Summary

The ongoing deterioration in the jobs market was on full display in the July Employment report. Nonfarm payrolls posted the second smallest gain in 3.5 years with an increase of 114K, average hourly earnings growth eased to 3.6% year-over-year and the unemployment rate jumped to 4.3% from 4.1% in June. The landfall of Hurricane Beryl at the start of the survey week looks to have had no significant impact on the change in payrolls or the increase in the unemployment rate.

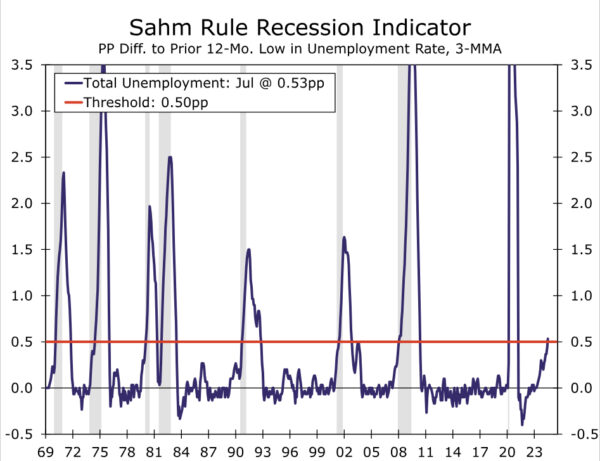

The increase in the unemployment rate now puts it over the 0.5 point Sahm Rule threshold that has historically been associated with the economy being in a recession. The rise in unemployment due to labor force entrants over the past year suggests the current increase may not be the sure-fire sign of a downturn it has been in the past. However, the significant rise in job losers over the past year underscores genuine weakening in labor market conditions that are quickly raising the risk of recession. We expect the Fed to begin reducing its policy rate in September as a result, with the possibility of a 50 bps cut at least on the table after today’s report.

The Beginning of the End?

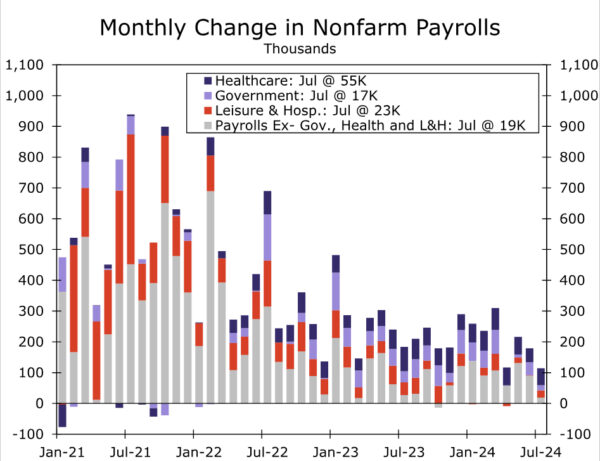

The ongoing deterioration in the jobs market was on full display in the July Employment report. Nonfarm payrolls expanded by just 114K, well below consensus expectations for a 175K gain and close to the smallest monthly gain this cycle. Revisions were minimal relative to the last two months’ downward adjustment of 111K, but were once again negative with the net change the prior two months lowered by 29K. Over the past three months, payrolls have expanded at an average monthly pace of 170K, down from 267K in the first quarter and 251K in 2023.

The BLS reported that the landfall of Hurricane Beryl at the start of the survey had no discernable effect on the collection of data for the survey period. It furthermore looks to have had no significant impact on the change in payrolls. To be removed from the payroll count in July, workers would have had to miss the entire pay period that overlapped with the survey week. Individuals paid bi-weekly or semi-monthly who worked the first week of the month therefore would still have been counted as employed. The 27% of workers who are paid weekly were more likely to miss work the entire payroll period covering the survey week, yet industries with a relatively high share of workers paid weekly such as construction, manufacturing and trade & transportation saw payrolls pick up slightly over the month.

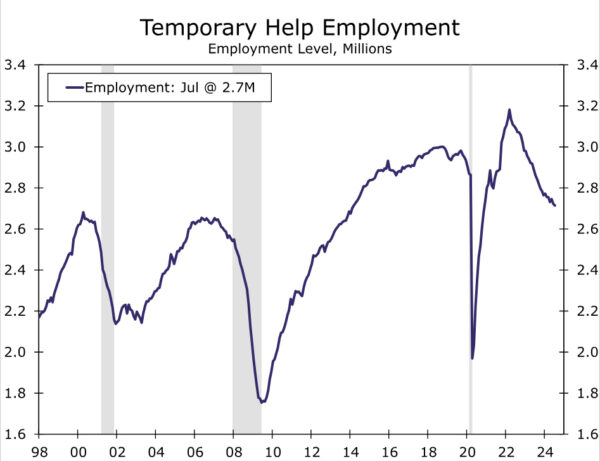

Nevertheless, hiring outside of healthcare (+55K)—and to a lesser extent government (+17K) and leisure & hospitality (+23K)—continues to look feeble (chart). Employment in white-collar jobs like information, financial services and professional & business services all fell in July. Meantime, temporary employment declined for the 26th time in 28 months and is now 242K below its 2019 average.

The separate Household Survey showed some disruption to work in July, with the number of individuals with a job but not at work due to bad weather surging 14-times above July’s historical average. However, workers absent from their jobs due to bad weather are counted as employed in the Household Survey whether they are paid for the time away or not.

This means the jump in the unemployment rate to 4.3% from 4.1% in June cannot be explained away by the hurricane. The increase in unemployment from 3.5% this time last year is more concerning because the unemployment rate tends to vacillate little throughout the business cycle. Rising unemployment can set off a negative feedback loop between income, spending and hiring. This dynamic has put a spotlight on the “Sahm Rule,” which highlights the historical pattern that the unemployment rate has never risen 0.5 points above its prior 12-month low (when measured on a three-month average basis) without the economy being in a recession.

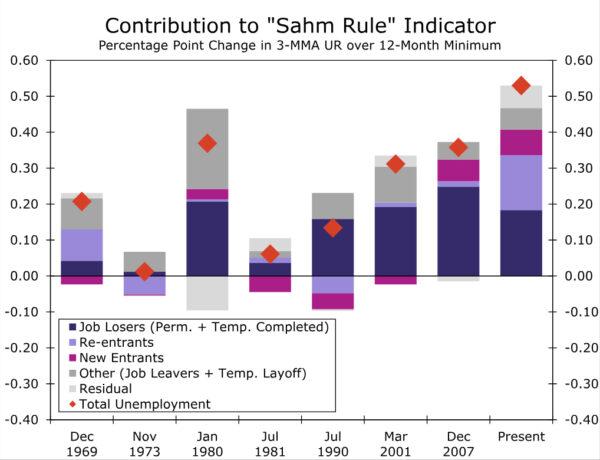

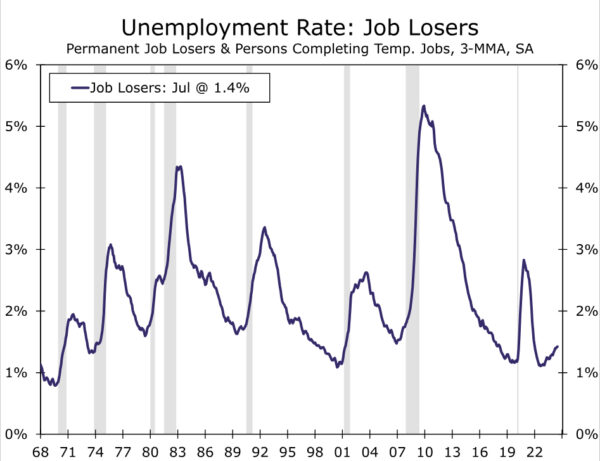

July’s unemployment rate reading has pushed the Sahm Rule indicator to 0.53, above its 0.5 point threshold. As we discussed in a recent report, the increase in unemployment has been driven more by entrants into the labor force than at the start of prior recessions. In July, new and re-entrants accounted for 22 bps of the rise in the Sahm Rule indicator over the past year, more than its contribution in the first month of each of the past seven recessions (2020 excluded, chart). This increase in unemployment for the “right” reasons suggests that the crossing of the 0.5 point threshold may not be the sure-fire sign of recession that it has been in the past. That said, unemployment due to a permanent job loss or completion of temporary work has also risen significantly over the past year, including another increase in July (chart). This increase for the “wrong” reasons underscores that even if the threshold for a recession might be somewhat higher this cycle, there has nevertheless been a clear deterioration in labor market conditions.

The looser labor market is having the intended effect of reducing inflation pressures. Average hourly earnings increased 0.2% in July, bringing the year-over-year change down to a three-year low of 3.6%. The moderation adds to other evidence released this week that labor costs are no longer a threat to inflation, including the Employment Cost Index, the Fed’s preferred gauge of compensation costs, slipping to an annualized rate of 3.7% in Q2 and unit labor costs now running comfortably below 2%.

Time to Get a Move On

The July jobs report offers the latest indication that the exceptional jobs market that followed the unique circumstances of the pandemic looks to have come to an end. Demand for new workers continues to fade, as evidenced by the downward trend in job openings, small business hiring plans and temporary help employment. Workers have taken notice, with perceptions of job availability and the share of employees quitting their jobs falling to cycle lows. The weakening trend in hiring, unemployment and job switching over the past year puts conditions on par with the late 2010s. While the labor market remains in decent shape in an absolute sense, further softening would be hard to attribute to “normalization” and instead would be consistent without outright weakness in our view.

We expect the FOMC to begin dialing back the current level of policy restriction soon. Although inflation has not yet returned to the Fed’s 2% target, the cooler jobs market points to inflation pressures continuing to recede. Our forecast remains for the FOMC to reduce the fed funds rate beginning in September by 25 bps at every other meeting through 2025, although growing risks to the employment side of the Fed’s mandate suggest a 50 bps cut in September could also be on the table as more and/or a faster pace of rate cuts look increasingly warranted.