By RoboForex Analytical Department

The USD/JPY pair unexpectedly declined last night due to a weakening US dollar. Currently, it is hovering around 156.33.

Japanese Finance Minister Shunichi Suzuki highlighted the government’s recent interventions to support the yen, significantly impacting the market. Official data reveals that throughout April, Japan spent approximately 9.79 trillion yen (62.2 billion USD) on efforts to stabilise the national currency.

Suzuki pointed out that the interventions aimed to mitigate excessive fluctuations in the currency market. He affirmed that Japan would continue to monitor the forex market and act against disorderly movements vigilantly, expressing satisfaction with the effects of these measures. This marks the first time the Japanese authorities have acknowledged their market interventions conducted in late April and early May.

The yen’s strengthening is also bolstered by the recent depreciation of the US dollar, driven by market anticipations of a potential earlier rate cut by the US Federal Reserve. As expectations grow for softened US monetary policy, the dollar has declined, boosting other currencies, including the yen.

USD/JPY technical analysis

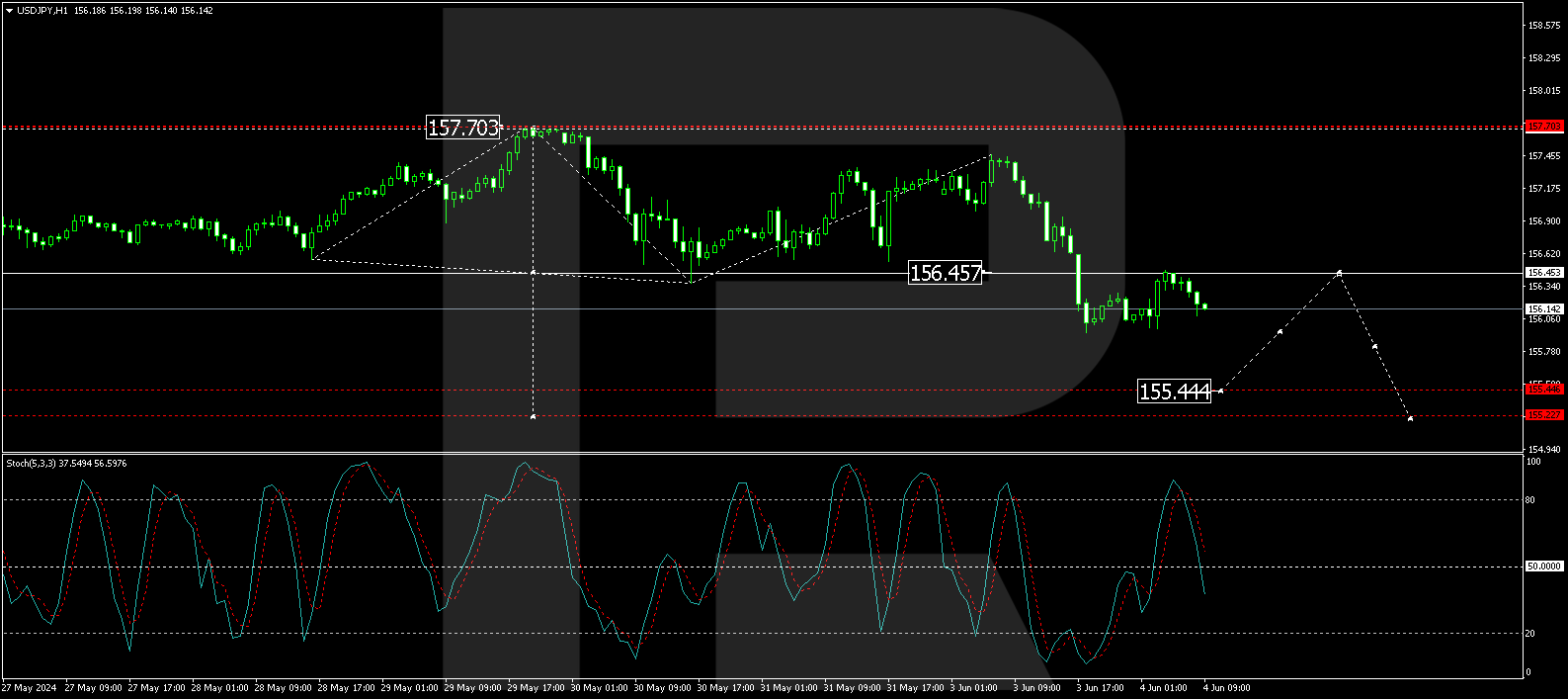

On the H4 chart, USD/JPY completed a correction wave, reaching 157.70. A new wave of decline aiming for 153.77 is forming. Once this target is reached, a potential correction to 155.44 (testing from below) may follow, preceding a further decline towards 149.70. The bearish outlook is technically supported by the MACD indicator, with its signal line below zero and pointing sharply downwards.

On the H1 chart, the correction phase to 157.47 has concluded, and a downward impulse towards 155.44 is underway. Following this, a correction to 156.45 (testing from below) could occur, potentially leading to a further drop to 155.22, the primary target. This scenario is technically confirmed by the Stochastic oscillator, whose signal line is positioned above 80 and is anticipated to drop to 20.

Summary

The yen’s unexpected strengthening reflects a complex interplay of domestic interventions and broader market reactions to shifts in US monetary policy. Given the ongoing adjustments in global economic expectations and central bank policies, investors and traders should closely monitor these developments, as further fluctuations in the USD/JPY pair are likely.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Japanese yen strengthens unexpectedly against US dollar Jun 4, 2024

- Oil prices decreased for the 5th consecutive session. AI companies support the NASDAQ index Jun 4, 2024

- OPEC+ extending key oil production cuts Jun 3, 2024

- Trade of the Week: USDInd seeks fresh directional catalyst Jun 3, 2024

- COT Soft Commodities Charts: Speculator bets led by Soybean Meal & Soybeans Jun 2, 2024

- COT Metals Charts: Weekly Speculator Changes led by Gold Jun 2, 2024

- COT Bonds Charts: Speculator bets led by 5-Year Bonds & US Treasury Bonds Jun 2, 2024

- COT Stock Market Charts: Speculator bets led by S&P500 & VIX Jun 2, 2024

- Week Ahead: Brent waits on OPEC+ meeting May 31, 2024

- Investors’ focus today is on the PCE Price Index data. Conditions for inflation growth are forming in Japan May 31, 2024