Japanese Yen had a broad-based declined in Asian session today, while Nikkei extended its recent up trend, momentarily reaching a new record high, ending the 34-year wait. This milestone is of considerable psychological significance for Japan, symbolizing the end of over three decades of economic stagnation ensued after the burst of the country’s stock and property bubble. The term “iron coffin lid” has often been used to describe the elusive barrier that is unreachable, making today’s breakthrough a momentous occasion for Japanese investors and the broader economy.

Despite recent weak PMI data and anticipation of BoJ rate hike later in the year, Japanese investors appear undeterred. BoJ Governor Kazuo Ueda continued his actively communicating with the markets, noting today that trend inflation is “heightening” and that service prices continue to “rise moderately”, reassuring investors of the central bank’s commitment to making “appropriate monetary policy decisions.”

The latest Reuters poll indicates that 83% of economists expect BoJ to end its negative interest rate policy in April, with 76% predicting the abandonment of yield curve control at the same meeting.

Meanwhile, Dollar’s weakness persists, even as the market pares back its expectations regarding Fed’s rate cuts. The minutes from January FOMC meeting reveal a committee majority concerned with the risks associated with premature policy easing. This sentiment reflects a broader inclination towards maintaining interest rates at their current level for an extended period, albeit with the recognition that this strategy may necessitate more aggressive cuts later on.

For the week, the Yen ranks as the poorest performer among major currencies, trailed by Dollar and Sterling. Conversely, New Zealand Dollar leads as the strongest, followed by Canadian Dollar and Swiss Franc, with Euro and Australian Dollar positioned in the middle. Nevertheless, upcoming PMI data and ECB meeting accounts hold the potential to further shuffle these rankings.

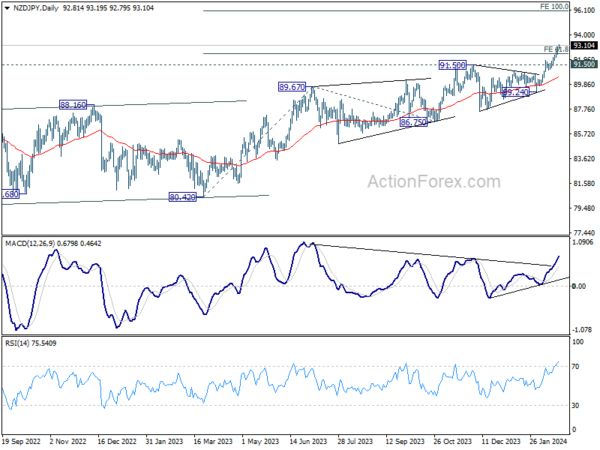

Technically, NZD/JPY’s up trend continues today and hit as high as 93.19 so far. D MACD is showing sign up upside acceleration. Given that 61.8% projection of 80.42 to 89.67 from 86.75 is broken, next target will be 100% projection at 96.00. In any case, outlook will now stay bullish as long as 91.50 resistance turned support holds.

In Asia, at the time of writing, Nikkei is up 1.86%. Hong Kong HSI is up 0.55%. China Shanghai SSE is up 0.78%. Singapore Strait Times is down -0.26%. Japan 10-year JGB yield is down -0.0005 at 0.725. Overnight, DOW rose 0.13%. S&P 500 rose 0.13%. NASDAQ fell -0.32%. 10-year yield rose 0.050 to 4.325.

FOMC minutes: A majority hesitant on swift monetary easing

The latest FOMC minutes reveal a predominant caution against premature easing of monetary policy. The document underscores a consensus among “most participants” over the potential risks of reducing interest rates too hastily, expressing a preference for delaying cuts rather than risking the need to reverse course.

During the FOMC meeting held on January 30-31, the discussion emphasized that participants did not anticipate it being appropriate to lower the federal funds rate target range without “greater confidence” that inflation was on a sustainable path back to 2% target. The determination of the future policy rate path was tied closely to “incoming data, the evolving outlook, and the balance of risks.” .

Although the balance of risks towards employment and inflation goals was seen as “moving into better balance”, participants remained “highly attentive to inflation risks”. While upside risks to inflation have “diminished”, inflation remains above target. This vigilance is framed within a broader context of concern that “progress toward price stability could stall”, particularly in scenarios where demand strengthens unexpectedly or supply-side improvements falter.

The predominant narrative within the FOMC leans towards a cautious approach to policy easing, with “most participants” underscoring the perils of “moving too quickly” and the importance of a meticulous evaluation of incoming data to ascertain whether inflation trends align with the target sustainably. In contrast, only “a couple of participants” raised concerns about the economic downsides of an “overly restrictive stance” persisting for an extended period.

Japan’s PMI composite drops to 50.3, from recovery to stagnation

Japan’s PMI Manufacturing dipped further to 47.2 from 48.0, marking the ninth consecutive month of sector contraction and hitting the lowest point since August 2020. PMI Services also declined, albeit more moderate, falling from 53.1 to 52.5. Consequently, Composite PMI, which combines both manufacturing and service sectors, decreased from 51.5 to a near-stagnation point of 50.3.

Usamah Bhatti, Economist at S&P Global Market Intelligence, commented on the recent data, noting that the slight improvement observed at the beginning of the year has “all but evaporate[d]” in February. He described the month’s growth as “only fractional,” attributing it to “softer upturn in services activity” that was insufficient to counterbalance the “steepest contraction in manufacturing output for a year.”

Australia’s Composite PMI climbs to 51.8, diminishing prospects for near-term RBA rate cut

Australia’s PMI Manufacturing fell sharply from 50.1 to 47.7 in February, with Manufacturing Output marking a 45-month low at 45.0. In stark contrast, PMI Services surged to a 10-month high of 52.8, propelling the Composite PMI to 51.8, the first time it has breached the 50-mark threshold since last June.

Warren Hogan, Chief Economic Advisor at Judo Bank, said the PMI results “weaken the case for monetary policy easing any time soon”. Improvement in activity indicators and modest rise in price indexes suggest that “risks to monetary policy remain even balanced”.

Hogan’s analysis also points to an economy that is gaining momentum, expanding at more vigorous pace in 2024 compared to the latter half of 2023. He posits that continuous improvements could herald stronger economic growth this year than the last, hinting that “soft landing is behind us”.

Furthermore, Composite Employment Index reached its highest level since last September, indicating “rising labour demand and employment growth” in the overall economy. This is accompanied by intensifying price pressures, with Composite Output Price Index’s climb to its highest point since last September 2023, indicating that domestic inflation could be hovering between 4% and 5%. Hogan cautions that the recent trend of disinflation “may well have run its course.”

New Zealand’s trade deficit widens, exports falls -7.1% yoy and imports down -20% yoy

New Zealand’s trade activity in January showed notable downturn, with goods exports dropping by -7.1% yoy to NZD 4.9B and goods imports declining by a substantial -20.0% yoy to NZD 5.9B. This resulted in trade deficit of NZD -976m, significantly larger than the anticipated NZD -200m.

A closer examination of the data reveals Australia as the leading contributor to the monthly fall in New Zealand’s exports, with a -17% decrease amounting to NZD -112m. Not far behind, Japan saw a dramatic -34% reduction in its exports from New Zealand, translating to NZD -105m. Conversely, EU was a rare bright spot, where New Zealand’s exports actually increased by 5.8%, or NZD 15m. Other major trading partners like China and the USA also experienced declines in exports from New Zealand, by -2.8% (NZD -42m) and -5.6% (NZD -31m), respectively.

On the import side, EU recorded the most significant monthly drop, with imports falling by -33% to NZD -386m. South Korea followed closely with a -34% decrease, equating to NZD -286m. Other notable decreases in imports came from China (NZD -84m, -5.4%), Australia (NZD -57m, -9.2%), and the USA (NZD -30m, -5.6%).

Looking ahead

Eurozone PMIs, CPI final, and ECB meeting accounts will be featured in European session. UK will also release PMIs. Later int he day, Canada retail sales will be a focus. US will publish jobless claims, PMIs, and existing home sales.

GBP/JPY Daily Outlook

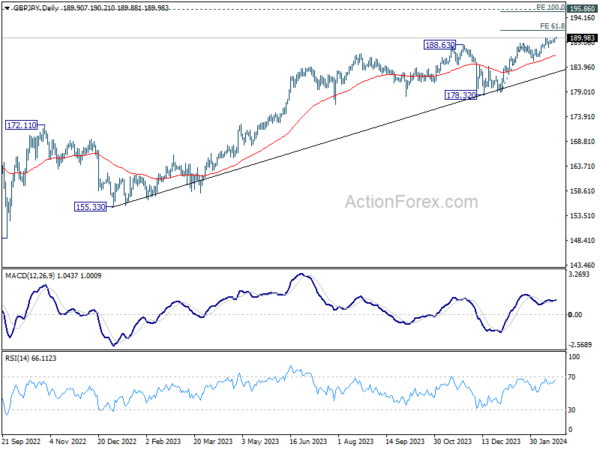

Daily Pivots: (S1) 189.42; (P) 189.68; (R1) 190.21; More…

GBP/JPY’s up trend is trying to resume by breaking through 190.05. Intraday bias is back on the upside for 61.8% projection of 178.71 to 188.90 from 185.21 at 191.50. On the downside, below 189.05 minor support will turn intraday bias neutral and bring consolidations again, before staging another rally.

In the bigger picture, up trend from 123.94 (2020 low) in in progress. Medium term outlook will stay bullish as long as 178.32 support holds. Next target is 195.86 long term resistance (2015 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Jan | -976M | -200M | -323M | -368M |

| 22:00 | AUD | Manufacturing PMI Feb P | 47.7 | 50.1 | ||

| 22:00 | AUD | Services PMI Feb P | 52.8 | 49.1 | ||

| 00:30 | JPY | Manufacturing PMI Feb P | 47.2 | 48.2 | 48 | |

| 00:30 | JPY | Services PMI Feb P | 52.5 | 53.1 | ||

| 08:15 | EUR | France Manufacturing PMI Feb P | 44 | 43.1 | ||

| 08:15 | EUR | France Services PMI Feb P | 45.6 | 45.4 | ||

| 08:30 | EUR | Germany Manufacturing PMI Feb P | 46.1 | 45.5 | ||

| 08:30 | EUR | Germany Services PMI Feb P | 48 | 47.7 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Feb P | 47.1 | 46.6 | ||

| 09:00 | EUR | Eurozone Services PMI Feb P | 48.7 | 48.4 | ||

| 09:30 | GBP | Manufacturing PMI Feb P | 47.1 | 47 | ||

| 09:30 | GBP | Services PMI Feb P | 54.4 | 54.3 | ||

| 10:00 | EUR | Eurozone CPI Y/Y Jan F | 2.80% | 2.80% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Jan F | 3.30% | 3.30% | ||

| 12:30 | EUR | ECB Meeting Accounts | ||||

| 13:30 | CAD | Retail Sales M/M Dec | 0.80% | -0.20% | ||

| 13:30 | CAD | Retail Sales ex Autos M/M Dec | 0.70% | -0.50% | ||

| 13:30 | USD | Initial Jobless Claims (Feb 16) | 217K | 212K | ||

| 14:45 | USD | Manufacturing PMI Feb P | 50.2 | 50.7 | ||

| 14:45 | USD | Services PMI Feb P | 52 | 52.5 | ||

| 15:00 | USD | Existing Home Sales Jan | 3.95M | 3.78M | ||

| 15:30 | USD | Natural Gas Storage | -59B | -49B | ||

| 16:00 | USD | Crude Oil Inventories | 3.9M | 12.0M |