year in a way that may not always be well captured by the seasonal adjustment process. We suspect inflation will resume its downward trajectory in the coming months. That said, today’s report is a reminder that the road back to 2% inflation likely will have some potholes, and it reinforces the hawks on the FOMC who have expressed skepticism that an imminent easing of policy is warranted. There are still two more CPI reports between now and the May FOMC meeting, in addition to a slew of other economic data, but the timing of the first rate cut is at risk of slipping to the summer.

Inflation Tops Expectations in January

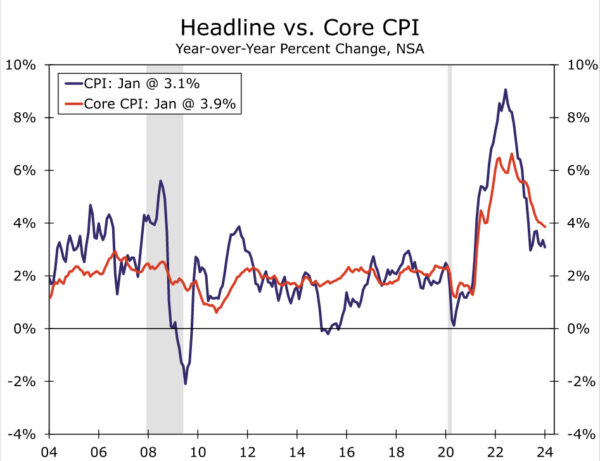

January’s Consumer Price Index (CPI) served as a reminder that despite marked improvement over the past year, the battle against inflation is not won yet. The CPI rose 0.3% in the first month of 2024, topping expectations for a 0.2% increase. On a 12-month basis, prices are up 3.1%—better than the 6.4% rise this time last year, but still too strong as far as the Fed is concerned and noticeably higher than the 1.8% average that prevailed over the 2010s.

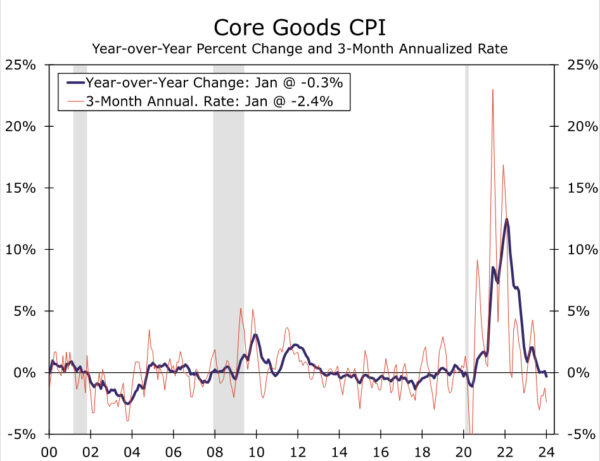

The surprisingly strong print in January can be largely traced to core services. Excluding food and energy, prices rose 0.4%, a tick higher than expected. The pickup came despite a larger-than-expected drop in core goods (-0.3%), fueled by a 3.4% drop in used autos as well as more modest price declines in apparel (-0.7%), medical goods (-0.6%) and household furnishings (-0.1%). Core goods prices are now down 0.3% on a year-over-year basis, the first decline since July 2020.

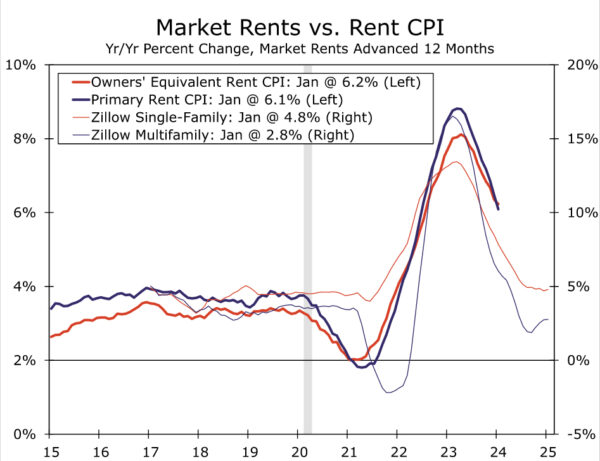

Core services, on the other hand, advanced 0.7% in January, the largest monthly gain in 16 months. Shelter costs were a standout, rising 0.6%. Some of that strength can be attributed to the volatile lodging away from home category (+1.8%), but owners’ equivalent growth perked back up with a 0.6% rise (0.56% before rounding). With more timely private sector measures of rent showing cost growth continuing to cool, including for single-family properties, we would expect to see January’s strength in OER reversed in the coming months and do not take today’s print as an indication that shelter disinflation has run its course. Notably, primary rent continued to cool over the month with the 0.36% increase the smallest since the summer of 2021.

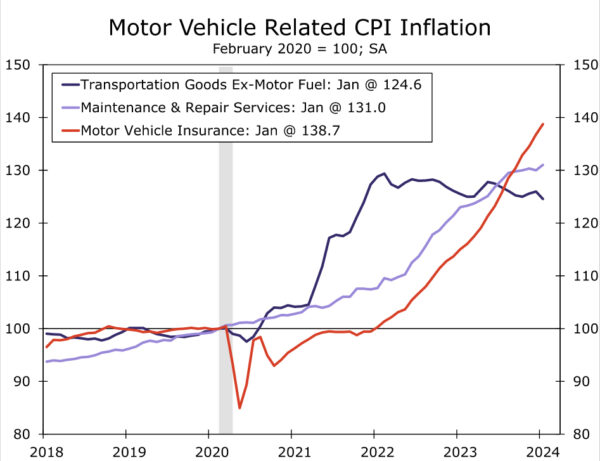

Yet core services inflation was strong in January beyond shelter, with prices also rising 0.6%. Transportation services increased 1.0% thanks to solid monthly hikes in motor vehicle insurance (1.4%), maintenance (+0.8%) and fees (+1.1%), along with a 1.4% rise in airfares. With prices for motor vehicle-related services having now risen as much as vehicles since 2020, we expect to see service-related pricing slow through the year. A 0.7% rise in medical care services, the most heavily weighted core category after shelter, also contributed to the hotter than expected print. However, unlike many other categories of the CPI, medical services does not feed into estimates of the Fed’s preferred measures of inflation, the PCE deflator, in which healthcare costs carry greater weight.

Another month of lower energy prices helped to keep the CPI’s headline rise in check. Gasoline prices fell 3.3% on a seasonally adjusted basis and are down 6.4% compared to one year ago. Unlike fuel, energy services prices posted a strong increase of 1.4%, boosted by a 2.0% increase in utility gas and a 1.2% gain in electricity prices. Food inflation also came in a little stronger than expected, rising 0.4%. We doubt gasoline prices will fall much further in the months ahead, but the January bounce in food and energy service prices is at odds with the recent trend in raw materials for these categories, such as foodstuff commodities and natural gas prices. We look for some relief in these categories in the coming months even as the deflation from gasoline prices ebbs.

FOMC: Not Confident Yet

This morning’s CPI data are a reminder that the road back to 2% inflation likely will have some potholes. The good news is that core goods inflation is already roughly back in line with its pre-pandemic pace. With supply chain pressures no longer easing, we see more limited scope for goods disinflation without a more marked cooling in demand. Services will therefore need to take the disinflation baton. The bad news is that, for January at least, services inflation dropped the baton.

We believe that core services inflation will resume its slowdown in the months ahead. Despite today’s reading, primary shelter prices have room to decelerate based on leading indicators for this series. The jump in prices for travel-services such as airfares and hotels is unlikely to be sustained, particularly as labor compensation growth continues to show signs of returning much closer to its pre-pandemic pace. That said, the FOMC made clear at its previous meeting that it would need to see further improvement in the inflation data before it felt comfortable cutting the fed funds rate. In our view, today’s report does not qualify as confidence-boosting. There are still two more CPI reports between now and the May meeting, in addition to a slew of other economic data. However, the timing of the first rate cut is at risk of slipping to the summer.