Summary

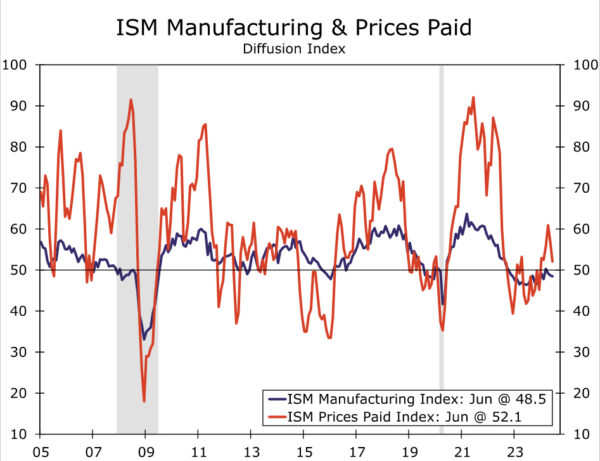

Manufacturing activity remained in contraction territory in June, but in a sign of moderating inflation pressure, the prices paid component fell 4.9 points. New orders rose more than any other component but remains in contraction.

Prices Cool

The ISM manufacturing index slipped to 48.5 in May as tight credit conditions and elevated borrowing costs continue to constrain activity in the factory sector. The headline reading marks a 0.2 point decrease from last month while the prices paid measures at 52.1 represents a 4.9 point monthly decline, the single biggest drop of any component (chart). Price pressures have not gone away, but they have abated.

A bounce in the orders component to 49.3 after slipping to 45.4 in May suggests that the decline in both orders and shipments of core capital goods in May could be short-lived. The 3.9 point jump here was the biggest gain of any component.

One interesting thing to watch is the emerging difficulties in shipping and supply chains. The ongoing attacks in the Suez Canal and the associated re-routing is both expensive and time-consuming. We have heard from a number of clients on this topic in recent weeks, but it was conspicuously absent from the respondent comments. For now at least, the supply chain disruptions are more of an annoyance than they are a massive disruption. The supplier deliveries measure came in at 49.8, up a bit from May’s reading.

The Great Divergence

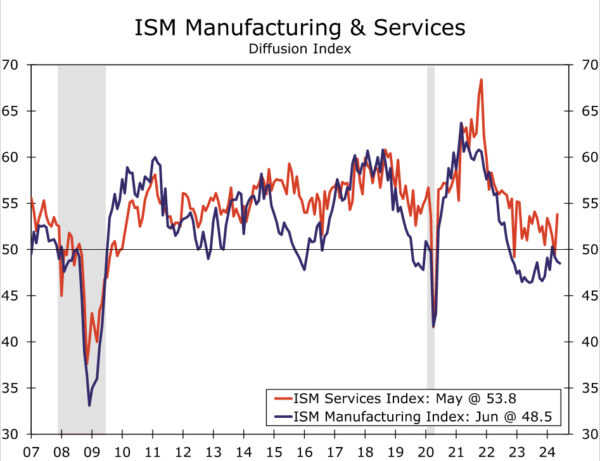

One could make the argument that since the Federal Reserve starting raising rates in this cycle, the manufacturing sector has been taking it in the chin while the service sector has been taking it in stride. What explains this dynamic?

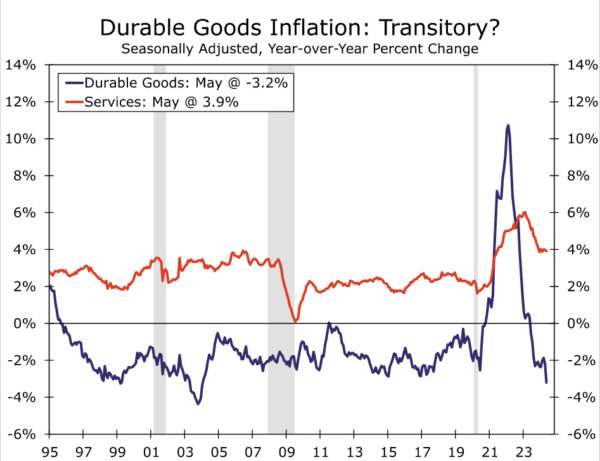

Prior to raising rates in the current cycle around 2021, policymakers at the Federal Reserve suspected that because supply chains were disrupted and because factories at home and overseas had shut down in compliance with COVID protocols, inflation was merely transitory. With the benefit of hindsight, it is clear now that inflation dynamics were not transitory. Yet a glance at the nearby chart shows that when it comes to durable goods prices, inflation was transitory. It is service sector pricing that has proved to be longer lasting.

The Federal Reserve began raising rates in March 2022. At that moment, the manufacturing sector may not have been humming along at full tilt the way it was in 2021, but the ISM manufacturing index at the time was firmly in expansion territory at 57.3. As rates continued to rise, the ISM began a trend decline, and by year’s end this trusted barometer for the factory sector broke through the 50 line of demarcation between expansion and contraction. It has remained mired there for 19 of the past 20 months. During the same time period, the service sector ISM has reported only two months of contraction (chart).

While higher financing costs do make big-ticket durable goods items harder to afford, there is more to the deteriorating picture for manufacturing than just Fed rate hikes. During 2020 and 2021, consumers were largely unable to fully engage in dining, travel and other in-person activity. Flush with cash from stimulus programs, many households bought new furniture for the homes where they were spending much more time. Sellers of boats, RVs, jet-skis and snowmobiles all had difficulty keeping product in stock. In short: lots of demand was pulled forward.

By 2022, even the most COVID restriction-abiding consumers were back in action crowding airports and hotels, and making reservations became an absolute requirement for dining out in many locales. While this catch-up spending in the service sector is finally losing a bit of momentum, it does offer some perspective on why service prices have been slower to come down.

The June jobs report will be published on Friday morning; our forecast is for a net gain of 200K jobs. The employment component in today’s report came in at 49.3. That does not move the needle for our forecast, nor do we suspect it to make much of a dent in consensus expectations. Manufacturing jobs have not added or subtracted more than 8K jobs in any given month so far this year.

More broadly, the latest GDP revisions revealed that growth in equipment outlays grew at an annualized pace of 1.6% in Q1; that comes after equipment spending fell in three out of four quarters in 2023. But overall business fixed investment in Q1 was actually stronger and boosted the headline by more than a full percentage point. Intellectual property outlays shot up at a 7.7% annualized rate in the first quarter, the fastest growth in a year and a half. We look for soft BFI spending in the second half of 2024 before a measured increase in capital outlays in 2025.