Japanese Yen staged in a notable rebound in European session, triggered by heightened market vigilance towards market interventions. This reaction comes in the wake of a significant meeting between Japan’s Ministry of Finance, Financial Services Agency, and Bank of Japan, marking the first such tripartite gathering since last May. The meeting was called into action as Yen plunged to a 34-year low against Dollar briefly, prompting concern over the currency’s rapid depreciation.

Key figures, including Japan’s top currency diplomat Masato Kanda, FSA Commissioner Teruhisa Kurita, and BoJ’s head of policy, Seiichi Shimizu, were in attendance. The focal point of discussions was Yen’s alarming descent, which officials see as straying from Japan’s economic fundamentals.

Kanda talked to reporters after the meeting, emphasizing the misalignment between Yen’s weakening and Japan’s economic health, pointing to speculative trading as a primary driver behind the currency’s fall. He asserted that “We will take appropriate action against excessive moves without ruling out any options”, delivering what is arguably the most direct and serious warning to financial markets since Yen’s decline following BoJ’s departure from negative interest rates earlier in the month.

Overall in the currency markets, Yen is the strongest for the day at this point, followed by Dollar. Swiss Franc is trading as the weakest, as selloff continues. While Euro and Sterling is gaining against the Franc, they’re indeed among the worst performers together with Aussie.

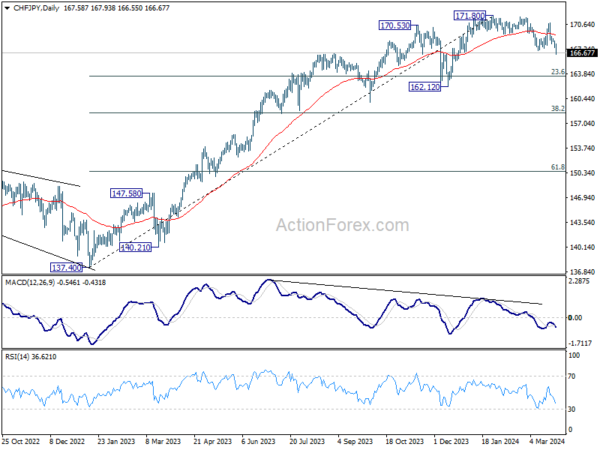

Technically, CHF/JPY’s fall from 171.80 resumes today by breaking through 167.05 support. This decline is seen as a correction to whole five-wave rally from 137.40. Risk will now stay on the downside as long as 55 D EMA (now at 169.21 holds. Next target is 23.6% retracement of 137.40 to 171.80 at 163.68.

In Europe, at the time of writing, FTSE is down -0.24%. DAX is up 0.57%. CAC is up 0.31%. UK 10-year yield is down -0.0341 at 3.939. Germany 10-year yield is down -0.048 at 2.305. Earlier in Asia, Nikkei rose 0.90%. Hong Kong HSI fell -1.36%. China Shanghai SSE fell -1.26%. Singapore Strait Times rose 0.57%. Japan 10-year JGB yield fell -0.0143 to 0.724.

Eurozone economic sentiment rises to 96.3 in Mar, above exp 96.1

Eurozone Economic Sentiment Indicator rose from 95.5 to 96.3 in March, above expectation of 96.1. Employment Expectations Indicator rose from 102.5 to 102.6. Economic Uncertainty Indicator fell from 20.3 to 19.2.

Eurozone industry confidence rose from -9.4 to -8.8. Services confidence rose from 6.0 to 6.3. Consumer confidence rose from -15.5 to -14.9. Retail trade confidence rose from -6.6 to -6.7. Construction confidence fell from -5.5 to -5.6.

EU Economic Sentiment Indicator rose from 95.5 to 96.2. Employment Expectations Indicator rose from 102.2 to 102.3. Economic Uncertainty Indicator fell from 19.8 to 18.7.

Amongst the largest EU economies, the ESI improved markedly in France (+2.6), and to a lesser extent in Italy (+1.5) and Germany (+0.9). It deteriorated in the Netherlands (-0.7) and Spain (-0.4) and remained broadly stable in Poland (+0.3).

NZ government drastically cuts 2024 growth forecast to 0.1%, lowers inflation outlook

New Zealand government has made significant revisions to its economic forecasts, projecting a notably subdued GDP growth of just 0.1% for this fiscal year, as revealed in its latest budget statement. Additionally, inflation outlook for both 2024 and 2025 was revised downwards.

The government said a “wide range of data” collected since December highlighted “further deterioration in the economic outlook.” The expected slowdown in economic activity materialized “sooner than expected,” while inflationary pressures have “eased more than expected.”

Specifically, GDP growth projections for 2024 have been significantly lowered from prior forecast of 1.5% to 0.1%. However, there is a silver lining with GDP growth forecast for 2025 being adjusted upwards from 1.5% to 2.1%.

On the inflation front, CPI forecast for 2024 was lowered from 4.1% to 3.3%, and for 2025, forecast was revised down from 2.5% to 2.2%.

Australia’s monthly CPI holds steady at 3.4% in Feb

Australia monthly CPI was unchanged at 3.4% yoy in February. When stripping out volatile items and holiday travel, the CPI saw a slight deceleration, moving from 4.1% yoy to 3.8% yoy. However, a closer look at the core inflation measure, the annual trimmed mean CPI, reveals a slight uptick from 3.8% yoy to 3.9% yoy, suggesting underlying inflationary pressures remain persistent.

The detailed breakdown of inflation contributors highlights showed that housing costs had the most substantial rise at 4.6% yoy. Food and non-alcoholic beverages also experienced a notable increase at 3.6% yoy. Additionally, alcohol and tobacco products saw a sharp price escalation at 6.1% yoy, and insurance and financial services costs surged by 8.4% yoy, the latter being the highest among the recorded sectors.

BoJ’s Tamura stresses gradual withdrawal of stimulus for steady policy normalization

BoJ board member Naoki Tamura said that Japan’s moderate economy recovery path is expected to continue, positive cycle of wage increases leading to higher inflation rates.

“The risk of our medium- and long-term forecasts being derailed is likely small,” he remarked in a speech today.

He underscored the importance of a deliberate and gradual approach to policy normalization, ensuring that the transition away from aggressive monetary support is managed with precision and foresight.

“How to manage monetary policy ahead is very important to ensure we deftly roll back our massive stimulus program, and move slowly but steadily toward policy normalization,” he articulated.

Central to Tamura’s vision is the restoration of interest rate flexibility, positioning BoJ to effectively modulate demand and influence price dynamics through rate adjustments.

“In my view, the central bank’s ultimate goal is to bring interest rates back to levels where they can be pushed up or down to adjust demand, and influence price moves,” he stated.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 151.13; (P) 151.35; (R1) 151.64; More…

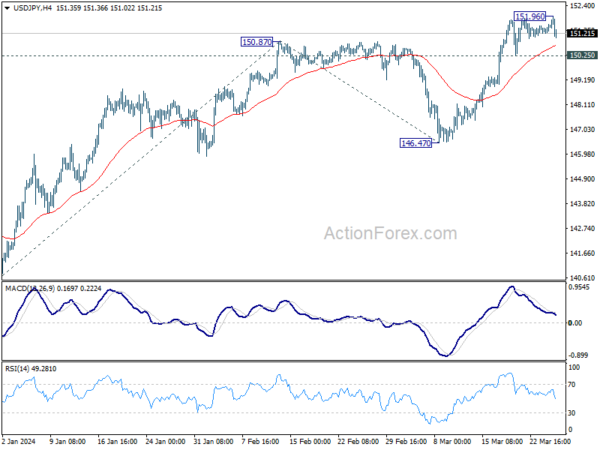

Intraday bias in USD/JPY is turned neutral gain as it retreated after edging higher to 151.96. On the downside, break of 150.25 support should confirm short term topping, and turn bias back to the downside for 55 D EMA (now at 148.93). Nevertheless, sustained break of 151.93 key resistance will confirm long term up trend resumption. Next near term target will be 61.8% projection of 140.25 to 150.87 from 146.47 at 153.03.

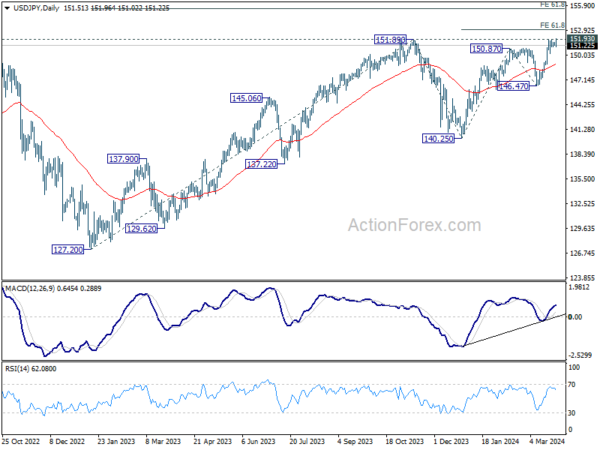

In the bigger picture, correction from 151.87 (2023) high could have completed at 140.25 already. Rise from 127.20 (2023 low), as part of the long term up trend, is probably ready to resume. Decisive break of 151.93 resistance (2022 high) will confirm this bullish case. Next medium term target will be 61.8% projection of 127.20 to 151.89 from 140.25 at 155.20. This will remain the favored case as long as 146.47 support holds, in case of another pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | AUD | Westpac Leading Index M/M Feb | 0.10% | -0.10% | ||

| 00:30 | AUD | Monthly CPI Y/Y Feb | 3.40% | 3.50% | 3.40% | |

| 09:00 | CHF | Credit Suisse Economic Expectations Mar | 11.5 | 10.2 | ||

| 10:00 | EUR | Eurozone Economic Sentiment Indicator Mar | 96.3 | 96.1 | 95.4 | 95.5 |

| 10:00 | EUR | Eurozone Industrial Confidence Mar | -8.8 | -9 | -9.5 | -9.4 |

| 10:00 | EUR | Eurozone Services Confidence Mar | 6.3 | 7.8 | 6 | |

| 10:00 | EUR | Eurozone Consumer Confidence Mar F | -14.9 | -14.9 | -14.9 | |

| 14:30 | USD | Crude Oil Inventories | -0.7M | -2.0M |