Summary

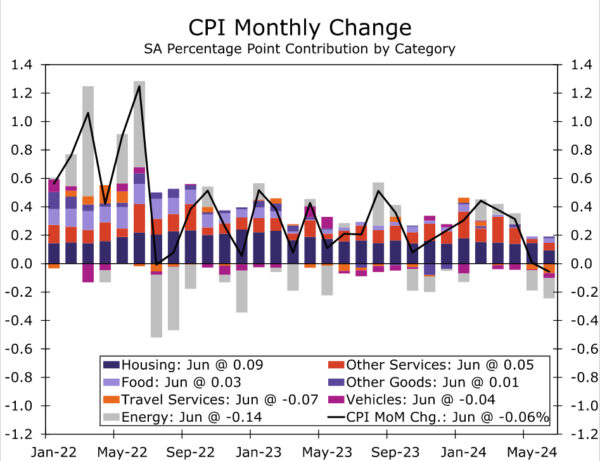

This morning’s CPI report was arguably the most encouraging one the FOMC has received since it began its inflation fight nearly two and a half years ago. Consumer prices declined by 0.1%, led lower by a drop in energy prices and a modest increase in food prices. Excluding food and energy, the core CPI increased by just 0.1% (0.06% unrounded), which was the smallest increase since January 2021, a time when high inflation was far from most minds. The slowdown in core CPI inflation was broad-based, with core goods prices once again declining and core services inflation advancing only 0.1% compared to the previous six-month average gain of 0.4%. A leg down in shelter inflation was a key contributor, but drops in more discretionary spending categories like airfares (-5%), lodging away from home (-2%) and recreation services (-0.1%) also played a role in the softer reading.

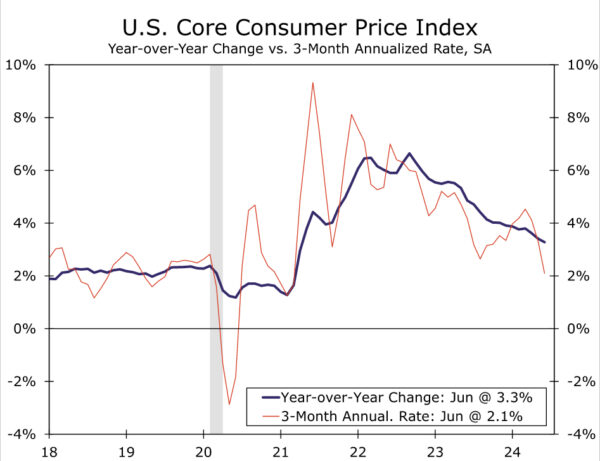

On balance, the economic data are the most supportive of a rate cut that they have been all year. Over the past three months, the core CPI has increased at a 2.1% annualized pace. This marks the smallest three-month change in core prices since March 2021. Furthermore, it is not just the inflation data that have shown signs of cooling in recent months. A deceleration in employment and a rise in the unemployment rate are just a couple of the numerous indicators that are pointing to less heat in the U.S. labor market. Chair Powell nodded to these trends in public comments this week, saying that “elevated inflation is not the only risk we face.” A rate cut as soon as the July 31 FOMC meeting is unlikely, but we remain of the view that the FOMC will cut the federal funds rate by 25 bps at its September meeting and reduce the fed funds rate by another 25 bps in December.

A Cool CPI Reading to Kick Off Summer

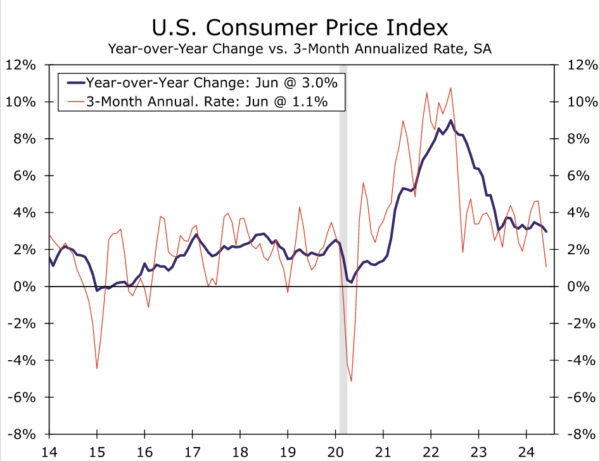

Consumer prices declined 0.1% in June, a surprisingly soft reading relative to consensus expectations for a gain of 0.1%. This was the first outright decline in the headline CPI since the spring of 2020 when the U.S. economy was in the throes of the COVID pandemic. Falling prices for gasoline (-3.8%) and electricity (-0.7%) helped offset a 2.4% rise in utility gas service, bringing overall energy prices down by 2% for the second consecutive month. Food inflation strengthened slightly in June compared to May, but the 0.2% increase in the month was well within the range of outcomes that was common pre-pandemic. Energy deflation and relatively restrained food price increases helped reduce the year-over-year change in the headline CPI from 3.3% in May to 3.0% in June (chart).

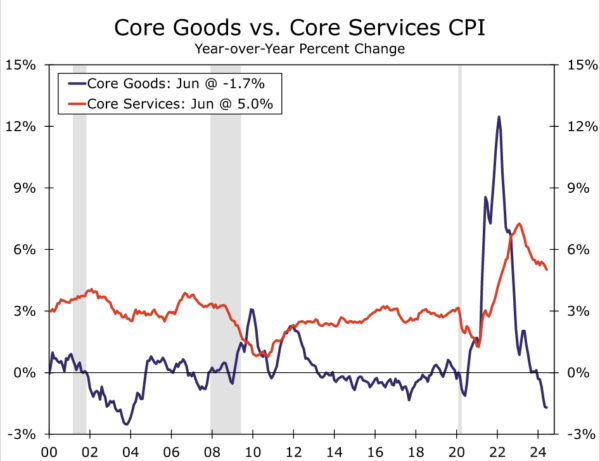

Fading price pressures across the economy were evident in the core index. Excluding food and energy, prices rose 0.1% (0.06% before rounding), which was the smallest increase since January 2021 and well below consensus expectations for a 0.2% increase. The softening was broad based, with goods prices once again falling and services rising just 0.1%.

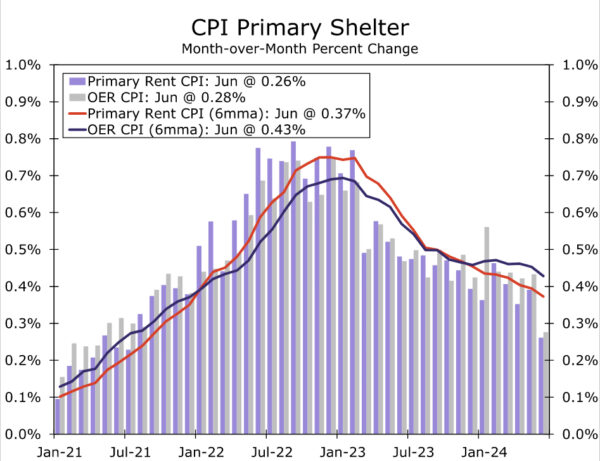

The shelter-disinflation-faithful were rewarded with owners’ equivalent rent rising just 0.28% and rent of primary residences also lurching lower to see the smallest increases since 2021 (chart). Forward-looking “spot” measures of rent from the private sector as well as the BLS’s New Tenant Rent Index suggest the monthly pace of shelter inflation can remain in the 0.25%-0.35% range through year-end. The slowdown in core services inflation extended beyond shelter. The squeeze on discretionary spending was clear in further price declines in lodging away from home, airfares and recreation services. Medical care services posted only a modest gain, while the muted rebound in motor vehicle insurance after last month’s abrupt decline further points to the weaker pricing environment for vehicles and parts finally feeding into related services. To that end, June’s drop in core goods was fueled by additional declines in used and new vehicle prices, while remaining core goods prices firmed slightly.

The case for a rate cut in September from the FOMC continues to build. Disinflation has broadened with goods no longer the sole driver of slower price growth (chart). The core CPI has increased at a 2.1% annualized rate over the past three months. This marks the smallest three-month change in core prices since March 2021. We will know more about the outlook for the June reading of the PCE deflator, the Fed’s preferred inflation measure due at the end of the month, after tomorrow’s release of the Producer Price Index. That said, our current expectation is that core PCE increased 0.1% in June, pushing the three-month annualized rate to 1.9%, under the Fed’s target.

The case to start cutting rates extends beyond just the recent run of softer inflation data. Nonfarm payrolls grew by 176K per month over the three months ending in June, the slowest three-month pace of job growth since January 2021. Employment growth has been carried by less cyclically-sensitive industries such as government and healthcare, a trend we covered in a recent special report. The unemployment rate is above its pre-pandemic low and its 2019 average, while the share of workers quitting their jobs, the level of temporary help workers and business hiring plans all remain below their pre-COVID marks. Chair Powell nodded to these trends in public comments this week, saying that “elevated inflation is not the only risk we face.” We remain of the view that the FOMC will cut the federal funds rate by 25 bps at its September meeting and reduce the fed funds rate by another 25 bps in December.