Japanese Yen recovers broadly in Asian session today, while Nikkei also soared to a new 34-year high, surpassing the 38k mark. The move came as a rather complex reactions to economic data showing that Japan unexpectedly slipping into recession. The surprised downturn also led to the country’s demotion to the world’s fourth-largest economy in 2023, with Germany ascending to third place.

This economic setback has not deterred speculations BoJ is still on track to exit its long-standing negative interest rate policy within the current year. This optimism is grounded in the resilience of Japan’s labor market and the robust investment intentions of its corporations. Yen’s current recovery is largely reflective of market sentiment that aligns with these expectations. However, the equity market’s robust performance suggests that investors may be anticipating a delayed policy adjustment by BoJ, at a time later than April.

On a global scale, Dollar continues to dominate as the week’s strongest currency, with investors keenly awaiting the forthcoming US retail sales figures. British Pound maintains its position as the second strongest currency, with significant interest focused on the upcoming UK GDP data. Eurozone holds the third spot in this week’s currency strength ranking. Conversely, Swiss Franc is languishing as the week’s weakest currency, with New Zealand Dollar, Australian Dollar, and Canadian Dollar trailing close behind. Australia’s recent lackluster employment report has notably dampened Aussie’s recovery momentum.

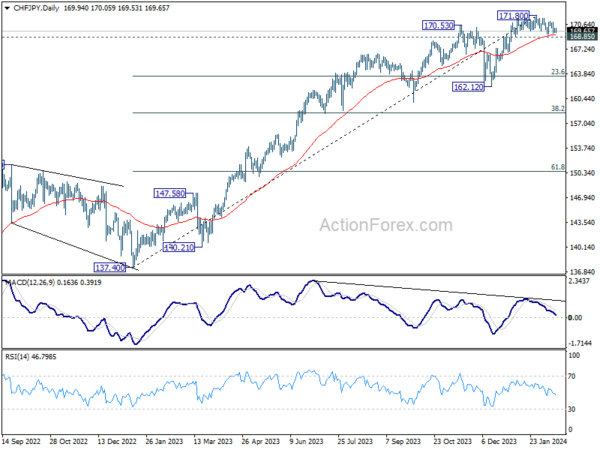

Technically, CHF/JPY is looking vulnerable to a deeper correction. Upside momentum has been clearly diminishing for a while, as seen in D MACD. Break of 168.85 support will argue that a medium term top was also formed, and bring deeper fall to 23.6% retracement of 137.40 to 171.80 at 163.68, as a correction to the uptrend from 137.40. Any extended selloff in Swiss Franc or rebound in Yen could catalyze this anticipated movement.

In Asia, Nikkei rose 1.25%. Hong Kong HSI is up 0.31%. Singapore Strait Times is up 0.56%. Japan 10-year JGB yield is down -0.0285 at 0.732. Overnight, DOW rose 0.40%. S&P 500 rose 0.96%. NASDAQ rose 1.30%. 10-year yield fell -0.049 to 4.267.

Japan Enters Technical Recession Amid Falling Consumption and Investment

Japan’s economy has entered a technical recession as GDP unexpectedly contracted by -0.1% qoq in Q4, much worse than expectation of 0.3% qoq growth. That also marked a continuation from -0.8% contraction seen in Q3. On annualized basis, the downturn was -0.4%, a stark contrast to the anticipated 1.4% growth and following -3.3% contraction in the previous quarter.

The contraction is attributed primarily to decline in private consumption, which accounts for over half of the Japanese economy, falling by -0.2% qoq. Capital expenditure, another significant driver of private-sector growth, also decreased by -0.1% qoq. However, external demand, as indicated by the net exports, provided a slight buffer, contributing 0.2 percentage points to GDP, with exports growing by 2.6% qoq.

Economy Minister Yoshitaka Shindo emphasized the importance of solid wage growth to support consumer spending, which he noted is currently “lacking momentum” amidst rising prices. He also pointed out that BoJ considers a broad range of data, including consumption patterns and risks to the economy, when formulating monetary policy.

RBA’s Bullock highlights inflation persistence and demand-supply imbalance

In today’s Senate Estimates appearance, RBA Governor Michele Bullock underscored the “persistent” nature of inflationary pressures within the Australian economy.

She pointed out the crucial distinction between demand growth rates and overall demand levels, emphasizing “growth rates are slowing, but aggregate demand is still above aggregate supply, and that’s what’s generating inflationary pressures.”

Bullock remained optimistic about RBA’s ability to manage inflation effectively without jeopardizing employment growth. “We think we’re in a good position to get inflation down in a reasonable amount of time while still keeping employment growing,” she noted.

Australia’s employment grows 0.5k in Jan, unemployment rate rises to 4.1%

Australia’s job market showed further signs of cooling in January, as the latest employment data reveals a modest increase of just 0.5k jobs, significantly below expectation of 20.7k growth. Looking at the details, full-time employment saw an uptick of 11.1k, counterbalanced by reduction in part-time job by -10.6k.

Unemployment rate unexpectedly rose from 3.9% to 4.1%, above expectation of 4.0%. That also marked the first occasion in two years since January 2022 that the rate has breached the 4% threshold. Participation rate held steady at 66.8%, but a notable decrease in monthly hours worked by -2.5% mom paints a picture of a slackening labor market.

BoE’s Bailey highlights persistent concerns over services inflation and wage trends

During an appearance the House of Lords Economics Affairs Committee, BoE Governor Andrew Bailey highlighted that UK’s inflation rates have fluctuated, slightly overshooting last month and slightly undershooting this month. The development balanced out to “pretty much leaves us where we were”.

He noted the inflation trend were “obviously encouraging” potential worse outcomes. However, he emphasized that services inflation is at levels that are “not compatible with a 2% sustained inflation target”. Meanwhile, pay growth reduction was “just not quite as far as we thought.”

Bailey’s observations come after the latest CPI data remained steady at 4% in January, with core CPI also unchanged at 5.1%. Bailey’s comment suggested that this week’s data s unlikely to prompt immediate policy shifts.

Fed’s Barr: Rate cut decisions hinge on continued good data

In a speech overnight, Fed Vice Chair Michael Barr noted that the FOMC is “confident” that US is “on a path to 2% inflation”. However, Barr underscored the importance of seeing “continued good data” before initiating reduction in federal funds rate.

Reflecting on the latest consumer product index inflation report, he acknowledged the potential for a “bumpy” journey back to the target inflation rate, emphasizing the need for a “careful approach” in the current economic climate.

Looking ahead

UK GDP data is the main focus in European session while production and trade balance will be featured. Swiss will release PPI and SECO consumer climate. Eurozone will release trade balance.

Later in the day, US retail sales will take center stage, and jobless claims, Empire state manufacturing, Philly Fed manufacturing, industrial production, business inventories, and NAHB housing index will be released. Canada will release manufacturing sales and housing starts.

USD/JPY Daily Outlook

Daily Pivots: (S1) 150.33; (P) 150.61; (R1) 150.86; More…

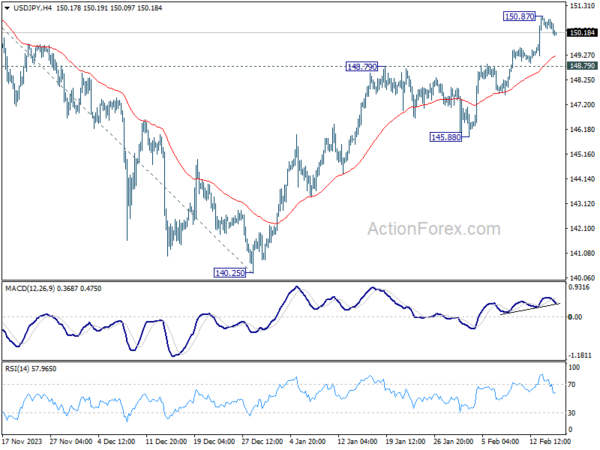

Intraday bias in USD/JPY is turned neutral with current retreat and some consolidations could be seen first. Downside of consolidation should be contained by 148.79 resistance turned support to bring another rally. Above 150.87 will resume the rise from 140.25 to 151.89/93 key resistance zone. Decisive break there will confirm larger up trend resumption of 155.50 projection level next.

In the bigger picture, fall from 151.89 is seen as a correction to the rally from 127.20, which might have completed at 140.25 already. Firm break of 151.89/93 resistance zone will confirm up trend resumption, and next target will be 61.8% projection of 127.20 to 151.89 from 140.25 at 155.50. This will now remain the favored case as long as 140.25 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | GDP Q4 Q/Q P | -0.10% | 0.30% | -0.70% | -0.80% |

| 23:50 | JPY | GDP Deflator Y/Y Q4 P | 3.80% | 4.00% | 5.30% | |

| 00:00 | AUD | Consumer Inflation Expectations Feb | 4.50% | 4.50% | ||

| 00:30 | AUD | Employment Change Jan | 0.5K | 20.7K | -65.1K | -62.7K |

| 00:30 | AUD | Unemployment Rate Jan | 4.10% | 4.00% | 3.90% | |

| 04:30 | JPY | Industrial Production M/M Dec F | 1.40% | 1.80% | 1.80% | |

| 07:00 | GBP | GDP M/M Dec | -0.20% | 0.30% | ||

| 07:00 | GBP | GDP Q/Q Q4 P | -0.10% | -0.10% | ||

| 07:00 | GBP | Industrial Production M/M Dec | -0.10% | 0.30% | ||

| 07:00 | GBP | Industrial Production Y/Y Dec | -0.10% | |||

| 07:00 | GBP | Manufacturing Production M/M Dec | 0.00% | 0.40% | ||

| 07:00 | GBP | Manufacturing Production Y/Y Dec | 1.30% | |||

| 07:00 | GBP | Goods Trade Balance (GBP) Dec | -14.1B | -14.2B | ||

| 07:30 | CHF | PPI M/M Jan | -0.20% | -0.60% | ||

| 07:30 | CHF | PPI Y/Y Jan | -1.10% | |||

| 08:00 | CHF | SECO Consumer Climate Q1 | -34 | -40 | ||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Dec | 15.7B | 14.8B | ||

| 13:00 | GBP | NIESR GDP Estimate Jan | 0.00% | |||

| 13:15 | CAD | Housing Starts Jan | 225K | 249K | ||

| 13:30 | CAD | Manufacturing Sales M/M Dec | -0.50% | 1.20% | ||

| 13:30 | USD | Initial Jobless Claims (Feb 9) | 217K | 218K | ||

| 13:30 | USD | Retail Sales M/M Jan | -0.20% | 0.60% | ||

| 13:30 | USD | Retail Sales ex Autos M/M Jan | 0.10% | 0.40% | ||

| 13:30 | USD | Import Price Index M/M Jan | -0.10% | 0.00% | ||

| 13:30 | USD | Empire State Manufacturing Index Feb | -12.5 | -43.7 | ||

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Feb | -8.9 | -10.6 | ||

| 14:15 | USD | Industrial Production M/M Jan | 0.30% | 0.10% | ||

| 14:15 | USD | Capacity Utilization Jan | 78.80% | 78.60% | ||

| 15:00 | USD | Business Inventories Dec | 0.30% | -0.10% | ||

| 15:00 | USD | NAHB Housing Market Index Feb | 46 | 44 | ||

| 15:30 | USD | Natural Gas Storage | -67B | -75B |