New Zealand and Australia Dollar rise appreciably in Asian session today, buoyed by a significant rebound in stock markets of China and Hong Kong. This positive momentum is largely attributed to the ripple effects of China’s larger-than-expected interest rate cut earlier in the week. Hang Seng Index, in particular, showcased a robust increase of around 3%, reflecting renewed investor confidence. This upbeat mood was further amplified by visible signs of China’s “national team” ramping up efforts to stabilize the stock market through strategic interventions, evident from the notable increase in assets within leading exchange-traded funds. At the same time, the offshore Chinese Yuan is also strengthening, now eyeing a breakthrough towards 7.2 level against Dollar.

Meanwhile, Dollar is on the softer side as market focus shifts towards the eagerly awaited FOMC minutes. The minutes are expected to temper expectations for an imminent rate cut, and emphasize that the inflation fight is not won yet. Despite a consensus among Fed officials regarding the likelihood of lower interest rate by year-end, the precise timing and manner of such a shift remain highly contingent on evolving economic indicators.

Market speculations, as reflected in fed fund futures, currently assign a 35% likelihood for an initial rate reduction in May, with the odds increasing to approximately 79% for June. This anticipation aligns with the broader consensus among economists, as revealed in a recent Reuters poll conducted from February 14-20. Out of 104 economists surveyed, a significant majority of 86 foresee Fed’s first rate cut occurring in Q2. Within this group, a slight majority of 53 earmarks June as the most probable month for this adjustment, whereas a smaller contingent of 33 anticipates May as the kickoff for easing measures, leaving a remainder who expect the first cut to unfold in H2.

As the week unfolds till now, New Zealand Dollar stands out as the frontrunner among currencies, closely followed by Australian Dollar, which has benefitted from the general uplift in regional market sentiments. Euro has is the third strongest, bolstered by yesterday’s data indicating a slight moderation in wage growth for Q4. On the other end of the spectrum, Canadian Dollar has faced downward pressure as the worst performer, following unexpectedly low consumer inflation readings, hinting at the potential for an earlier-than-anticipated rate cut by BoC. Swiss Franc and Dollar are also experiencing weakness, whereas Yen and Sterling are mixed.

Technically, Hong Kong HSI’s rebound made some progress today by breaking through 55 D EMA (now at 16288) decisively. Further rise is now in favor as long as 16055.08 support holds, towards channel resistance (now at around 17700. At this point, it’s too early call for bullish trend reversal, and strong resistance could be seen from 38.2% retracement of 22700.85 to 14794.16 at 17814.51 to limit upside. But for the near term, extended rebound and improvement in sentiment could lend additional support to Aussie and Kiwi.

In Asia, at the time of writing, Nikkei is down -0.29%. Hong Kong HSI is up 2.73%. China Shanghai SSE is up 2.17%. Singapore Strait Times is down -0.49%. Japan 10-year JGB yield is down -0.0025 at 0.730. Overnight, DOW fell -0.17%. S&P 500 fell -0.60%. NASDAQ fell -0.92%. 10-year yield fell -0.020 to 4.275.

Australia Westpac leading index falls to -0.25%, sub-par growth to continue

Australia’s economy is bracing for continued “sub-par growth” into 2024, as indicated by the downturn in the Westpac Leading Index, which dipped from -0.01% to -0.25% in January. Westpac anticipates the economic growth rate to hover around an annualized 1.3% in the first half of this year, marking an improvement from the latter half of 2023’s 0.8%, yet remaining significantly below the usual trend rate of about 2.5%.

In the realm of monetary policy, Westpac’s analysis suggests a measured approach by RBA. The central bank is expected to take additional time to gain “sufficient confidence” that inflation will revert to target range within a reasonable timeframe. Economic indicators leading up to the March meeting are projected to reinforce a narrative of “weak growth and demand environment domestically,” which would justify RBA’s decision to maintain its current policy stance.

This cautious period of observation is likely to precede any shift towards a more definitive “on hold” position by the Board, with considerations for interest rate cuts anticipated to emerge further down the line.

Australia’s Q4 wage growth hits 4.2%, driven by sharp public sector increase

Australia’s wage price index rose 0.9% qoq in Q4, decelerating from the previous quarter’s 1.3% qoq increase, but in line with market expectations. Annually, wage growth ticked up from 4.1% yoy to 4.2% yoy, marking the highest rate since Q1 2009.

A closer look at sector-specific data reveals that private sector annual wage growth slowed slightly from 4.3% yoy to yoy. In contrast, public sector wage growth accelerated sharply from 3.5% yoy to 4.3% yoy, the highest rate since Q1 2010.

The surge in public sector wages underscores the impact of cyclical patterns of enterprise bargaining, as highlighted by Michelle Marquardt, ABS head of prices statistics. She noted, “In the December quarter 2023, 38 percent of public sector jobs saw a wage rise, considerably higher than the 29 percent from the same quarter in the previous year.”

Furthermore, average hourly wage change for these jobs escalated to 4.3%, surpassing 2.8% recorded at the same time last year and achieving the highest level since September 2008.

Japan’s exports rises 11.9% yoy in Jan, imports down -9.6% yoy

Japan’s export recorded 11.9% yoy increase to JPY 7333B in January, marking the second consecutive month of growth. However, imports saw a contrasting trend, decreasing by -9.6% yoy to JPY 9091B. This resulted in a trade deficit of JPY -1758B for the month.

A notable highlight from the trade data was Japan’s trade surplus with the US, amounting to JPY 415B, as exports reached an all-time high for the month at JPY 1.42T.

Conversely, Japan faced a JPY -959.52B trade deficit with China, another significant trading partner. Despite this deficit, exports to China were supported by strong demand for chip-making equipment and cars.

On seasonally adjusted basis, exports registered decline of -3.6% mom to JPY 8765B, while imports fell more sharply by -10.5% mom to JPY 8230B. This shift led to trade surplus of JPY 235B.

Looking ahead

UK public sector net borrowing is a feature in European session, while Eurozone will release consumer confidence. Later in the day, Canada will publish new housing price index. But main focus is on FOMC minutes.

AUD/USD Daily Report

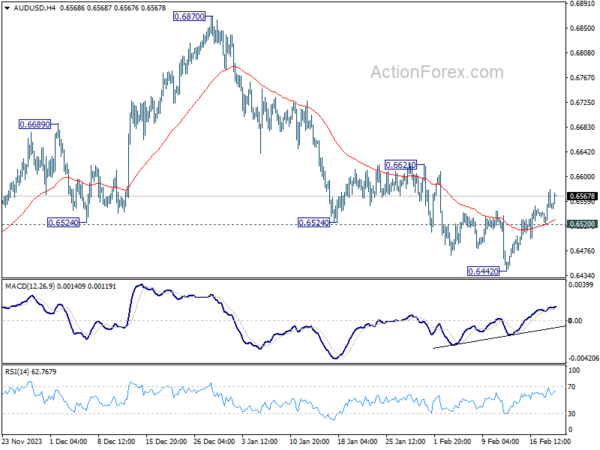

Daily Pivots: (S1) 0.6521; (P) 0.6550; (R1) 0.6578; More…

AUD/USD’s recovery from 0.6442 extends higher, but upside is still capped well below 0.6621 resistance. Intraday bias remains neutral and further decline is in favor. Below 0.6520 minor support will turn bias to the downside for retesting 0.6442 first. Firm break there will resume the the decline from 0.6870 towards 0.6269 low. Nevertheless, considering bullish convergence condition in 4H MACD, decisive break of 0.6621 will turn near term outlook bullish for 0.6870 resistance instead.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which might still be in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | PPI Input Q/Q Q4 | 0.90% | 0.40% | 1.20% | |

| 21:45 | NZD | PPI Output Q/Q Q4 | 0.70% | 0.40% | 0.80% | |

| 23:50 | JPY | Trade Balance (JPY) Jan | 0.24T | -0.23T | -0.41T | -0.44T |

| 00:00 | AUD | Westpac Leading Index M/M Jan | -0.10% | 0.00% | ||

| 00:30 | AUD | Wage Price Index Q/Q Q4 | 0.90% | 0.90% | 1.30% | |

| 07:00 | GBP | Public Sector Net Borrowing (GBP) Jan | -18.4B | 6.8B | ||

| 13:30 | CAD | New Housing Price Index M/M Jan | 0.10% | 0.00% | ||

| 15:00 | EUR | Eurozone Consumer Confidence Feb P | -16 | -16 | ||

| 19:00 | USD | FOMC Minutes |